Answered step by step

Verified Expert Solution

Question

1 Approved Answer

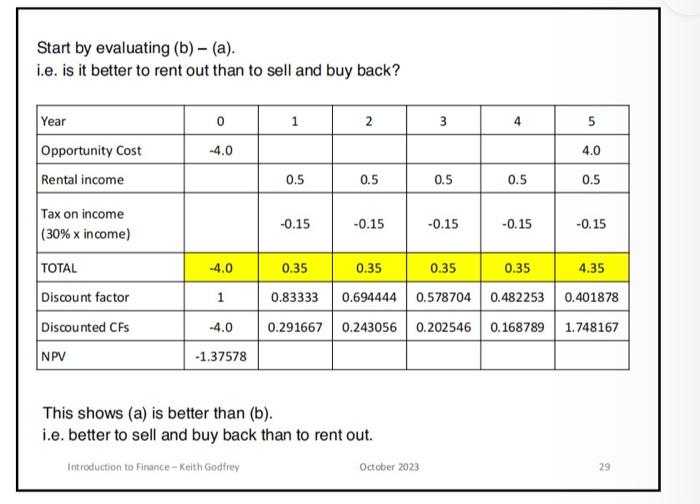

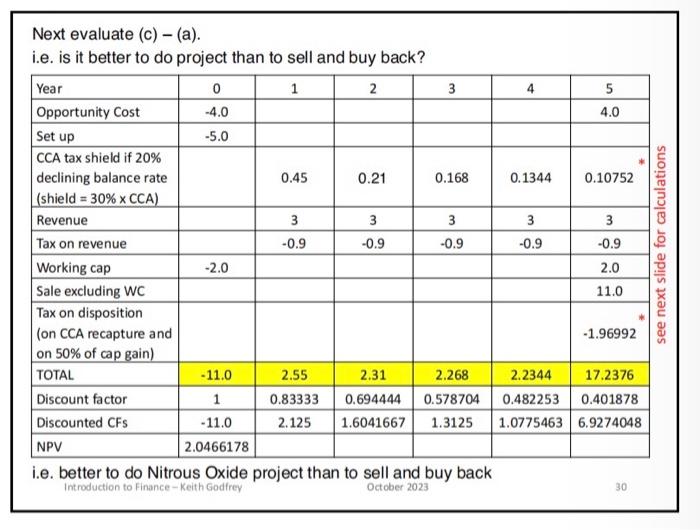

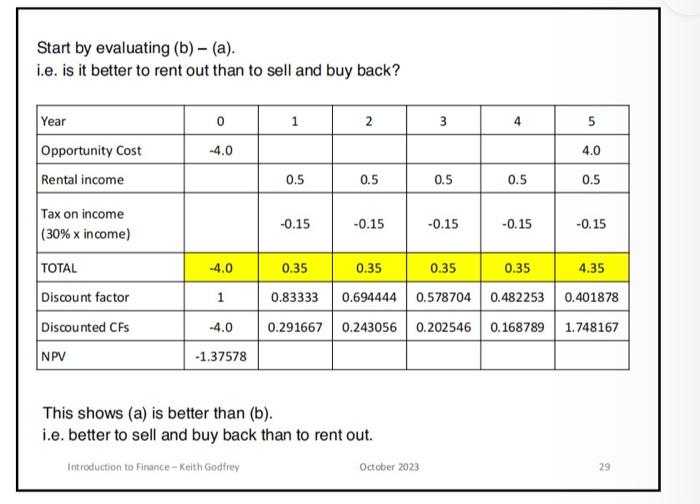

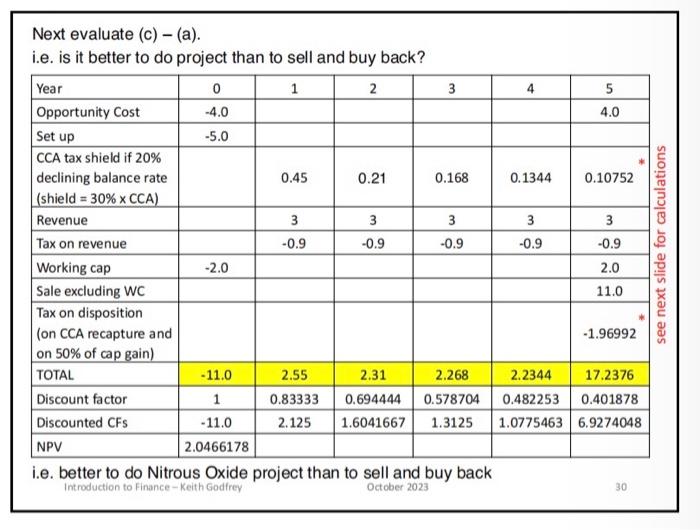

How is this problem solved? Start by evaluating (b)(a). i.e. is it better to rent out than to sell and buy back? This shows (a)

How is this problem solved?

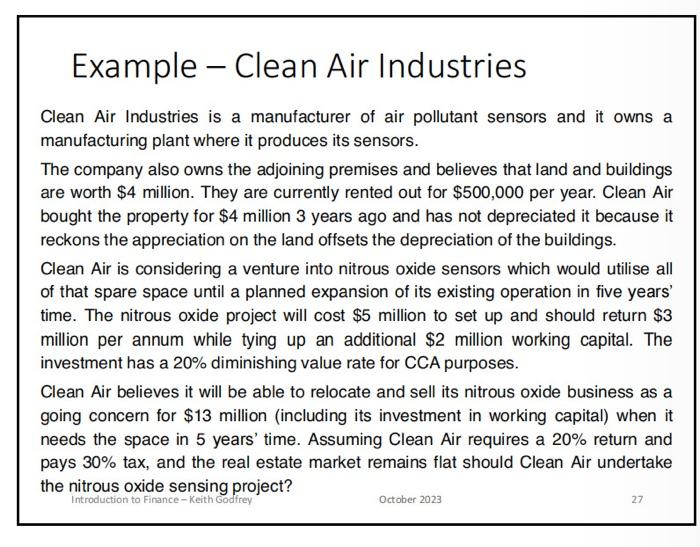

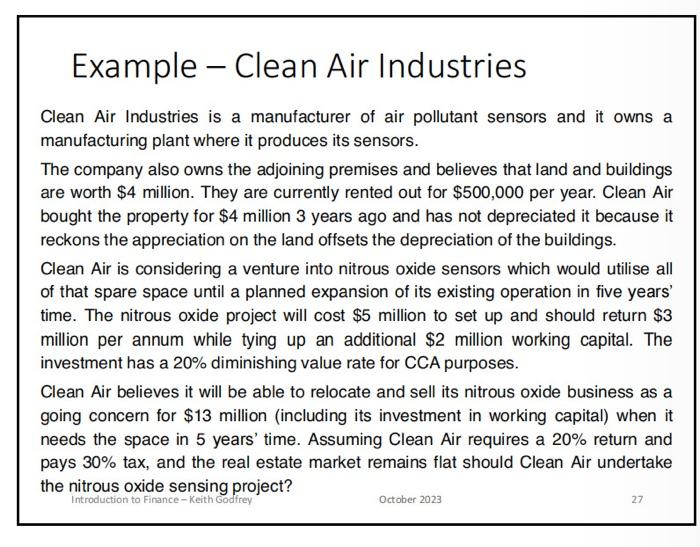

Start by evaluating (b)(a). i.e. is it better to rent out than to sell and buy back? This shows (a) is better than (b). i.e. better to sell and buy back than to rent out. Next evaluate (c) - (a). Clean Air Industries is a manufacturer of air pollutant sensors and it owns a manufacturing plant where it produces its sensors. The company also owns the adjoining premises and believes that land and buildings are worth $4 million. They are currently rented out for $500,000 per year. Clean Air bought the property for $4 million 3 years ago and has not depreciated it because it reckons the appreciation on the land offsets the depreciation of the buildings. Clean Air is considering a venture into nitrous oxide sensors which would utilise all of that spare space until a planned expansion of its existing operation in five years' time. The nitrous oxide project will cost $5 million to set up and should return $3 million per annum while tying up an additional $2 million working capital. The investment has a 20% diminishing value rate for CCA purposes. Clean Air believes it will be able to relocate and sell its nitrous oxide business as a going concern for $13 million (including its investment in working capital) when it needs the space in 5 years' time. Assuming Clean Air requires a 20% return and pays 30% tax, and the real estate market remains flat should Clean Air undertake the nitrous oxide sensing project? Introduction to Finance - Keith Godfrey October 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started