How many marks should we give for part a?

How many marks should we give for part b?

How many marks should we give for part c

Thnks. just need a simple explanation

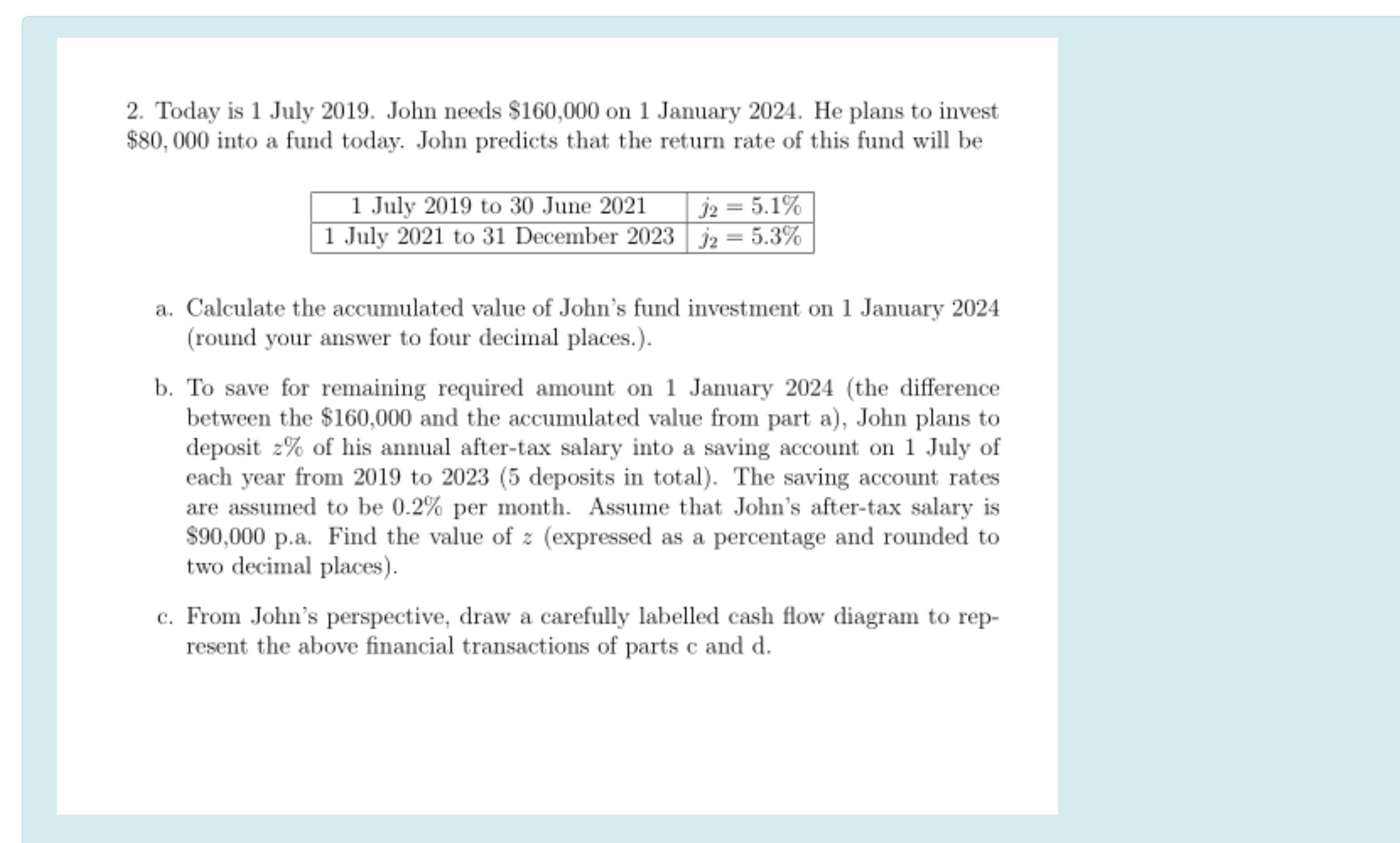

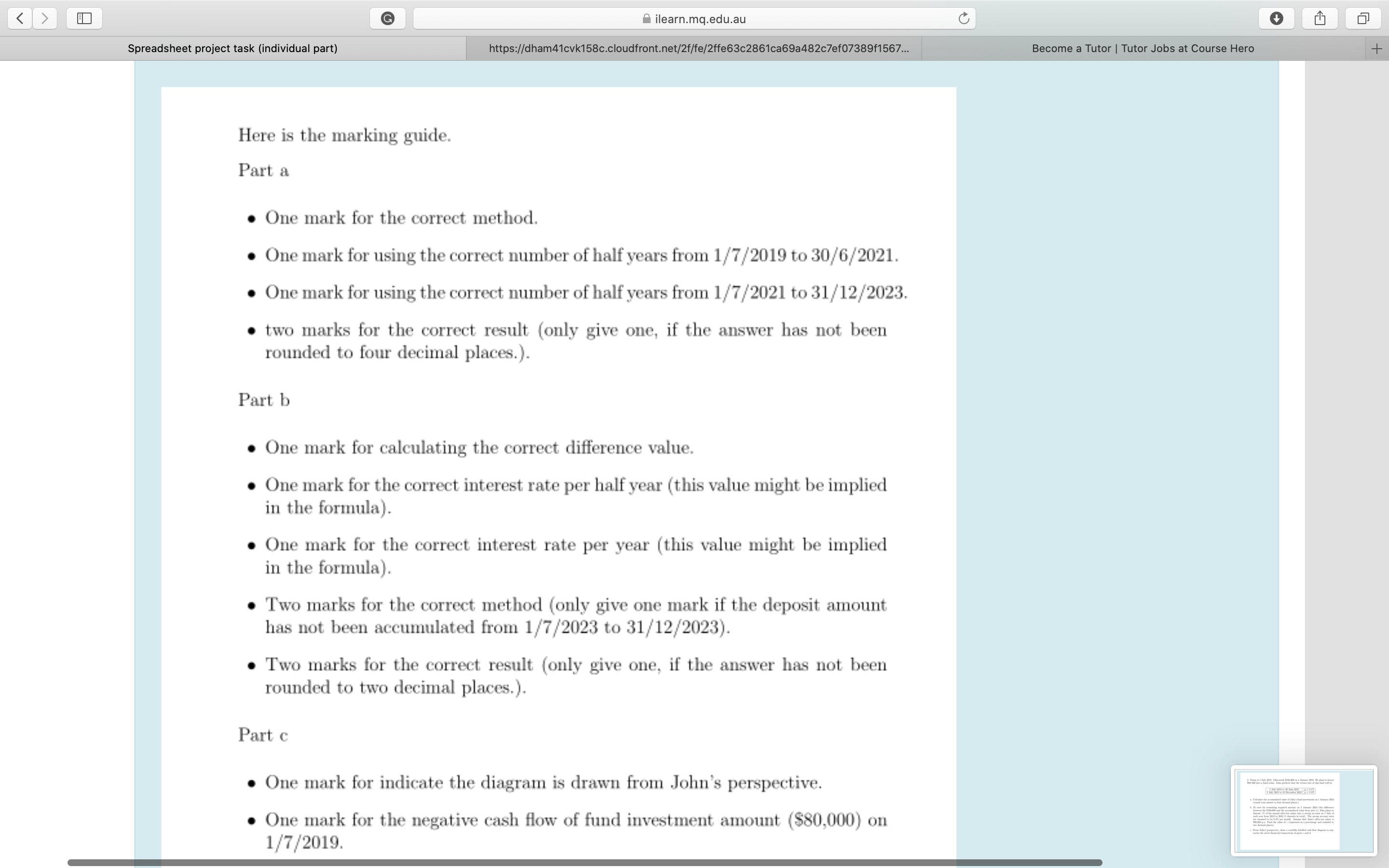

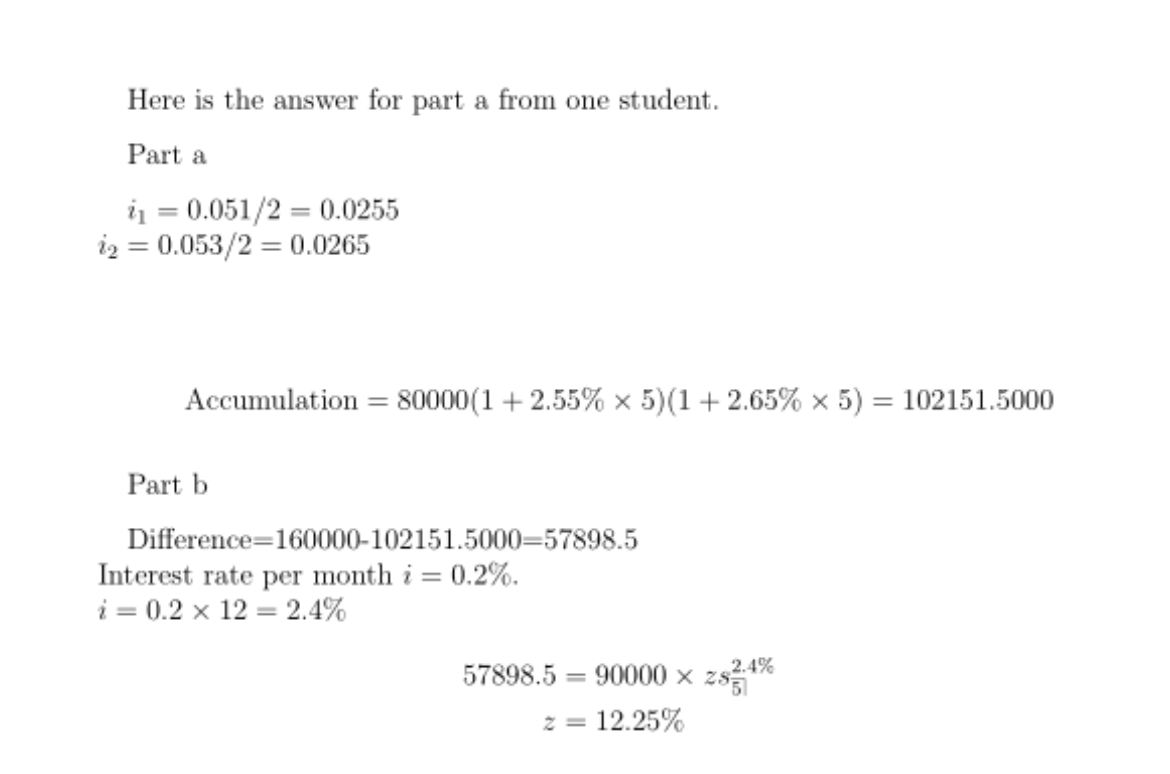

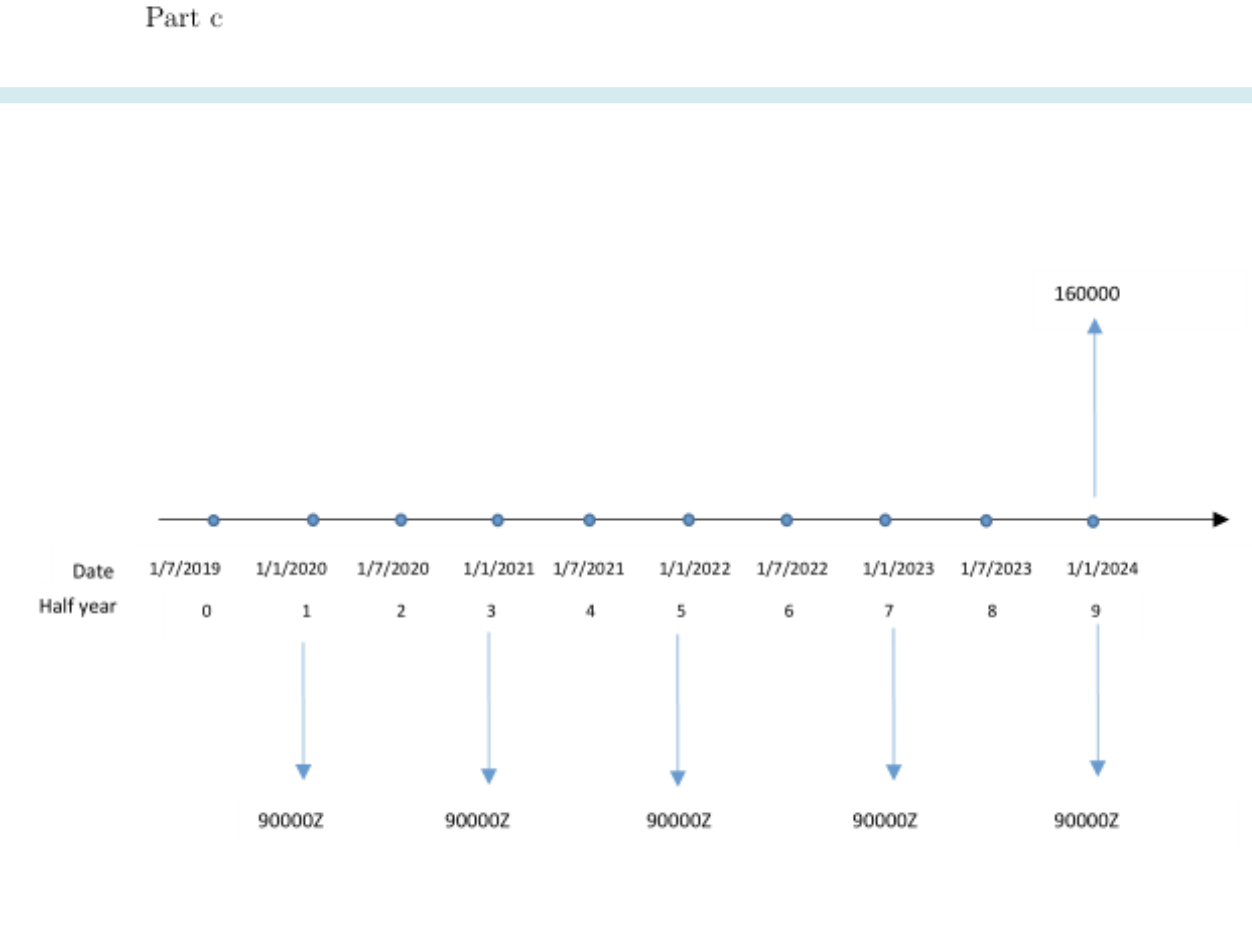

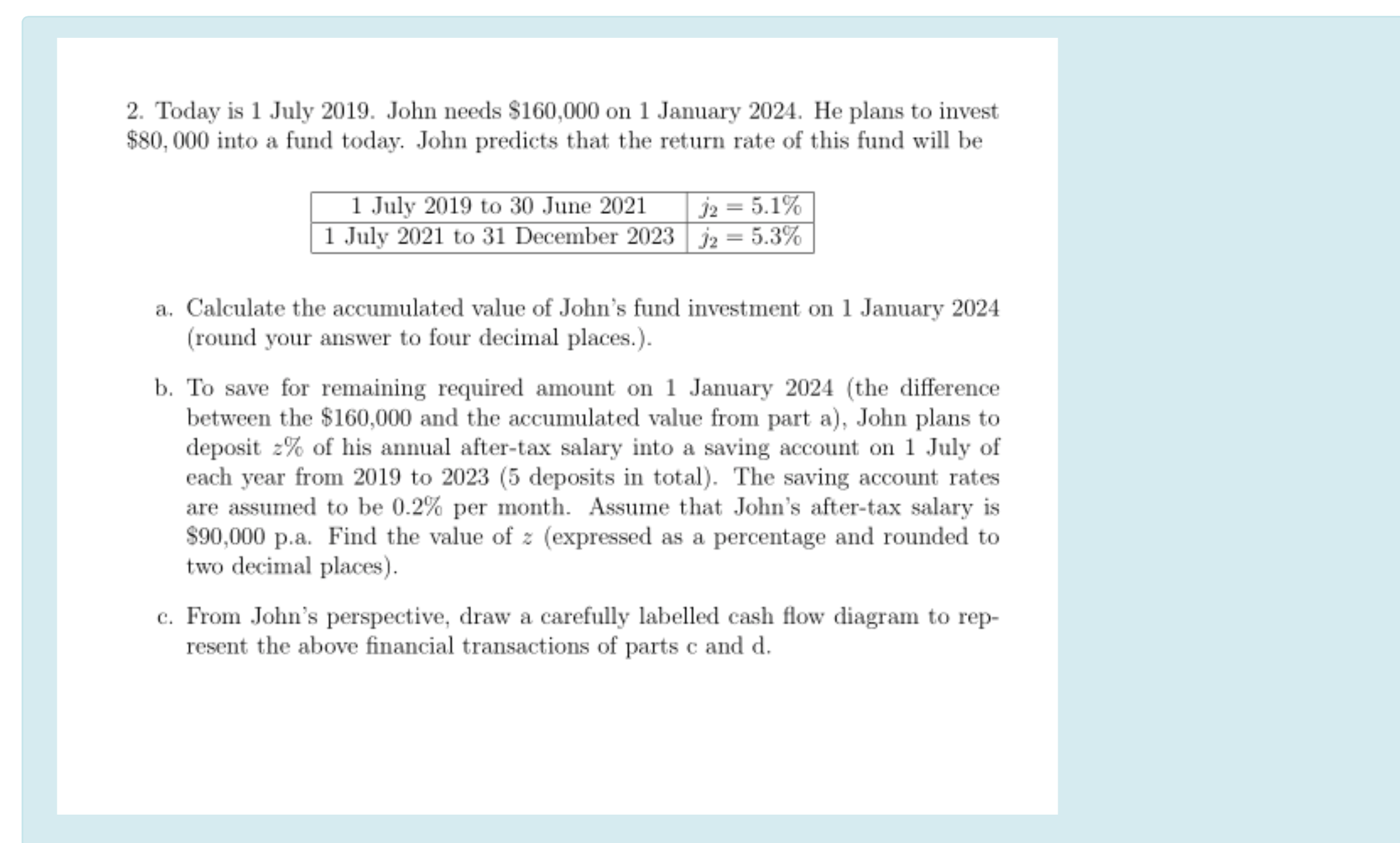

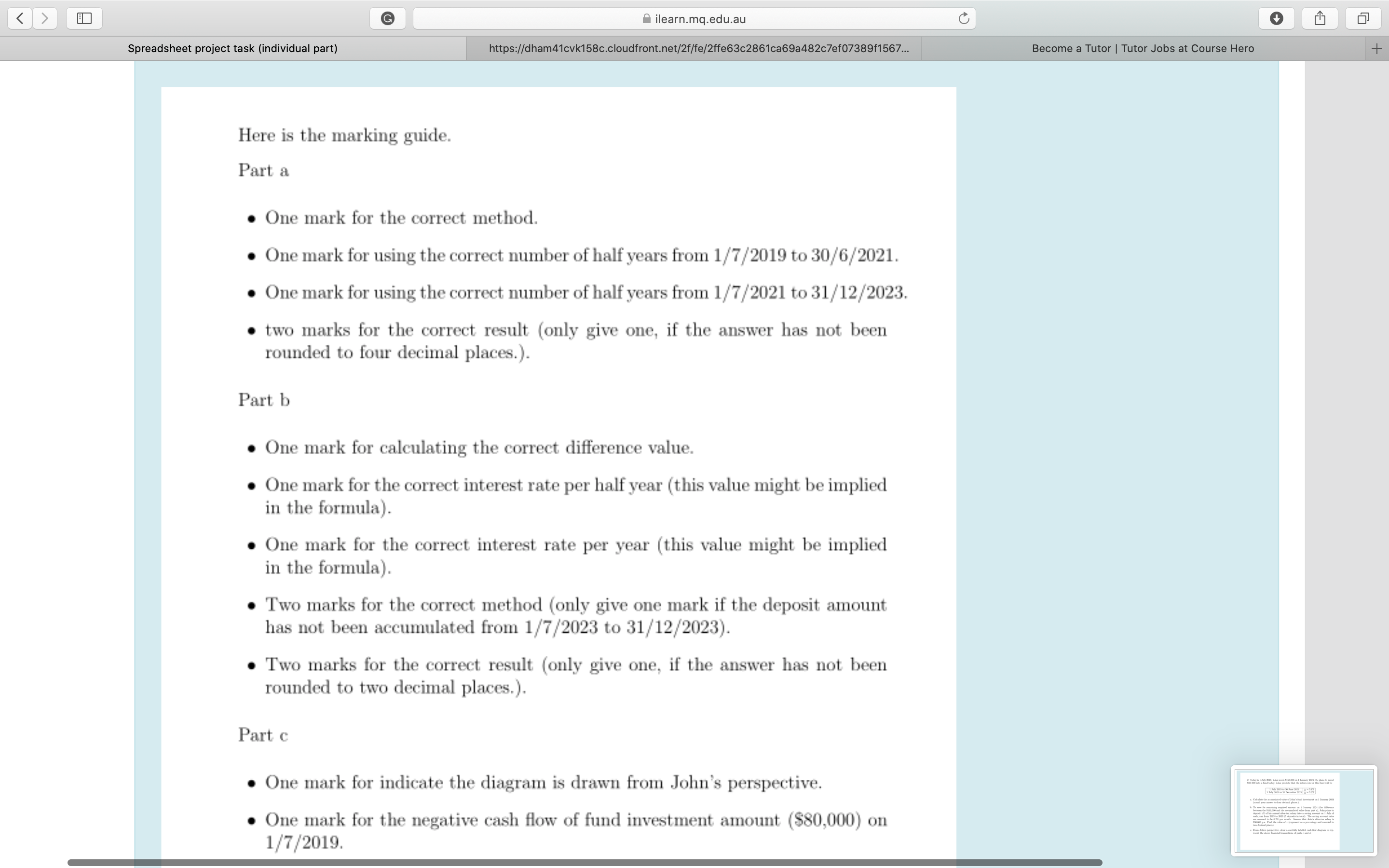

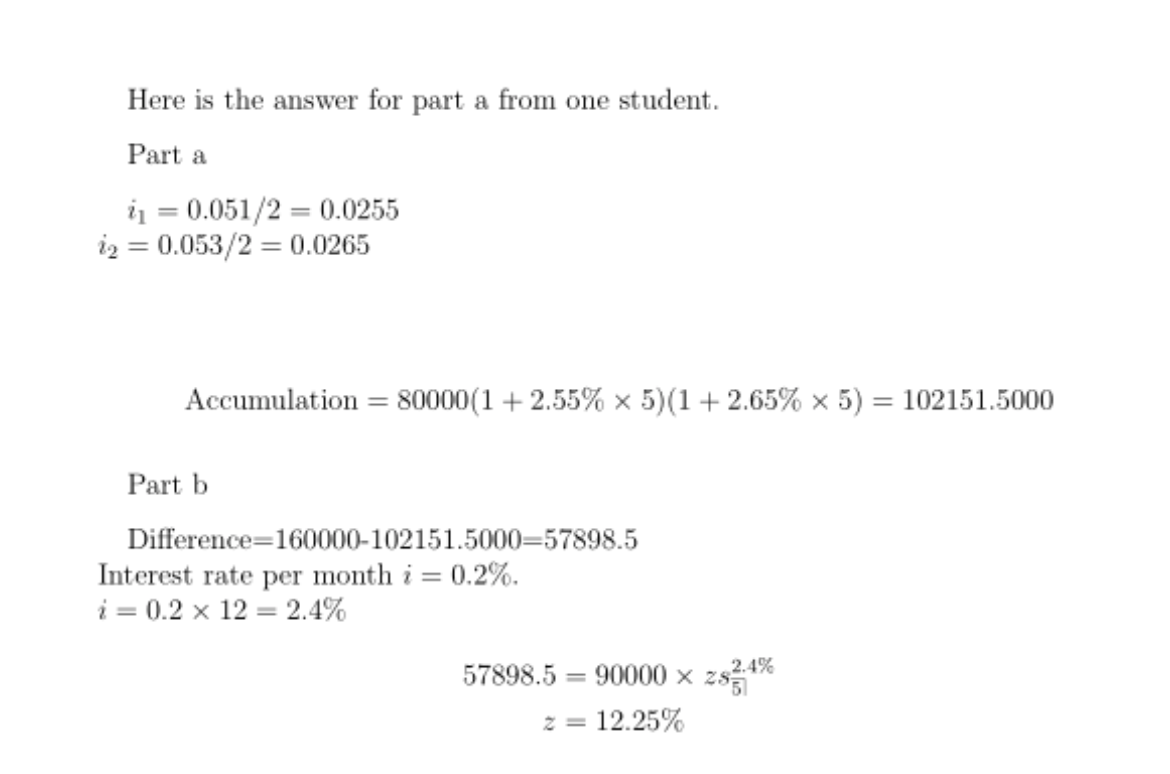

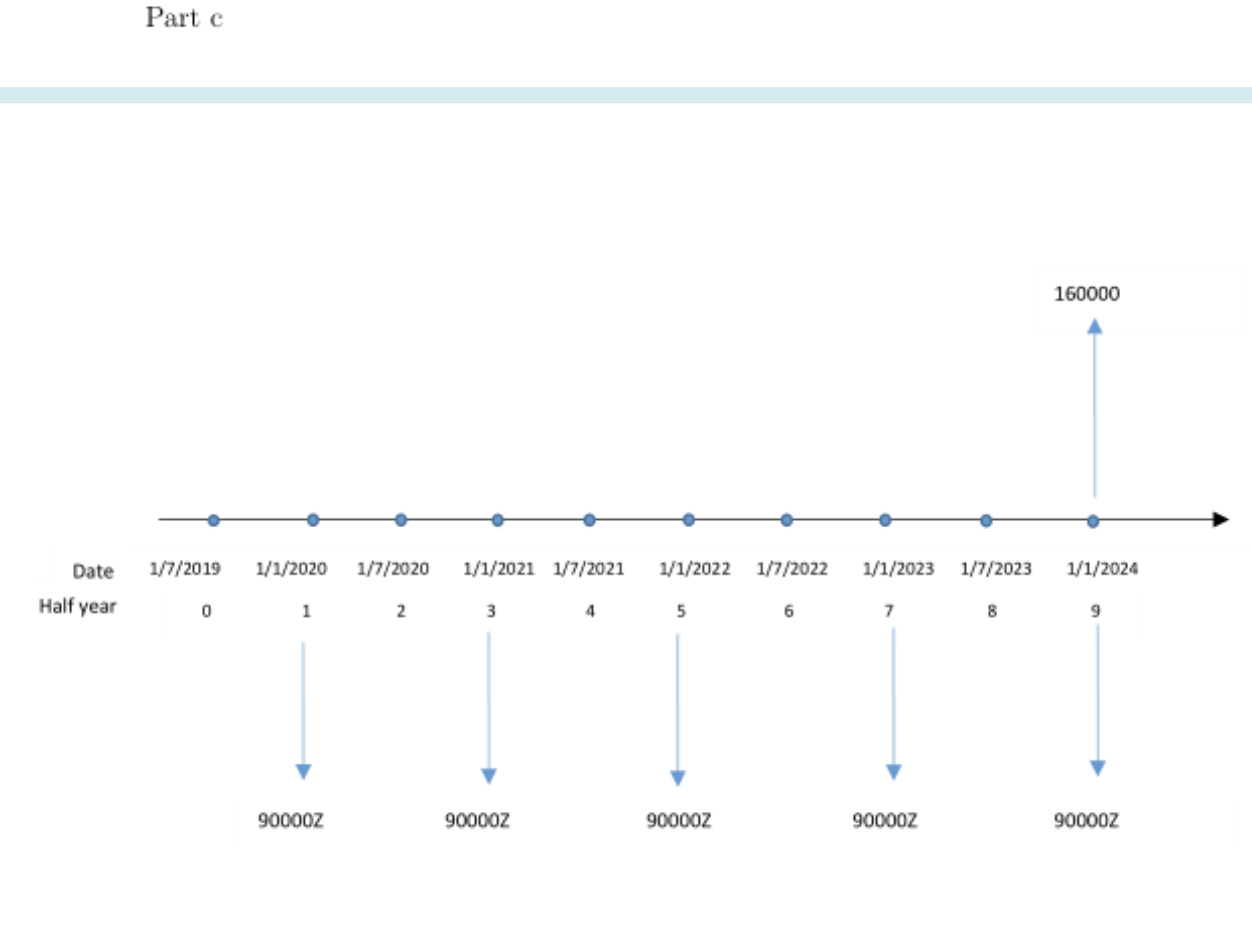

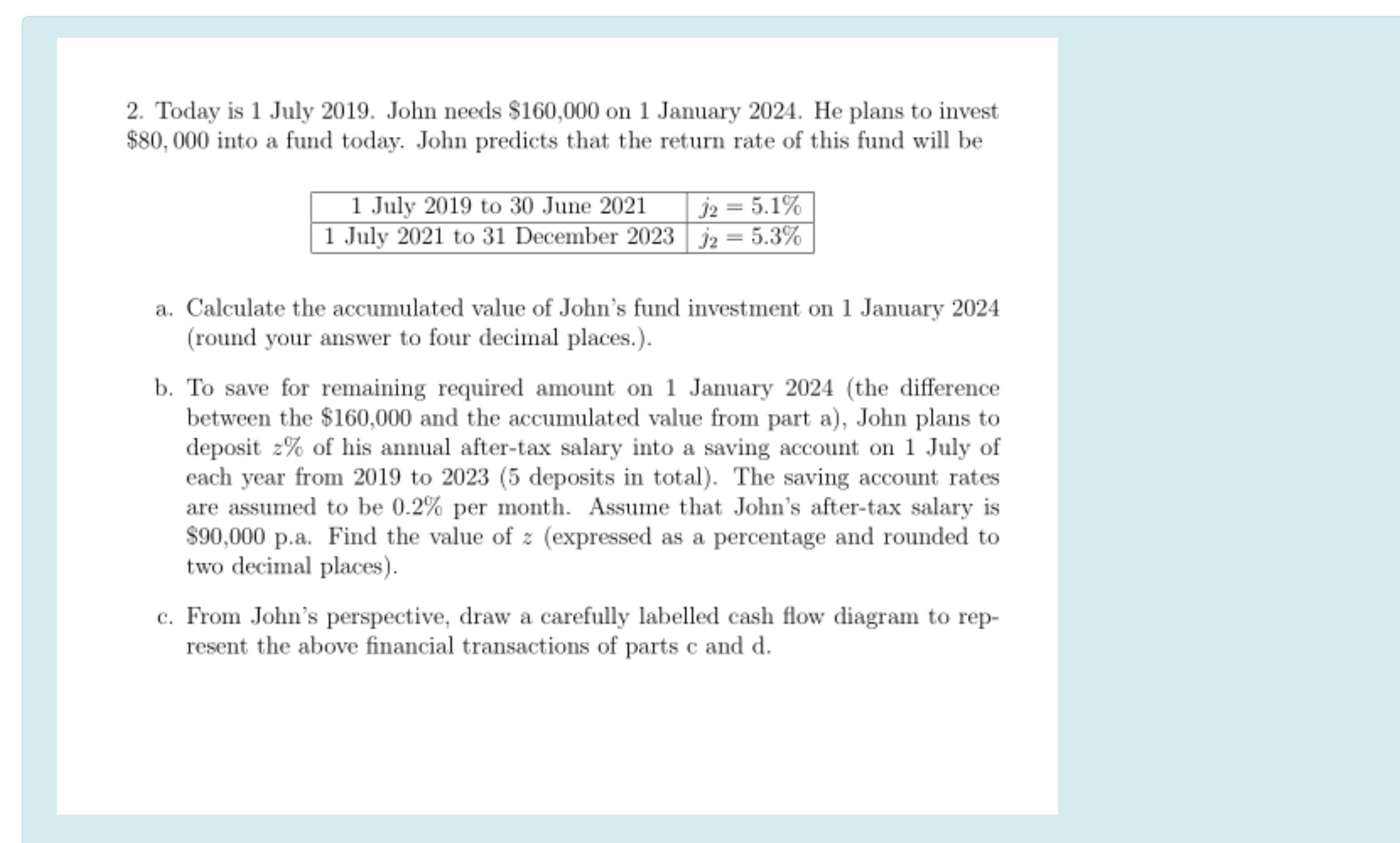

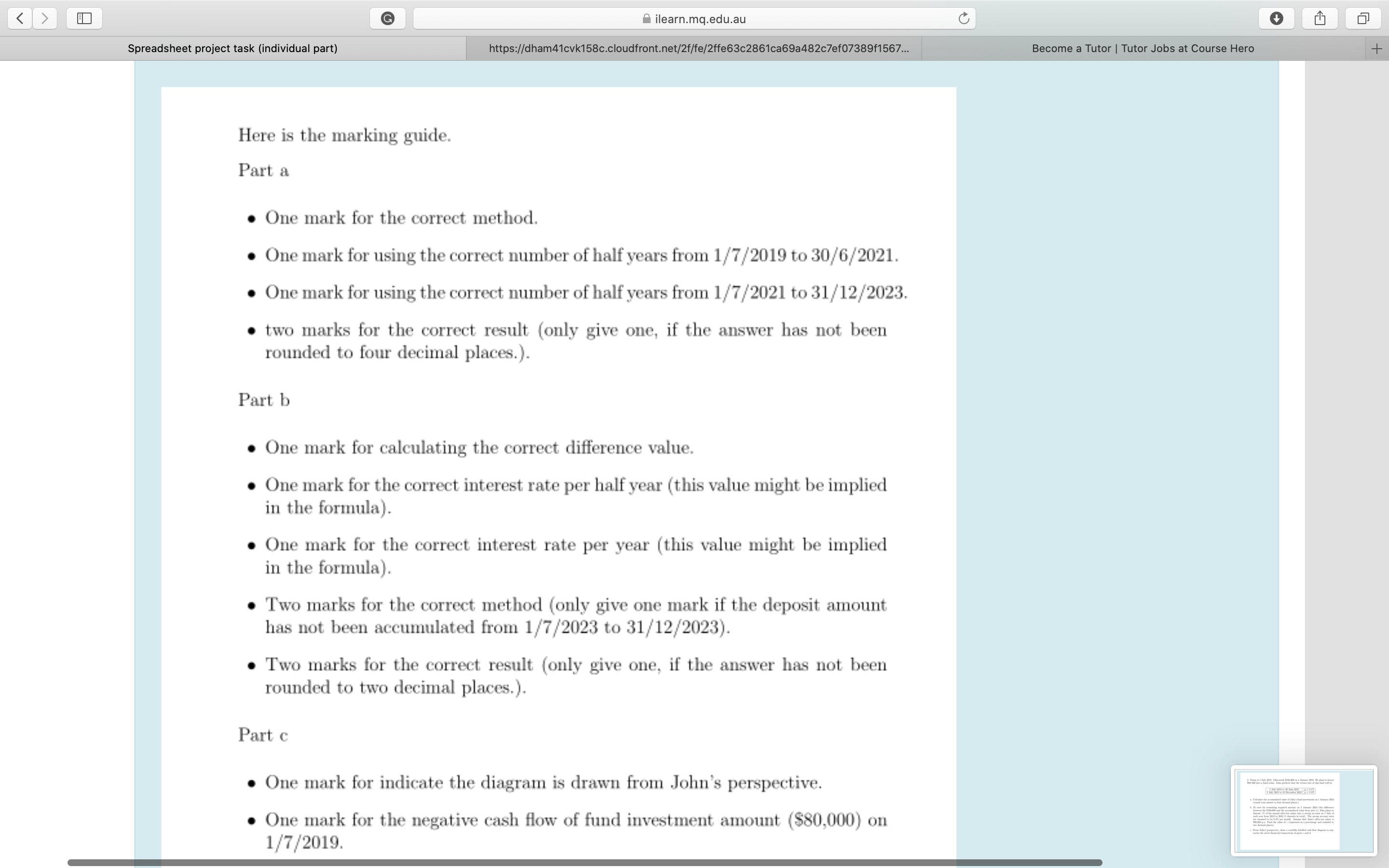

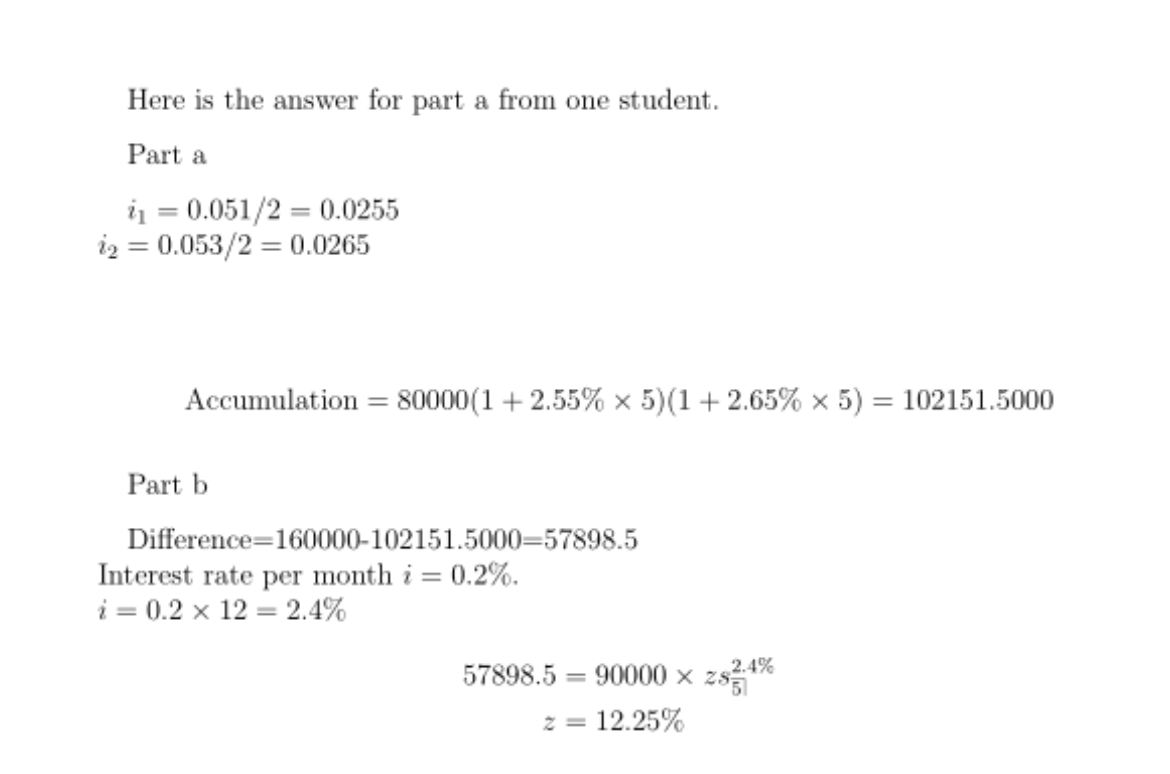

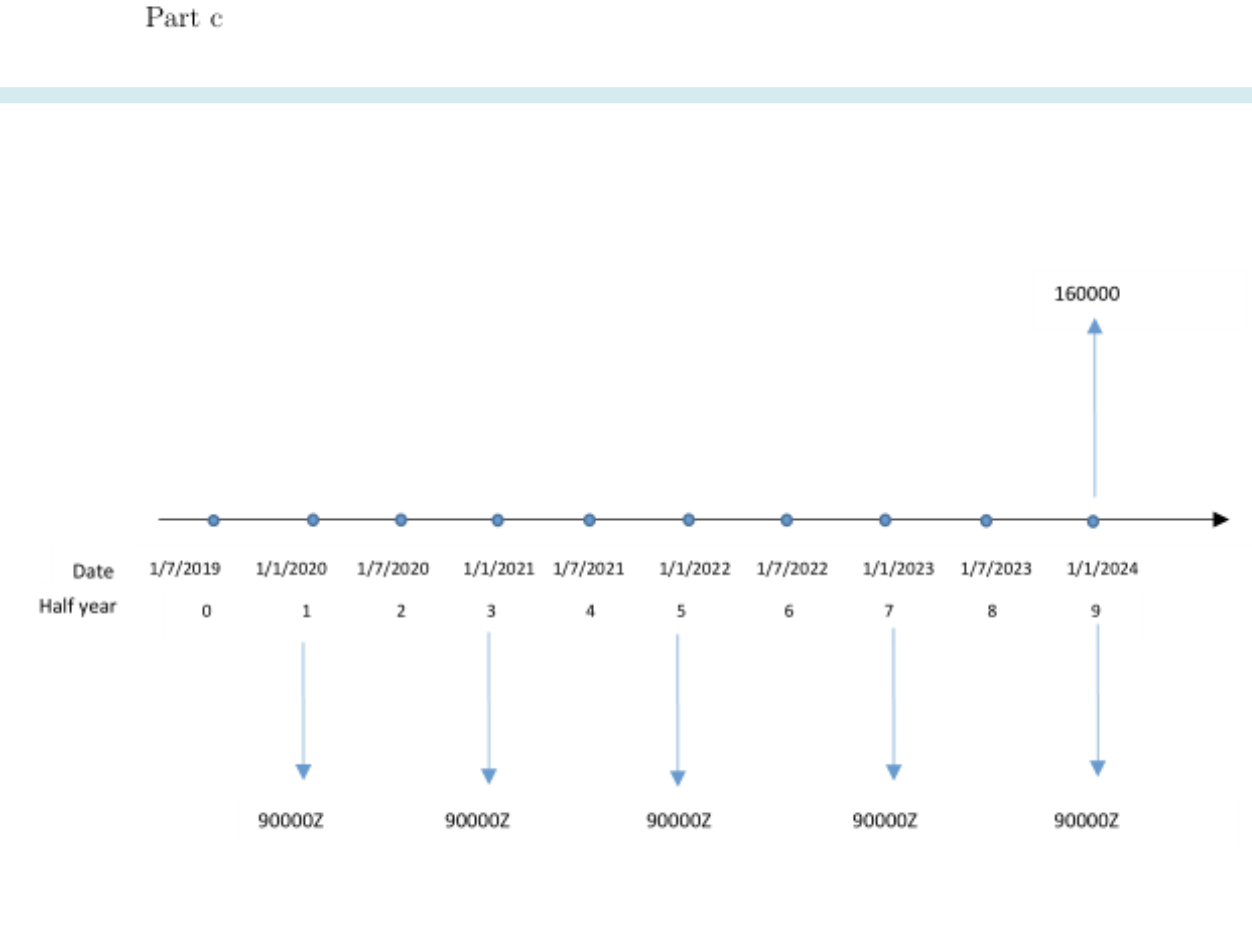

2. Today is 1 July 2019. John needs $160,000 on 1 January 2024. He plans to invest $80, 000 into a fund today. John predicts that the return rate of this fund will be 1 July 2019 to 30 June 2021 12 = 5.1% 1 July 2021 to 31 December 2023 12 = 5.3% a. Calculate the accumulated value of John's fund investment on 1 January 2024 (round your answer to four decimal places.). b. To save for remaining required amount on 1 January 2024 (the difference between the $160,000 and the accumulated value from part a), John plans to deposit 2% of his annual after-tax salary into a saving account on 1 July of each year from 2019 to 2023 (5 deposits in total). The saving account rates are assumed to be 0.2%% per month. Assume that John's after-tax salary is $90,000 p.a. Find the value of z (expressed as a percentage and rounded to two decimal places). c. From John's perspective, draw a carefully labelled cash flow diagram to rep- resent the above financial transactions of parts c and d. G ilearn.mq.edu.au C Spreadsheet project task (individual part) https://dham41cvk158c.cloudfront.net/2f/fe/2ffe63c2861ca69a482c7ef07389f1567... Become a Tutor | Tutor Jobs at Course Hero + Here is the marking guide. Part a . One mark for the correct method. . One mark for using the correct number of half years from 1/7/2019 to 30/6/2021. . One mark for using the correct number of half years from 1/7/2021 to 31/12/2023. . two marks for the correct result (only give one, if the answer has not been rounded to four decimal places.). Part b . One mark for calculating the correct difference value. . One mark for the correct interest rate per half year (this value might be implied in the formula). . One mark for the correct interest rate per year (this value might be implied in the formula). . Two marks for the correct method (only give one mark if the deposit amount has not been accumulated from 1/7/2023 to 31/12/2023). . Two marks for the correct result (only give one, if the answer has not been rounded to two decimal places.). Part c . One mark for indicate the diagram is drawn from John's perspective. . One mark for the negative cash flow of fund investment amount ($80,000) on 1/7/2019.Here is the answer for part a from one student. Part a 21 = 0.051/2 = 0.0255 12 = 0.053/2 = 0.0265 Accumulation = 80000(1 + 2.55% x 5) (1 + 2.65% x 5) = 102151.5000 Part b Difference=160000-102151.5000-57898.5 Interest rate per month i = 0.2%. i = 0.2 x 12 = 2.4% 57898.5 = 90000 x 2324 z = 12.25%