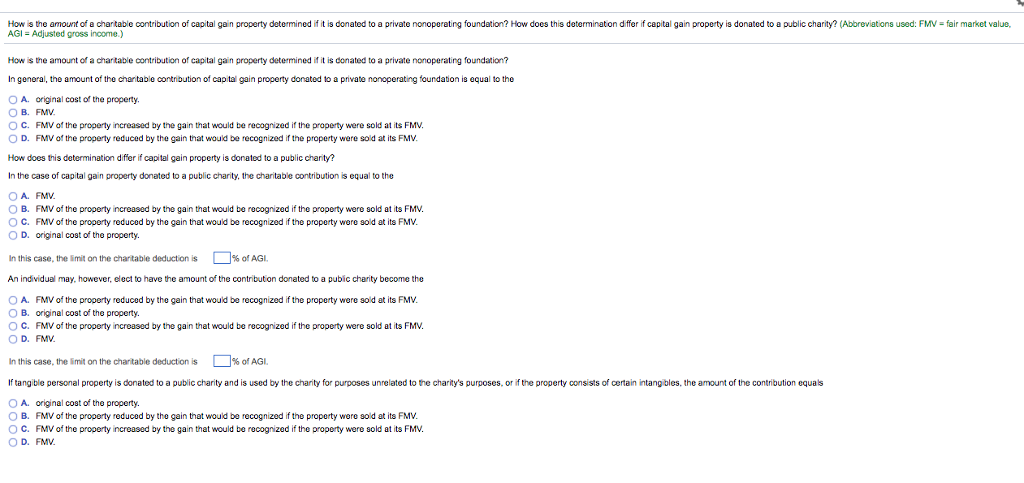

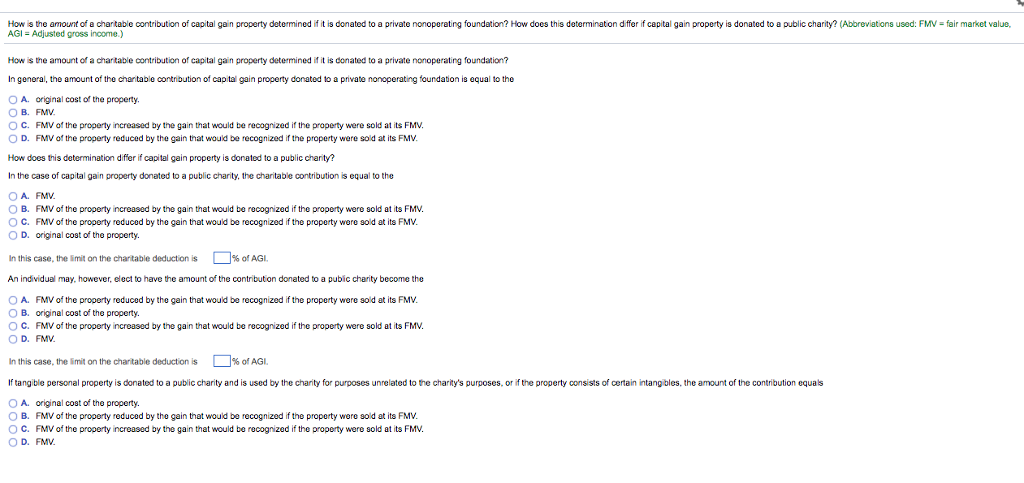

How is the amount of a chartable contribution of capital gain property determined if it is donated to a private nonoperating foundation? How does this determination differ if capital gain property is donated to a public charity? (Abbreviations used: FMV-fair market value, AGI- Adjusted gross income.) How is the amount of a chartable contribution of capital gain property determined if it is donated to a private nonoperating foundation? In general, the amount of the chantable contribution of cap tal gain property donated to a private nonoperating foundation is equal to the O A. original cost of the property .FMV. O C. FMV of the property increased by the gain that would be recognized if the property were sold at its FMV OD. FMV of the property reduced by the gain that would be recognized if the property were sold at its FMV How does this determination difer if capital gain property is donated to a public charity? In the case of capital gain property donated to a public charity, the charitable contribution is equal to the O B. FMV of the property increased by the gain that would be recognized if the property were sold at its FM. O C. FMV of the property reduced by the gain that would be recognized if the property were sold at its FMV O D. original cost of the property ]%ofAGl. In this case, the imit on the chartable deduction is An individual may, however, elect to have the amount of the contributon donated to a pubic charity become the O A. O B. O C. O D. FMV of the property reduced by the gain that would be recognized if the property were sold at its FMV original cost of the property. FMV of the property increased by the gain that would be recognized if the property were sold at its FMV FMv. In this case, the imit on the chartable deduction is ]%0AGl If tangible personal property is donated to a public charity and is used by the charity for purposes unrelated to the charity's purposes, or if the property consists of certain intang bles, the amount of the contribution equals O A. original cost of the property O B. FMV of the property reduced by the gain that would be recognized if the property were sold at its FMV O C. FMV of the property increased by the gain that would be recognized if the property were sold at its FM. O D. FMv