Answered step by step

Verified Expert Solution

Question

1 Approved Answer

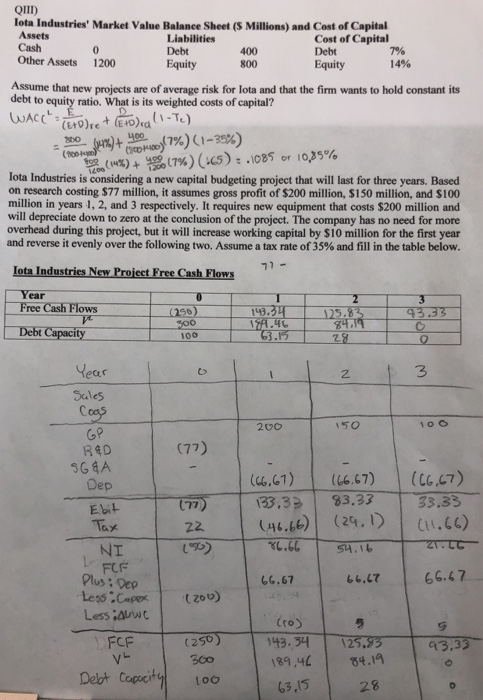

how is value levered (V^L) calculated? i understand majority of everything as the answers are given to me. Please explain clearly how 300 was gotten

how is value levered (V^L) calculated? i understand majority of everything as the answers are given to me. Please explain clearly how 300 was gotten and the other V^L numbers were gotten.

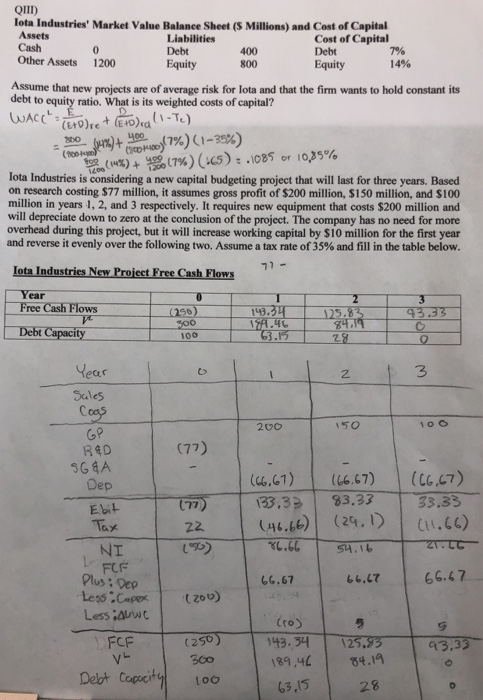

lota Industries' Market Value Balance Sheet (S Millions) and Cost of Capital Assets Cash Other Assets 1200 Liabilities Cost of Capital 0 Debt Equity Debt 400 Equity 800 14% Assume that new projects are of average risk for lota and that the firm wants to hold constant its debt to equity ratio. What is its weighted costs of capital? mo-ge%)+cyo...f7%) (1-35%) lota Industries is considering a new capital budgeting project that will last for three years. Based on research costing $77 million, it assumes gross profit of $200 million, $150 million, and $100 million in years 1, 2, and 3 respectively. It requires new equipment that costs $200 million and will depreciate down to zero at the conclusion of the project. The company has no need for more overhead during this project, but it will increase working capital by $10 million for the first year and reverse it evenly over the following two. Assume a tax rate of 35% and fill in the table below. lota Industries New Project Free Cash Flows ear ree 143 Debt Capacity 106 3 2 ear Sales 50 200 (77) R4D (G6.6) (66.67) (CG.7) Dep 33.33 (77 Ebit 22 )(29. NT FCF Plus : Less Capex 200) Less Auwc 66.47 66,47 66.67 (ro) (250) FCF 43.34 125.33.33 89.444.1 Lo6 63,15 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started