Answered step by step

Verified Expert Solution

Question

1 Approved Answer

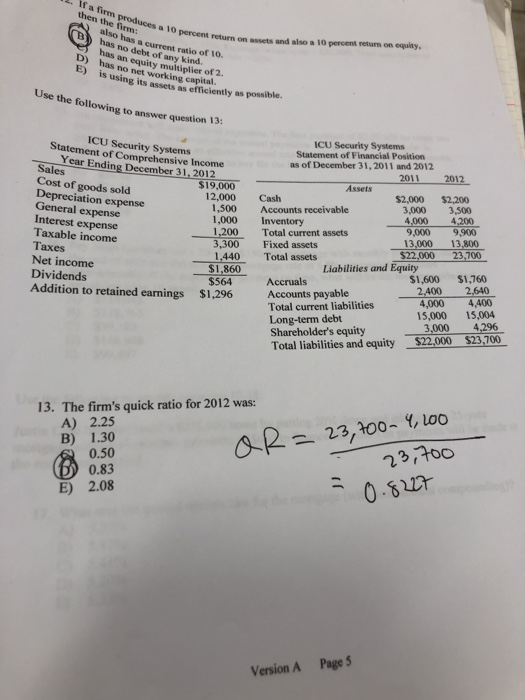

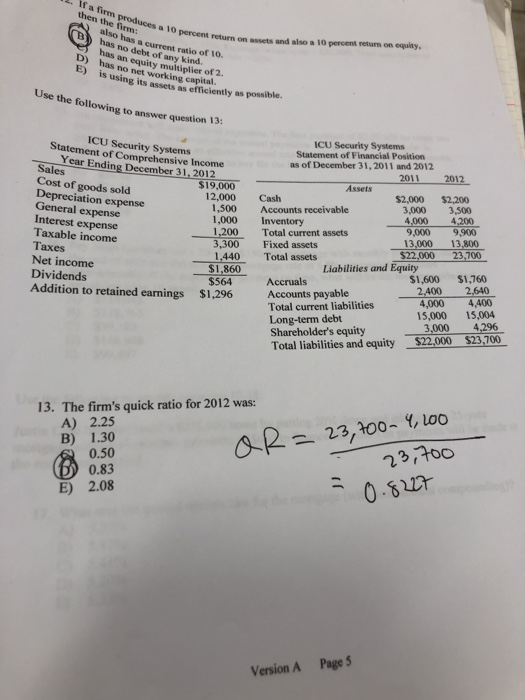

How is my answer wrong ? (Says the correct answer is B) Ir a firm produces a 10 percent also has a current ratio of

How is my answer wrong ? (Says the correct answer is B)

Ir a firm produces a 10 percent also has a current ratio of 10. D) has nn equity multiplier or 2 Use the following to answer question 13: return on assets and also a 10 percent return on equity, has no debt of any kind. Ehs no net working capital. 8 its assets as efficiently as possible. ICU Security Systems Statement of Comprehensive Income ICU Security Systems Statement of Financial Position as of December 31, 2011 and 2012 Year Ending December 31,2012 2011 2012 Sales Cost of goods sold Depreciation expense General expense Interest expense Taxable income Taxes Net income Dividends $19,000 Assets 12,000 Cash $2,000 $2,200 1,500 Accounts receivable 1,000 Inventory 1,200 Total current assets 3,000 3,500 4000 4.200 9,000 9,900 13,000 13,800 522,000 23.700 Fixed assets 1440 Total assets $1,860 $564 Liabilities and Equity $1,600 $1,760 Accruals Accounts payable 2.400 2640 4,000 4,400 15,000 15,004 Addition to retained earnings $1,296 Total current liabilities Long-term debt Shareholder's equity 3,000 4,296 $23,700 Total liabilities and equity$22,000 23,300.. Y,Loo 237700 13. The firm's quick ratio for 2012 was: A) 2.25 B) 1.30 0.50 0.83 E) 2.08 0.8r Page 5 Version A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started