Answered step by step

Verified Expert Solution

Question

1 Approved Answer

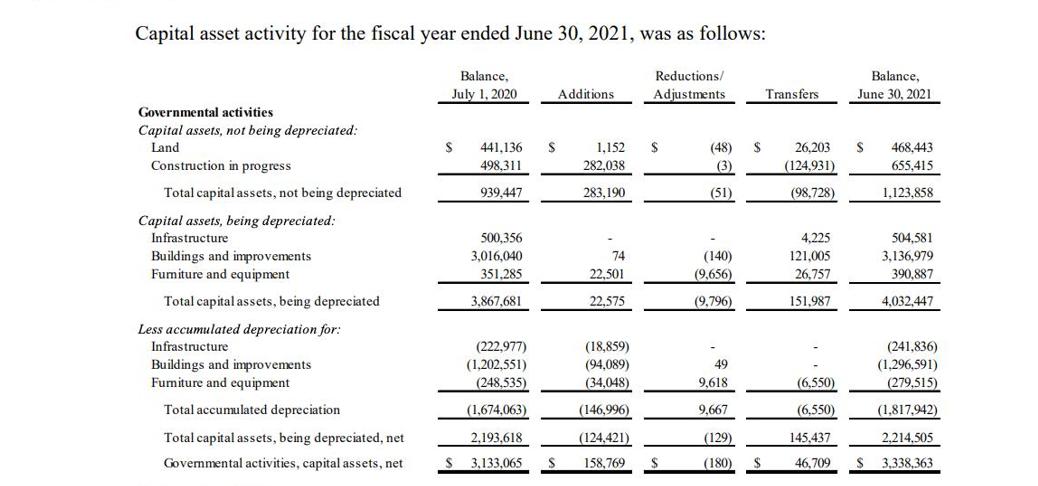

How much depreciation did the government charge in its government-wide statements on capital assets used in government activities? Capital asset activity for the fiscal year

How much depreciation did the government charge in its government-wide statements on capital assets used in government activities?

Capital asset activity for the fiscal year ended June 30, 2021, was as follows: Balance, July 1, 2020 Reductions/ Adjustments Governmental activities Capital assets, not being depreciated: Land Construction in progress Total capital assets, not being depreciated Capital assets, being depreciated: Infrastructure Buildings and improvements Furniture and equipment Total capital assets, being depreciated Less accumulated depreciation for: Infrastructure Buildings and improvements Furniture and equipment Total accumulated depreciation Total capital assets, being depreciated, net Governmental activities, capital assets, net $ 441,136 498,311 939,447 500,356 3,016,040 351,285 3,867,681 Additions 11 (222,977) (1,202,551) (248,535) (1,674,063) 2,193,618 $ 3,133,065 S 1,152 282,038 283,190 74 22,501 22,575 (18,859) (94,089) (34,048) (146,996) (124,421) 158,769 $ S (48) (3) (51) (140) (9,656) (9,796) 49 9.618 9,667 (129) (180) $ $ Transfers. 26,203 (124,931) (98,728) 4.225 121,005 26,757 151,987 (6,550) (6,550) 145,437 46,709 Balance, June 30, 2021 S 468,443 655,415 1,123,858 504,581 3,136,979 390,887 4,032,447 (241,836) (1,296,591) (279,515) (1,817,942) 2,214,505 $ 3,338,363

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of depreciation charged by the government in its governmentwide statements o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started