Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how i can do this questions. i had to try many time question 2 GQ Ltd has been presented with the following project: A new

how i can do this questions. i had to try many time

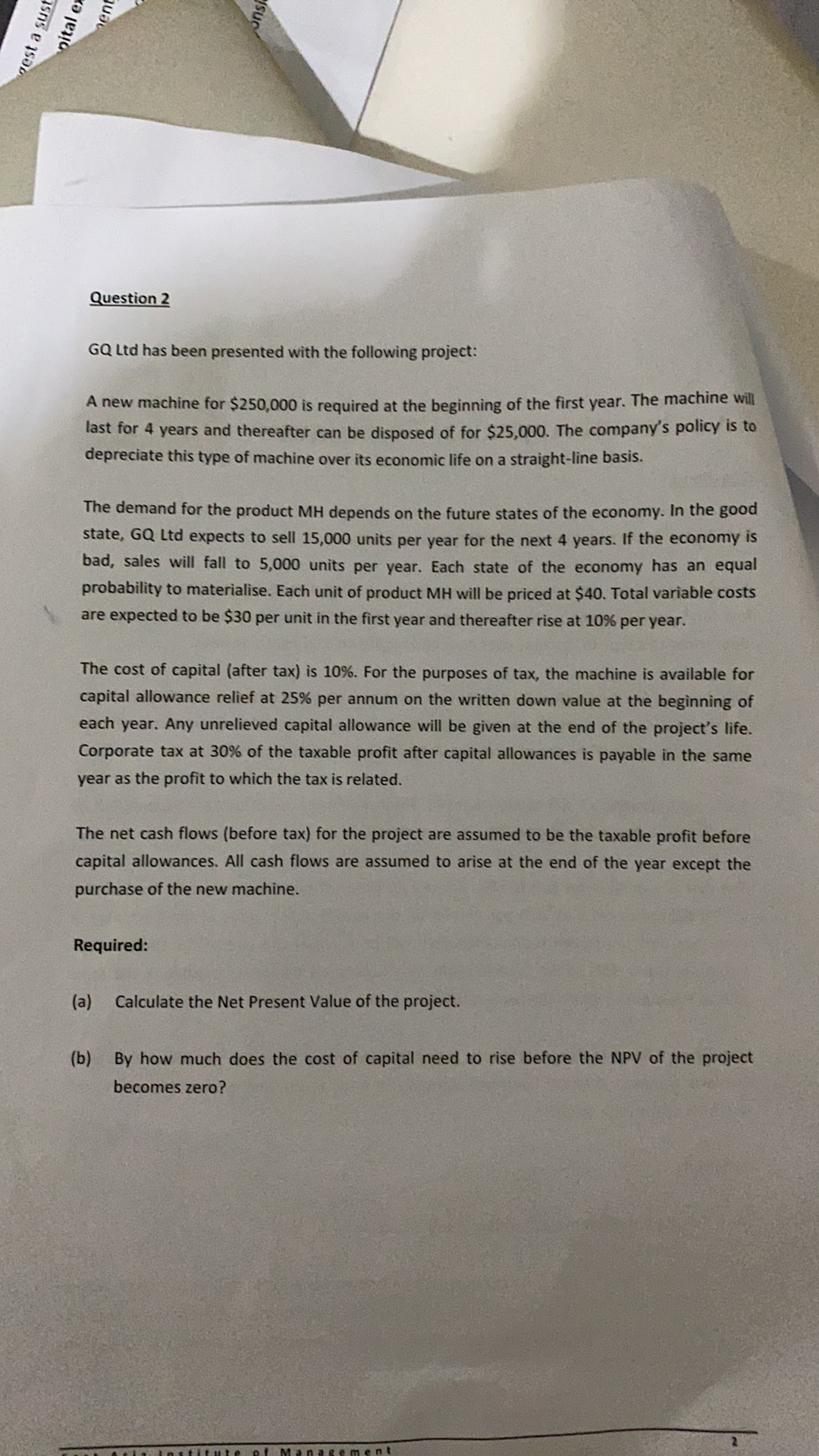

question 2 GQ Ltd has been presented with the following project: A new machine for $250,000 is required at the beginning of the first year. The machine win last for 4 years and thereafter can be disposed of for $25,000. The companvs policy is to depreciate this type of machine over its economic life on a straight-line basis. The demand for the product MH depends on the future states of the economy. In the good state, GQ Ltd expects to sell 15,000 units per year for the next 4 years. If the economy is bad, sales will fall to 5,000 units per year. Each state of the economy has an equal probability to materialise. Each unit of product MH will be priced at $40. Total variable costs are expected to be $30 per unit in the first year and thereafter rise at 10% per year. The cost of capital (after tax) is 10%. For the purposes of tax, the machine is available for capital allowance relief at 25% per annum on the written down value at the beginning of each year. Any unrelieved capital allowance will be given at the end of the project's life. Corporate tax at 30% of the taxable profit after capital allowances is payable in the same year as the profit to which the tax is related. The net cash flows (before tax) for the project are assumed to be the taxable profit before capital allowances. All cash flows are assumed to arise at the end of the year except the purchase of the new machine. Required: (a) (b) Calculate the Net Present Value of the project. By how much does the cost of capital need to rise before the NPV of the project becomes zero ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started