Question

How have ABC Company's contributions to retirement plan accounts for Archie and Elaine performed since January 1, 2015? If the Peytons had earned an

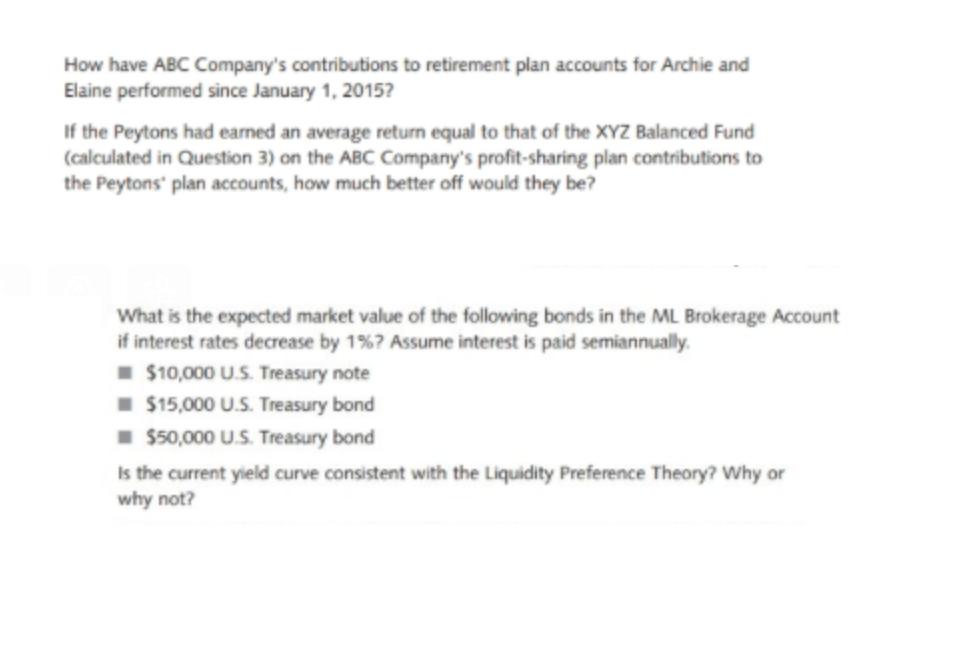

How have ABC Company's contributions to retirement plan accounts for Archie and Elaine performed since January 1, 2015? If the Peytons had earned an average return equal to that of the XYZ Balanced Fund (calculated in Question 3) on the ABC Company's profit-sharing plan contributions to the Peytons' plan accounts, how much better off would they be? What is the expected market value of the following bonds in the ML Brokerage Account if interest rates decrease by 1% ? Assume interest is paid semiannually. $10,000 U.S. Treasury note $15,000 U.S. Treasury bond $50,000 U.S. Treasury bond Is the current yield curve consistent with the Liquidity Preference Theory? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 ABC Companys contributions to Archie and Elaines retirement plan accounts since January 1 2015 wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App