Answered step by step

Verified Expert Solution

Question

1 Approved Answer

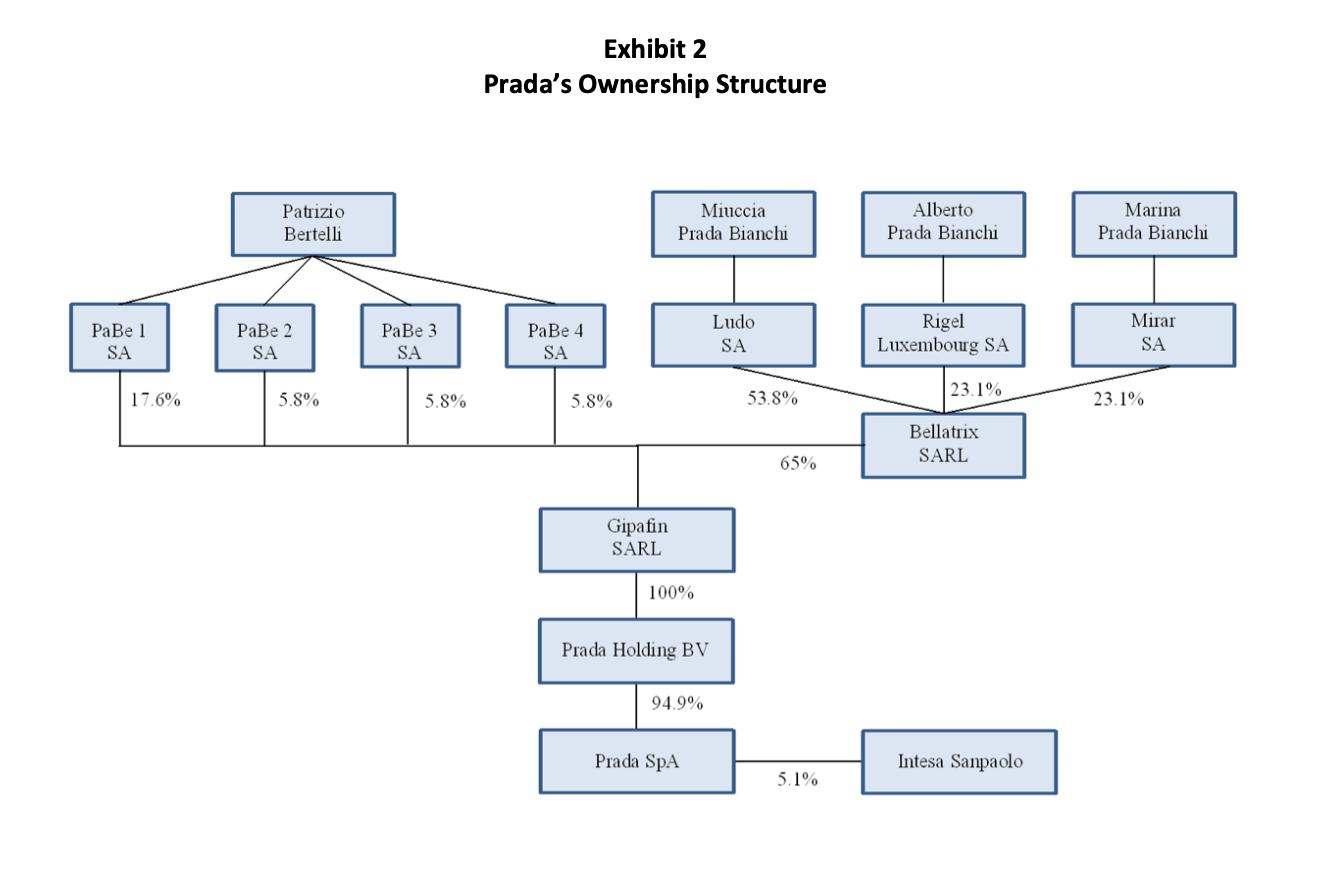

How many sale shares must each of bank Intesa Sanpaolo and Prada Holding sell in the secondary tranche to cut their stakes to 1% and

- How many sale shares must each of bank Intesa Sanpaolo and Prada Holding sell in the secondary tranche to cut their stakes to 1% and 80% (post-greenshoe)? How many shares must the 15% greenshoe include?

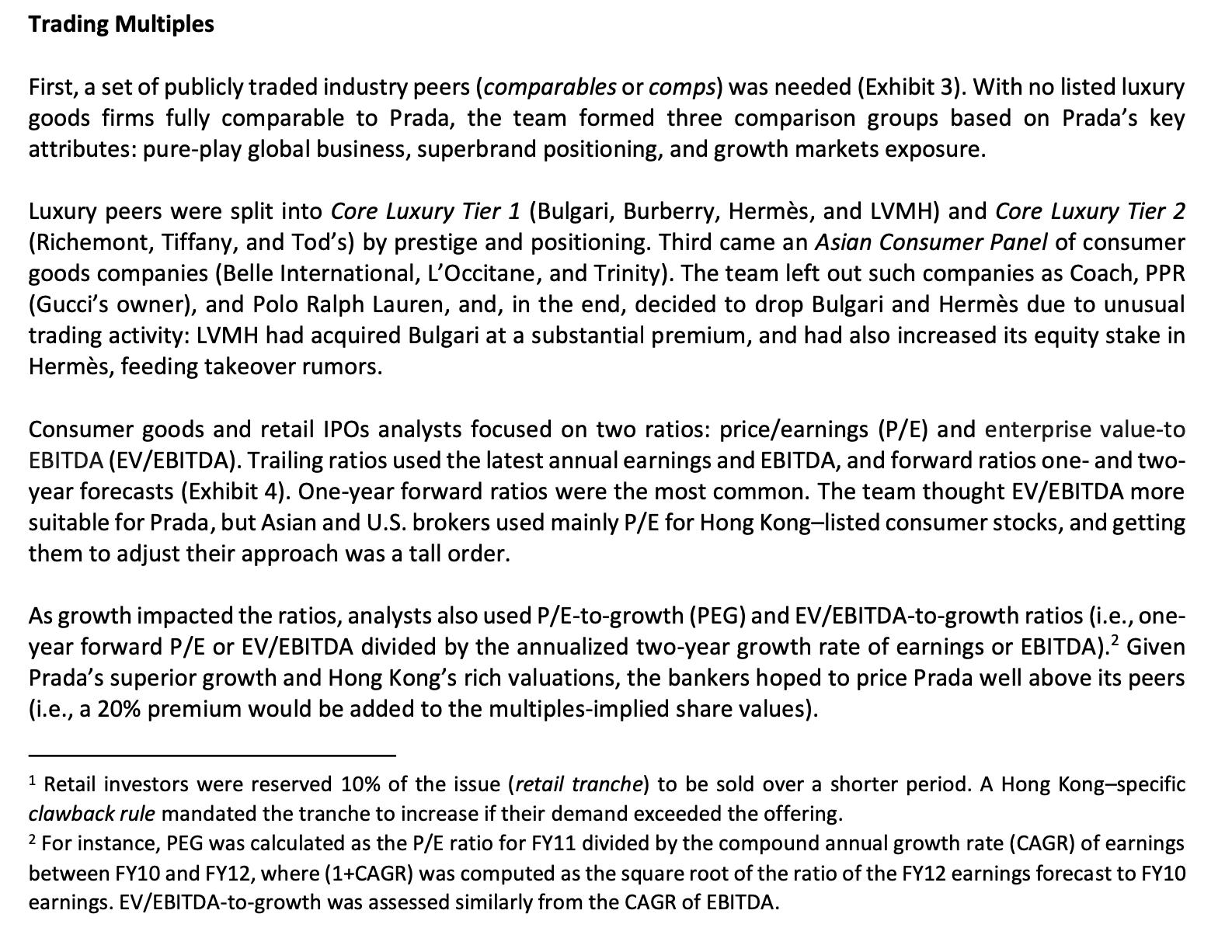

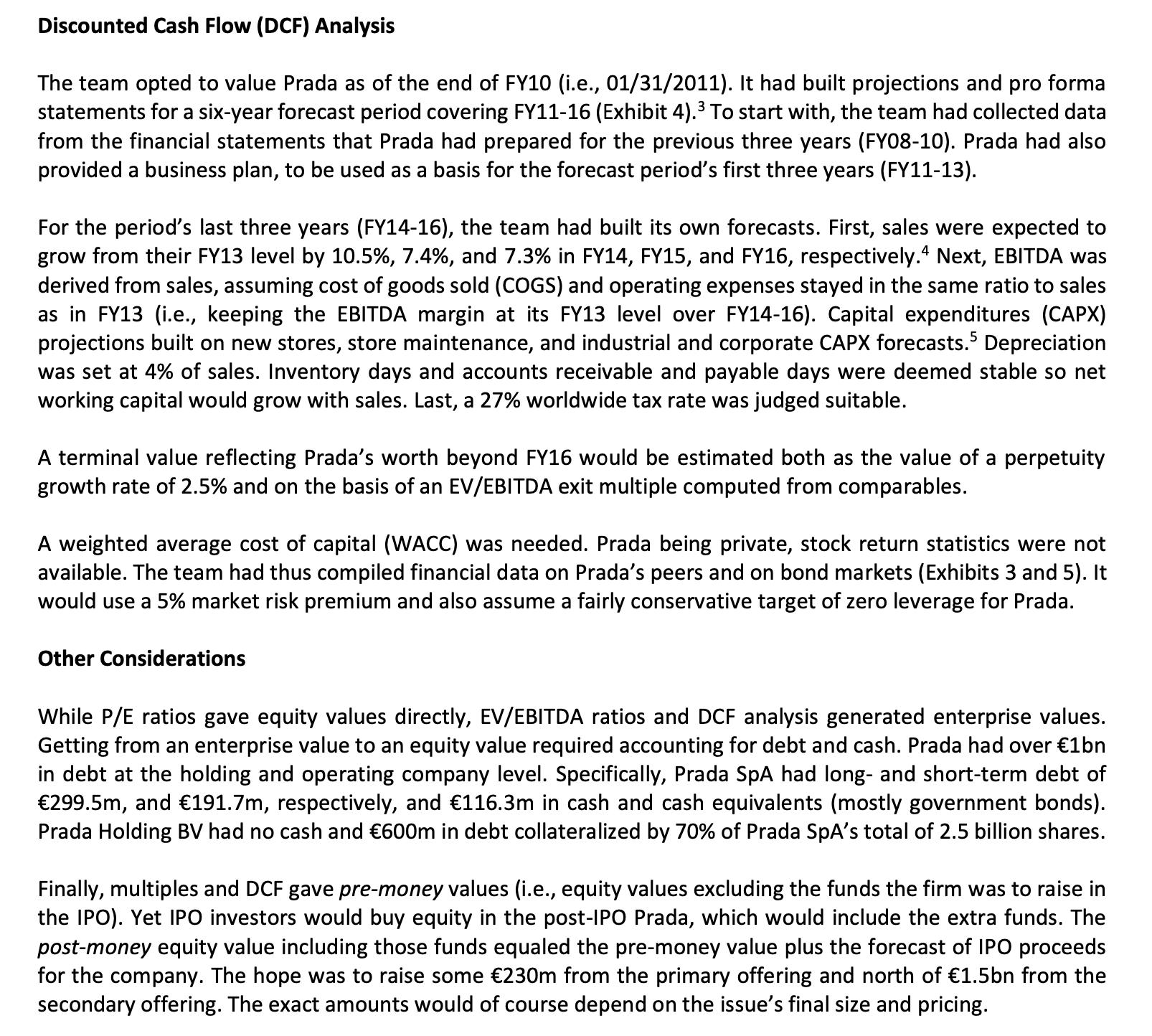

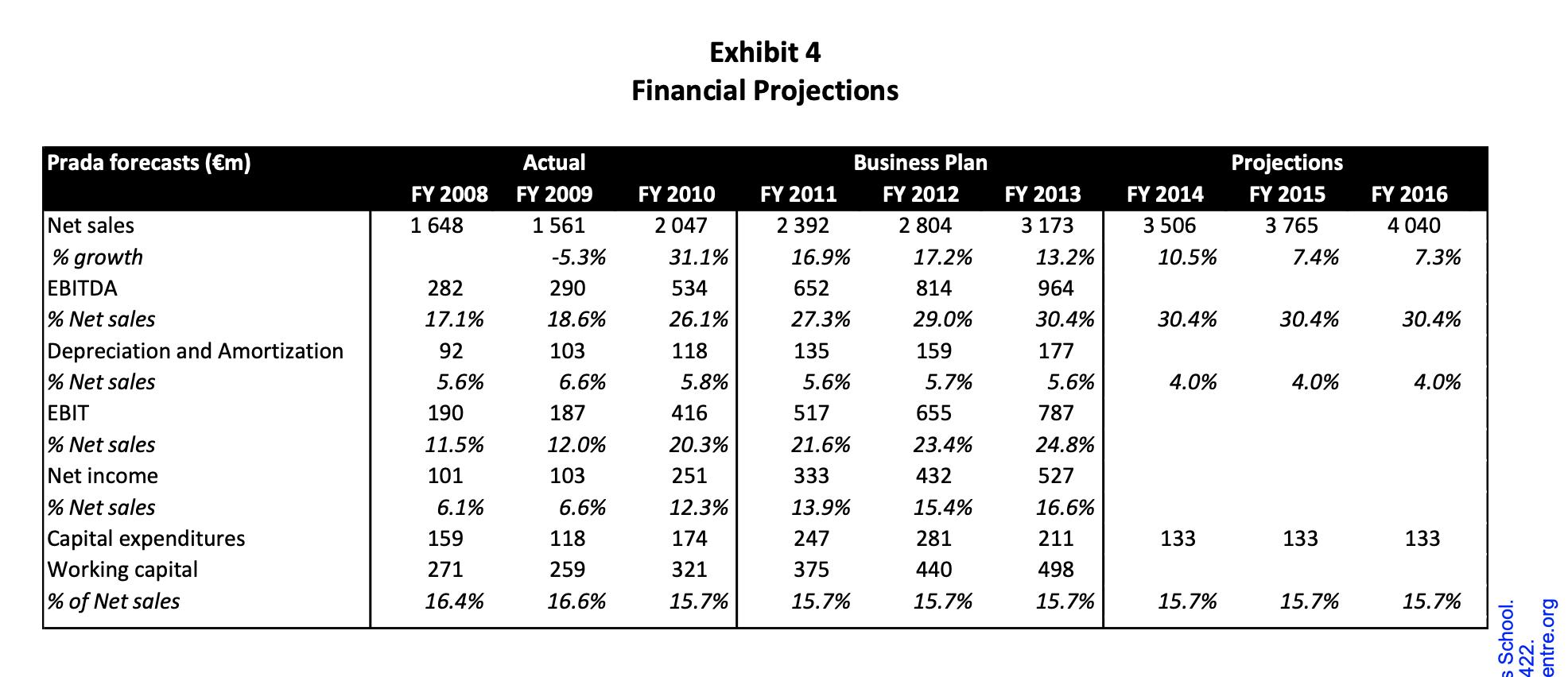

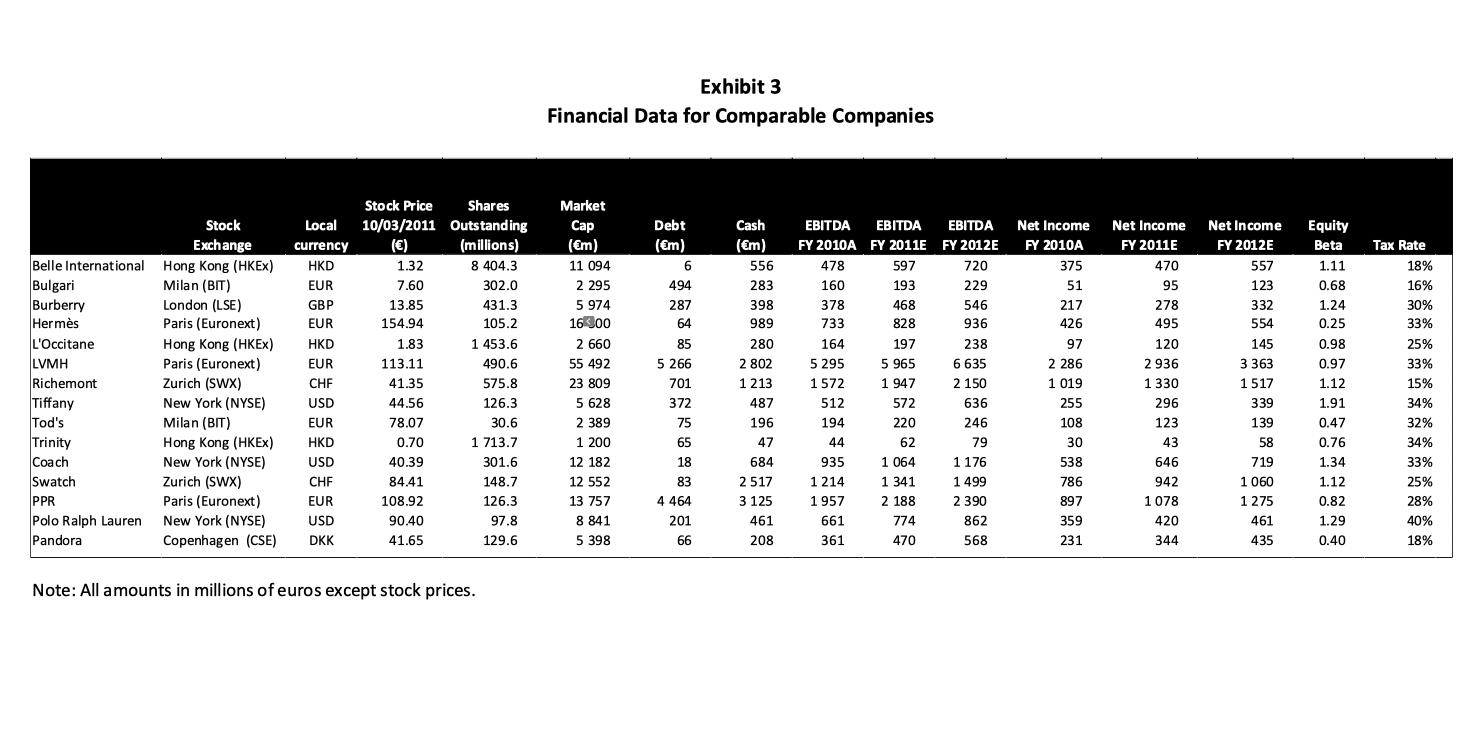

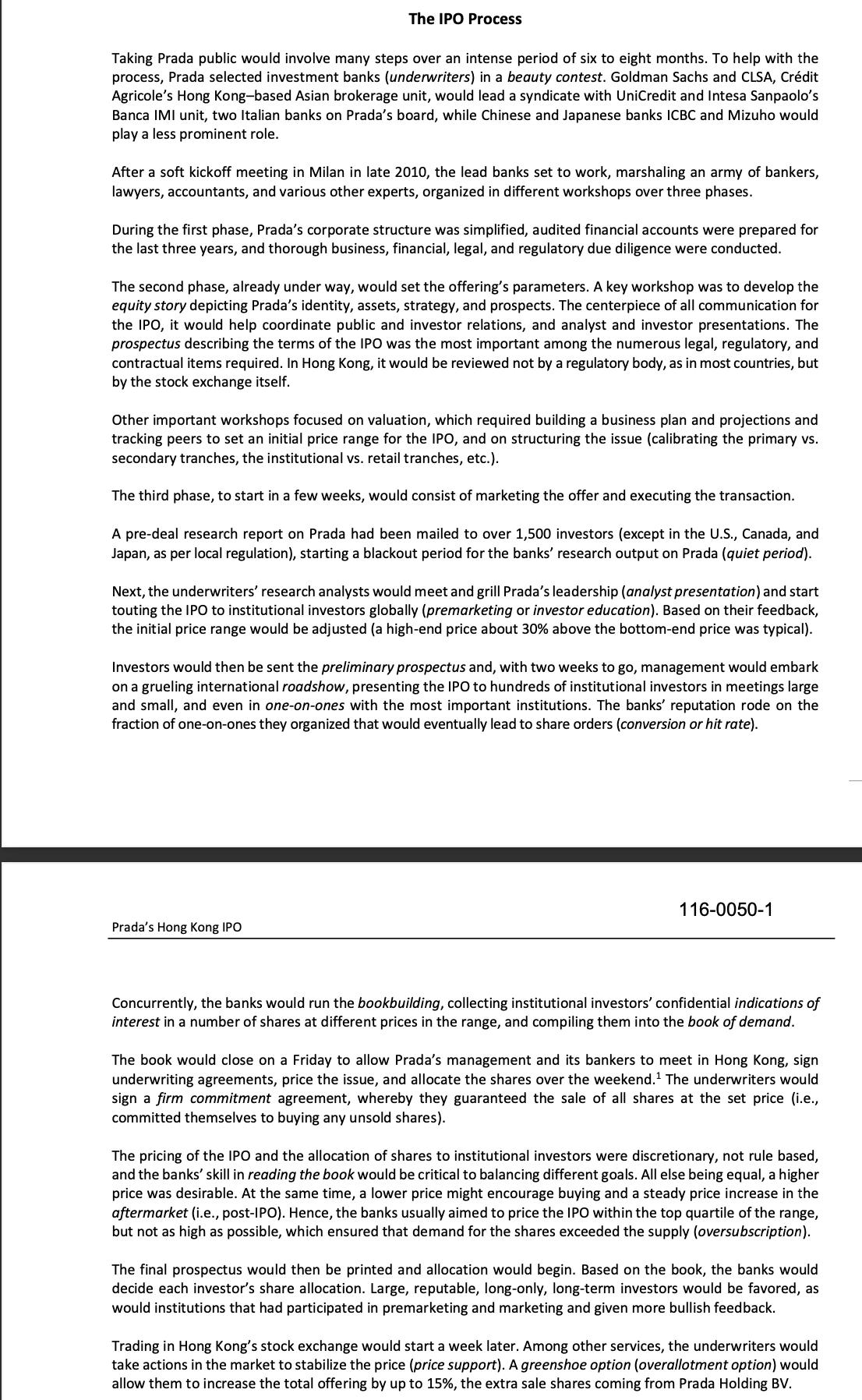

Trading Multiples First, a set of publicly traded industry peers (comparables or comps) was needed (Exhibit 3). With no listed luxury goods firms fully comparable to Prada, the team formed three comparison groups based on Prada's key attributes: pure-play global business, superbrand positioning, and growth markets exposure. Luxury peers were split into Core Luxury Tier 1 (Bulgari, Burberry, Herms, and LVMH) and Core Luxury Tier 2 (Richemont, Tiffany, and Tod's) by prestige and positioning. Third came an Asian Consumer Panel of consumer goods companies (Belle International, L'Occitane, and Trinity). The team left out such companies as Coach, PPR (Gucci's owner), and Polo Ralph Lauren, and, in the end, decided to drop Bulgari and Herms due to unusual trading activity: LVMH had acquired Bulgari at a substantial premium, and had also increased its equity stake in Herms, feeding takeover rumors. Consumer goods and retail IPOs analysts focused on two ratios: price/earnings (P/E) and enterprise value-to EBITDA (EV/EBITDA). Trailing ratios used the latest annual earnings and EBITDA, and forward ratios one- and two- year forecasts (Exhibit 4). One-year forward ratios were the most common. The team thought EV/EBITDA more suitable for Prada, but Asian and U.S. brokers used mainly P/E for Hong Kong-listed consumer stocks, and getting them to adjust their approach was a tall order. As growth impacted the ratios, analysts also used P/E-to-growth (PEG) and EV/EBITDA-to-growth ratios (i.e., one- year forward P/E or EV/EBITDA divided by the annualized two-year growth rate of earnings or EBITDA). Given Prada's superior growth and Hong Kong's rich valuations, the bankers hoped to price Prada well above its peers (i.e., a 20% premium would be added to the multiples-implied share values). 1 Retail investors were reserved 10% of the issue (retail tranche) to be sold over a shorter period. A Hong Kong-specific clawback rule mandated the tranche to increase if their demand exceeded the offering. 2 For instance, PEG was calculated as the P/E ratio for FY11 divided by the compound annual growth rate (CAGR) of earnings between FY10 and FY12, where (1+CAGR) was computed as the square root of the ratio of the FY12 earnings forecast to FY10 earnings. EV/EBITDA-to-growth was assessed similarly from the CAGR of EBITDA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A greenshoe option allows the group of investment banks that underwrite an initial public offering ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started