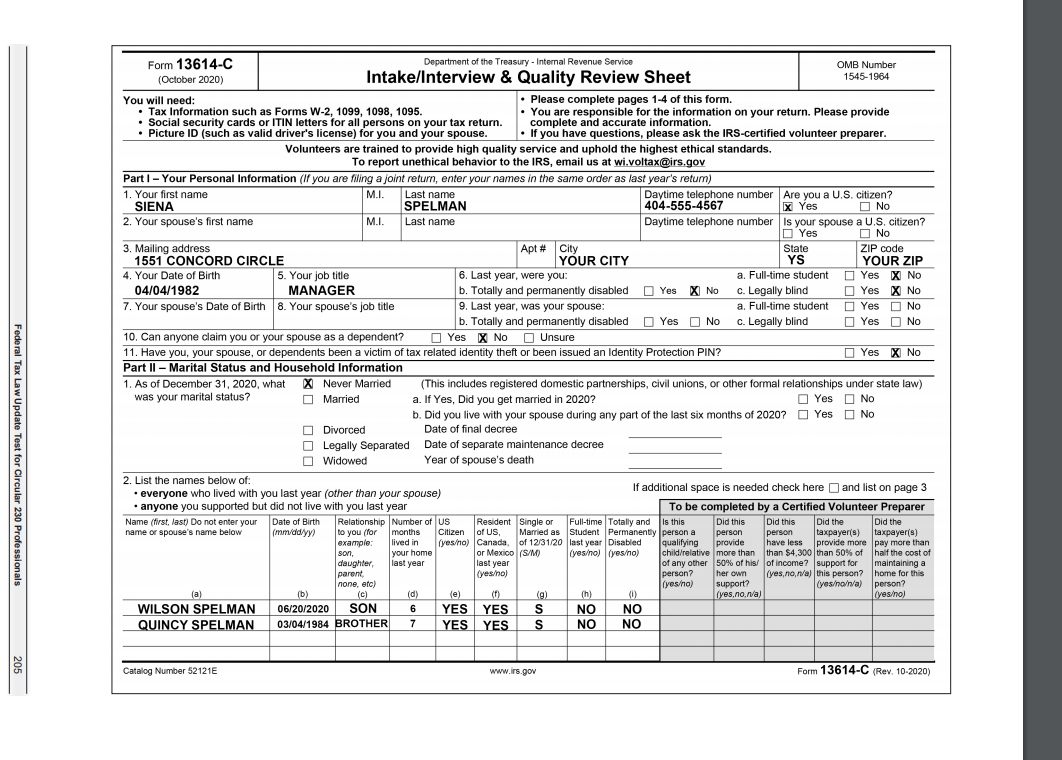

| How many dependents may Siena claim? | | | | | | | |

| |

| | | | | | | | A. 0, neither Wilson nor Quincy qualifies | | | | | | | | | | | | | | | | B. 1, only Wilson qualifies | | | | | | | | | | | | | | | | C. 1, only Quincy qualifies | | | | | | | | | | | | | | | | D. 2, both Wilson and Quincy qualify | | | | | | | | |

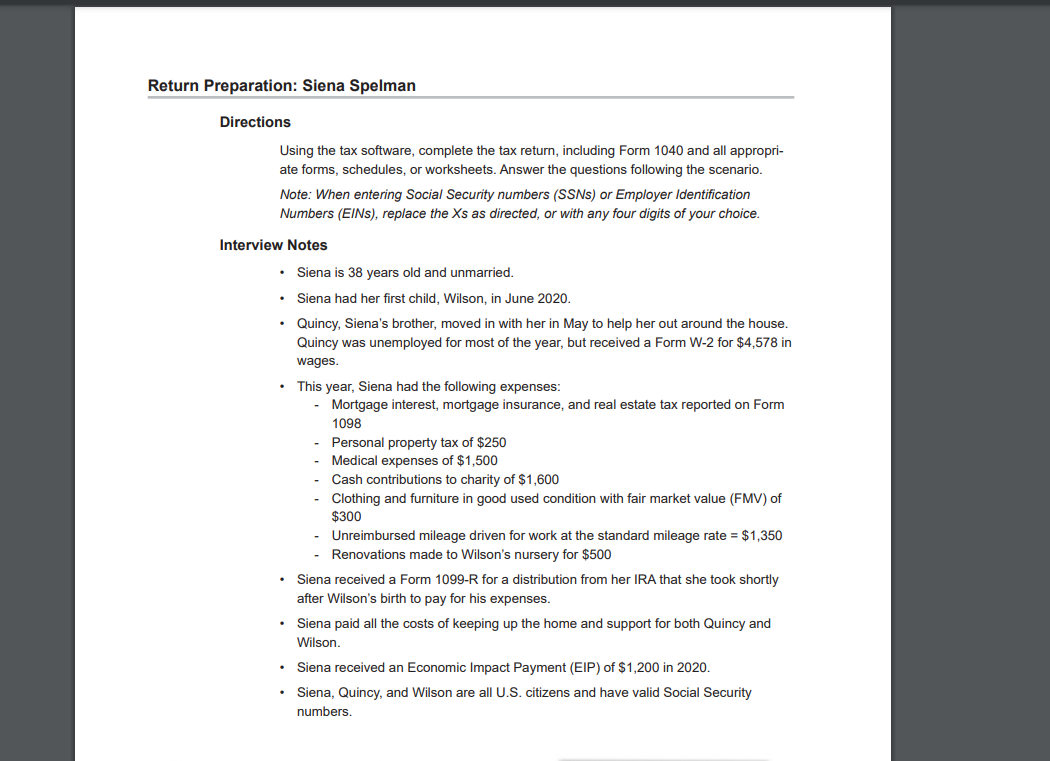

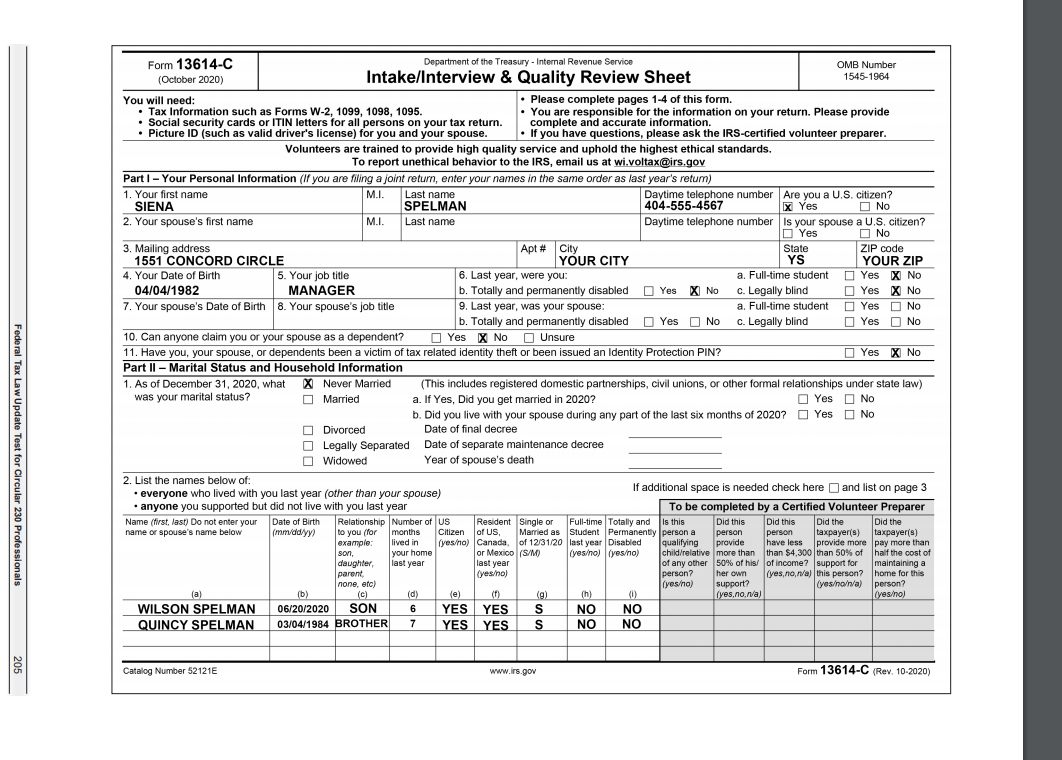

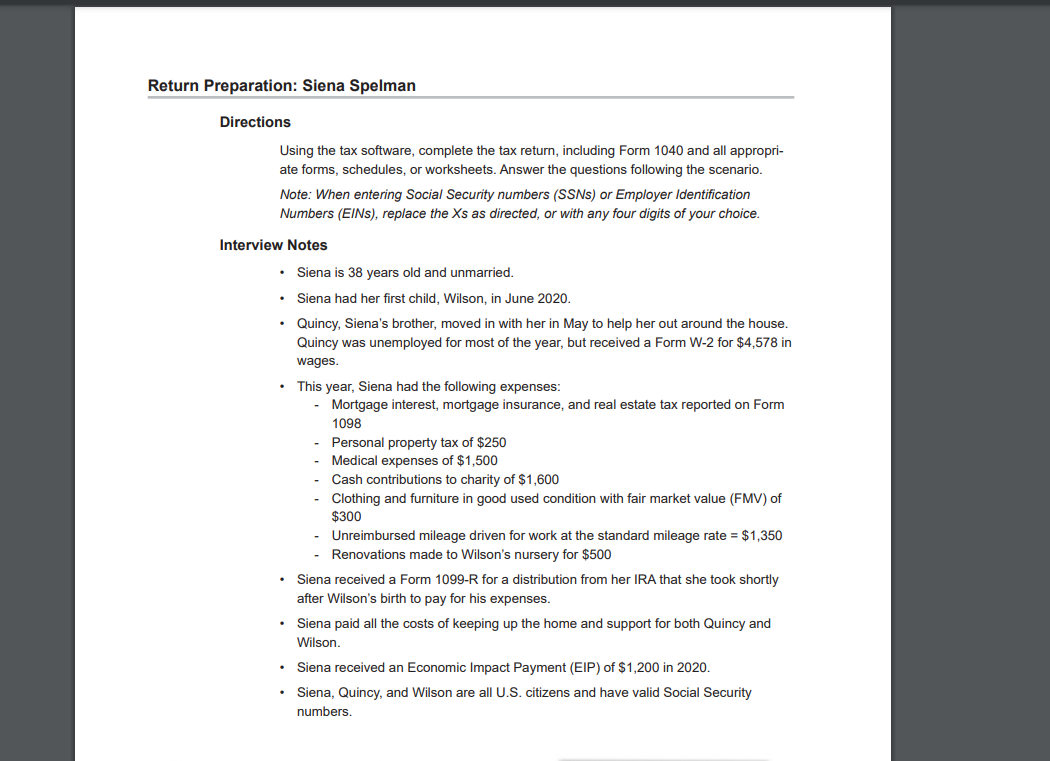

Return Preparation: Siena Spelman Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. Interview Notes Siena is 38 years old and unmarried. Siena had her first child, Wilson, in June 2020. Quincy, Siena's brother, moved in with her in May to help her out around the house. Quincy was unemployed for most of the year, but received a Form W-2 for $4,578 in wages. This year, Siena had the following expenses: - Mortgage interest, mortgage insurance, and real estate tax reported on Form 1098 Personal property tax of $250 Medical expenses of $1,500 Cash contributions to charity of $1,600 Clothing and furniture in good used condition with fair market value (FMV) of $300 - Unreimbursed mileage driven for work at the standard mileage rate = $1,350 - Renovations made to Wilson's nursery for $500 Siena received a Form 1099-R for a distribution from her IRA that she took shortly after Wilson's birth to pay for his expenses. Siena paid all the costs of keeping up the home and support for both Quincy and Wilson Siena received an Economic Impact Payment (EIP) of $1,200 in 2020. Siena, Quincy, and Wilson are all U.S. citizens and have valid Social Security numbers. Federal Tax Law Update Test to Form 13614-C Department of the Treasury - Internal Revenue Service OMB Number (October 2020) Intake/Interview & Quality Review Sheet 1545-1964 You will need: . Please complete pages 1-4 of this form. Tax Information such as Forms W-2, 1099, 1098, 1095. You are responsible for the information on your return. Please provide Social security cards or ITIN letters for all persons on your tax return. complete and accurate information. Picture ID (such as valid driver's license) for you and your spouse. If you have questions, please ask the IRS-certified volunteer preparer. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltax@irs.gov Part 1 - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's return) 1. Your first name M.I. Last name Daytime telephone number Are you a U.S. citizen? SIENA SPELMAN 404-555-4567 X Yes O No 2. Your spouse's first name M.I. Last name Daytime telephone number is your spouse a U.S. citizen? D Yes D No 3. Mailing address Apt # City State ZIP code 1551 CONCORD CIRCLE YOUR CITY YS YOUR ZIP 4. Your Date of Birth 5. Your job title 6. Last year, were you: a. Full-time student Yes X No 04/04/1982 MANAGER b. Totally and permanently disabled Yes X No c. Legally blind Yes X No 7. Your spouse's Date of Birth 8. Your spouse's job title 9. Last year, was your spouse: a. Full-time student D Yes D No b. Totally and permanently disabled Yes No c. Legally blind Yes No 10. Can anyone claim you or your spouse as a dependent? Yes X No Unsure 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? Yes X No Part II - Marital Status and Household Information 1. As of December 31, 2020, what X Never Married (This includes registered domestic partnerships, civil unions, or other formal relationships under state law) was your marital status? I Married a. If Yes, Did you get married in 2020? Yes No b. Did you live with your spouse during any part of the last six months of 2020? Yes No Divorced Date of final decree Legally Separated Date of separate maintenance decree O Widowed Year of spouse's death 2. List the names below of: everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 anyone you supported but did not live with you last year To be completed by a Certified Volunteer Preparer Name (first, last) Do not enter your Date of Birth Relationship Number of US Resident Single or Full-time Totally and is this Did this Did this Did the Did the name or spouse's name below (mmady to you (for months Citizen of US, Married as Student Permanently person a person person taxpayer's) taxpayer(s) example: lived in (yeso) Canada, of 12/31/20 last year Disabled qualifying provide have less provide more pay more than son, your home or Mexico (S/M) lyeso) (yeso) child/relative more than than $4,300 than 50% of half the cost of daughter last year last year of any other 50% of his/ of income? support for maintaining a parent (yeso) ) person? her own (yes, no, n/a) this person? home for this none, etc) (yeso) support? (yesoa) person? (a) (b) (c) (d) (e) (1) (g) (h) (0) (yes, no.rva) (yeso) WILSON SPELMAN 06/20/2020 SON 6 YES YES S NO NO QUINCY SPELMAN 03/04/1984 BROTHER 7 YES YES S NO NO Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2020)