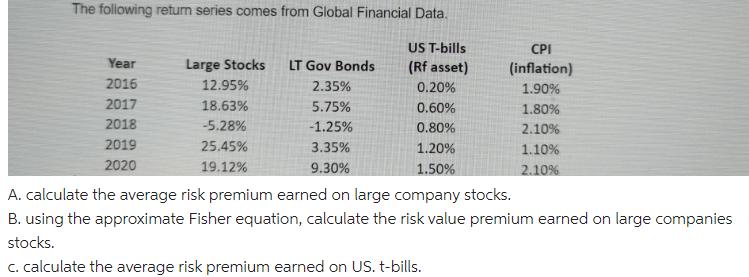

The following return series comes from Global Financial Data. Year 2016 2017 2018 2019 2020 Large Stocks 12.95% 18.63% -5.28% 25.45% 19.12% LT Gov

The following return series comes from Global Financial Data. Year 2016 2017 2018 2019 2020 Large Stocks 12.95% 18.63% -5.28% 25.45% 19.12% LT Gov Bonds 2.35% 5.75% -1.25% 3.35% 9.30% US T-bills (Rf asset) 0.20% 0.60% 0.80% 1.20% 1.50% CPI (inflation) 1.90% 1.80% 2.10% 1.10% 2.10% A. calculate the average risk premium earned on large company stocks. B. using the approximate Fisher equation, calculate the risk value premium earned on large companies stocks. c. calculate the average risk premium earned on US. t-bills.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

A The average risk premium earned on large company stocks can be calculated by subtracting the avera...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started