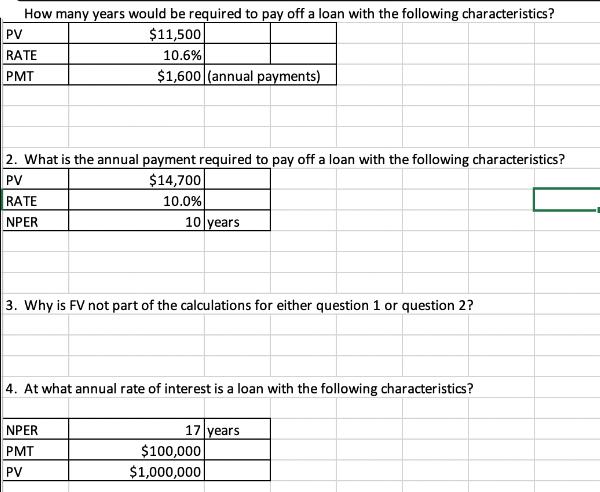

Question: How many years would be required to pay off a loan with the following characteristics? PV $11,500 10.6% RATE PMT $1,600 (annual payments) 2.

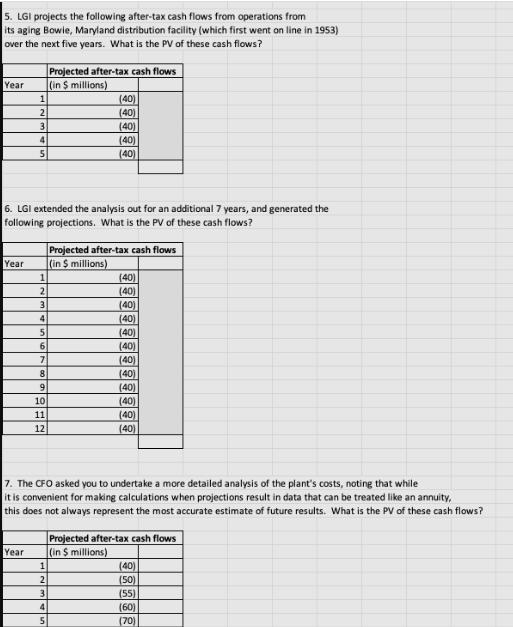

How many years would be required to pay off a loan with the following characteristics? PV $11,500 10.6% RATE PMT $1,600 (annual payments) 2. What is the annual payment required to pay off a loan with the following characteristics? PV RATE NPER $14,700 10.0% 10 years 3. Why is FV not part of the calculations for either question 1 or question 2? 4. At what annual rate of interest is a loan with the following characteristics? NPER PMT PV 17 years $100,000 $1,000,000 5. LGI projects the following after-tax cash flows from operations from its aging Bowie, Maryland distribution facility (which first went on line in 1953) over the next five years. What is the PV of these cash flows? Year Year 1 2 3 4 5 6. LGI extended the analysis out for an additional 7 years, and generated the following projections. What is the PV of these cash flows? Year 1 2 3 4 5 6 7 8 9 10 11 12 Projected after-tax cash flows (in $ millions) 1 2 (40) (40) (40) (40) (40) 3 4 5 Projected after-tax cash flows (in 5 millions) (40) (40) (40) (40) 7. The CFO asked you to undertake a more detailed analysis of the plant's costs, noting that while it is convenient for making calculations when projections result in data that can be treated like an annuity, this does not always represent the most accurate estimate of future results. What is the PV of these cash flows? (40) (40) (40) (40) (40) (40) (40) (40) Projected after-tax cash flows (in $ millions) (40) (50) (55) (60) (70)

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts