Question

How much additional margin must be deposited in one month? How much additional margin must be deposited in 2 months? What is the profit from

How much additional margin must be deposited in one month?

- How much additional margin must be deposited in 2 months?

- What is the profit from this futures trade?

- What would the profit be of the equivalent forward contract?

- Why is the profit of the futures trade different than the equivalent forward contract? Choose one answer:

- With futures you must fund losses and receive profits immediatley, the effects of which are amplified through interest earned on the margin account

- The futures contract is easier to trade because it is an exchange traded product

- It is not possible to arbitrage the differences in futures and forward strategies in this situation

For the next two questions, assume the continuously compounded risk free rate is 5%.

At what lease rate would the forward price of a commodity be equal to it's current spot price?

What does this imply about the lease rate on a commodity exhibiting backwardation? Choose one answer:

- The lease rate is higher than the risk-free interest rate

- The lease rate is lower than the risk-free interest rate

- The lease rate is the same as the risk-free interest rate

- The relationship between the risk-free rate and the lease rate cannot be determined when the asset is in backwardation

If corn has a convenience yield of 2% and storage costs of 3% while the continuously compounded risk free rate is 5%.

What is the forward price of corn for delivery 2 years from now if the current spot price is $3.50?

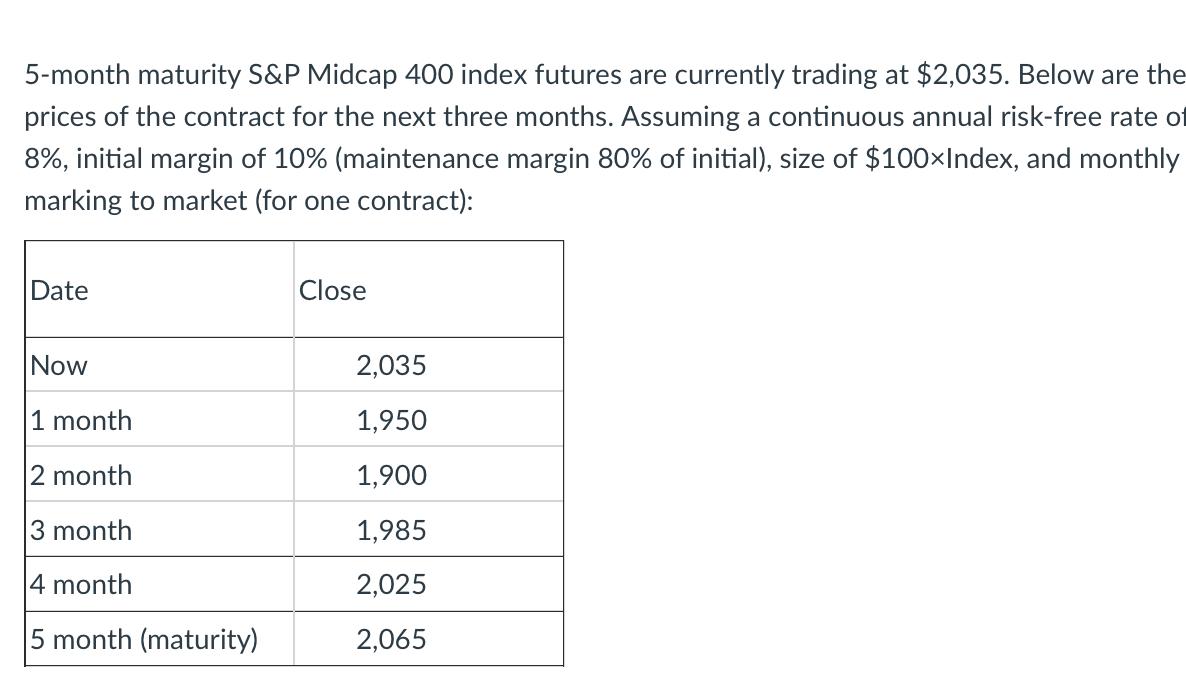

5-month maturity S&P Midcap 400 index futures are currently trading at $2,035. Below are the prices of the contract for the next three months. Assuming a continuous annual risk-free rate of 8%, initial margin of 10% (maintenance margin 80% of initial), size of $100xIndex, and monthly marking to market (for one contract): Date Now 1 month 2 month 3 month 4 month 5 month (maturity) Close 2,035 1,950 1,900 1,985 2,025 2,065

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer these questions we will need to work through the provided information step by step Lets begin with the first question which asks about the additional margin that must be deposited in one mon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started