How much did the company spend on PPE in 2014?

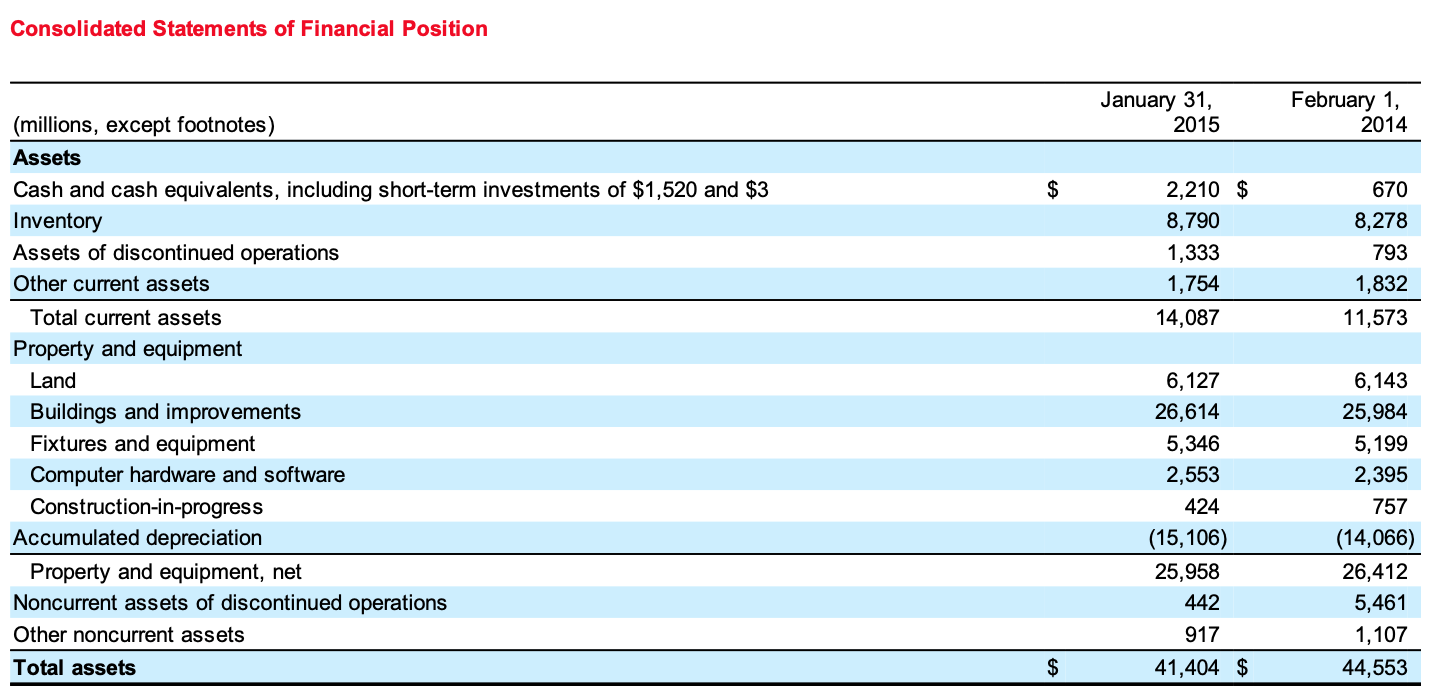

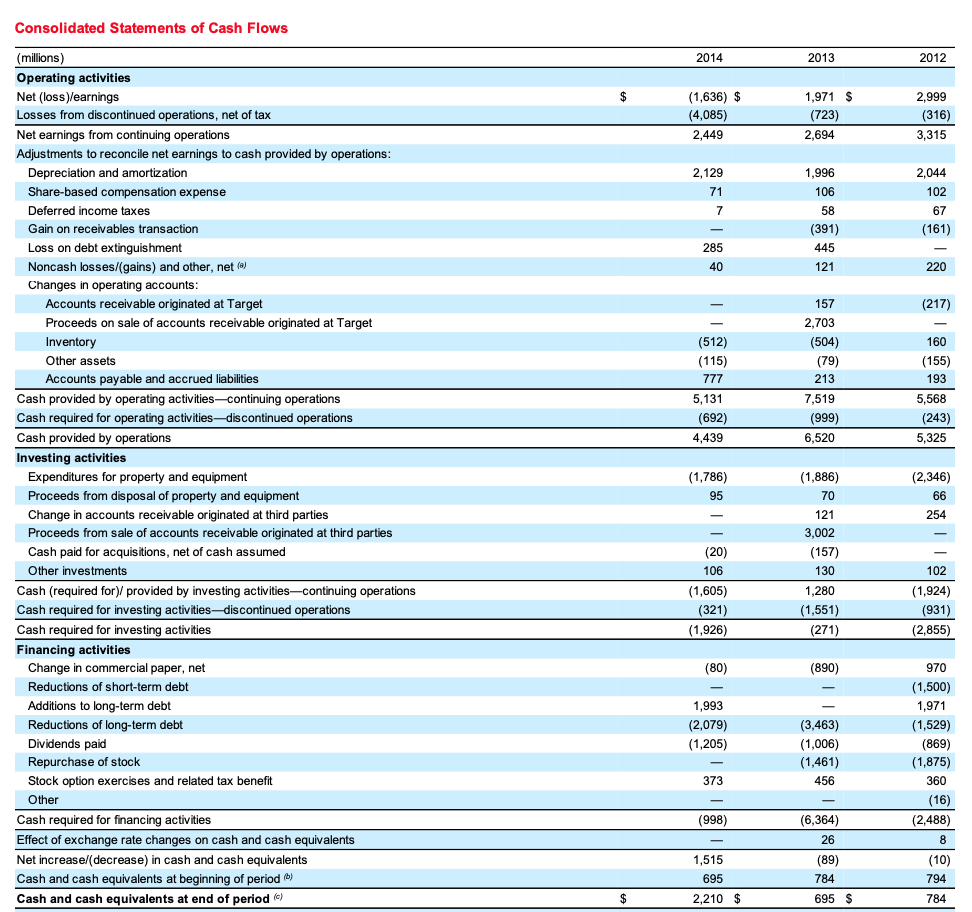

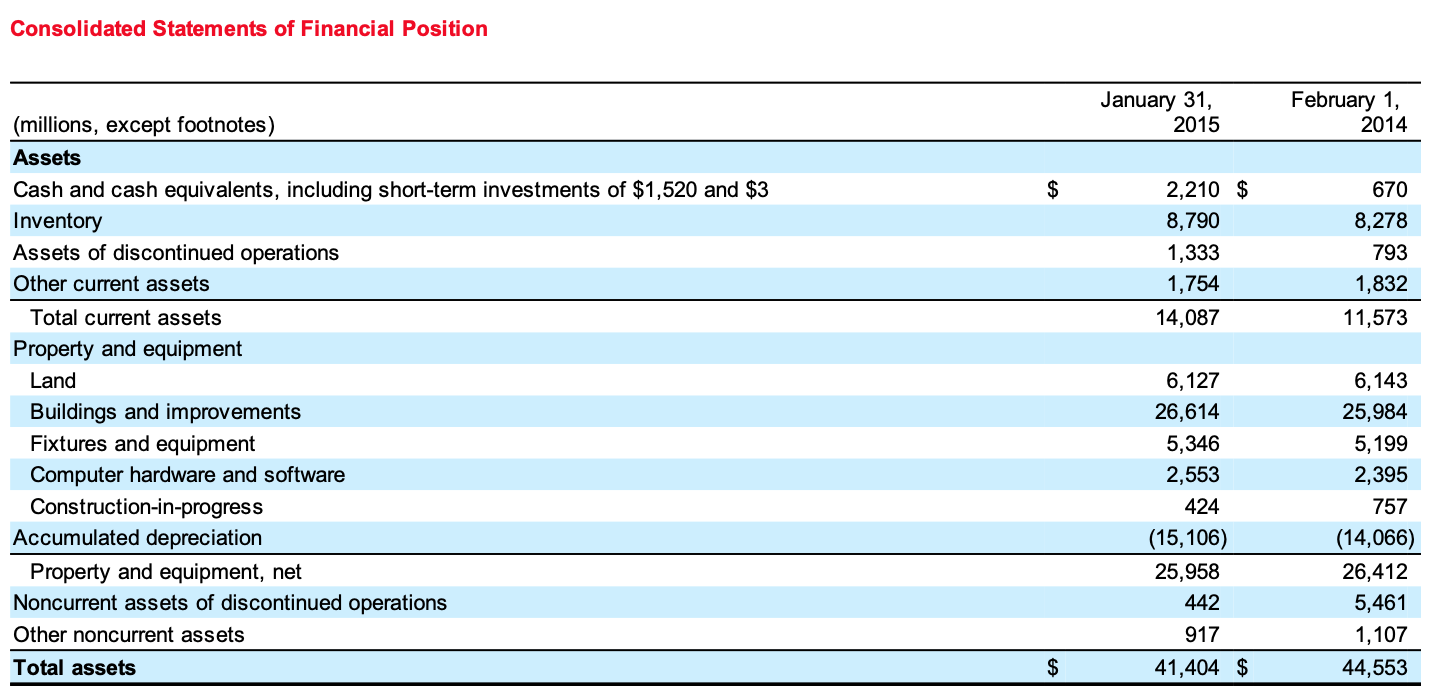

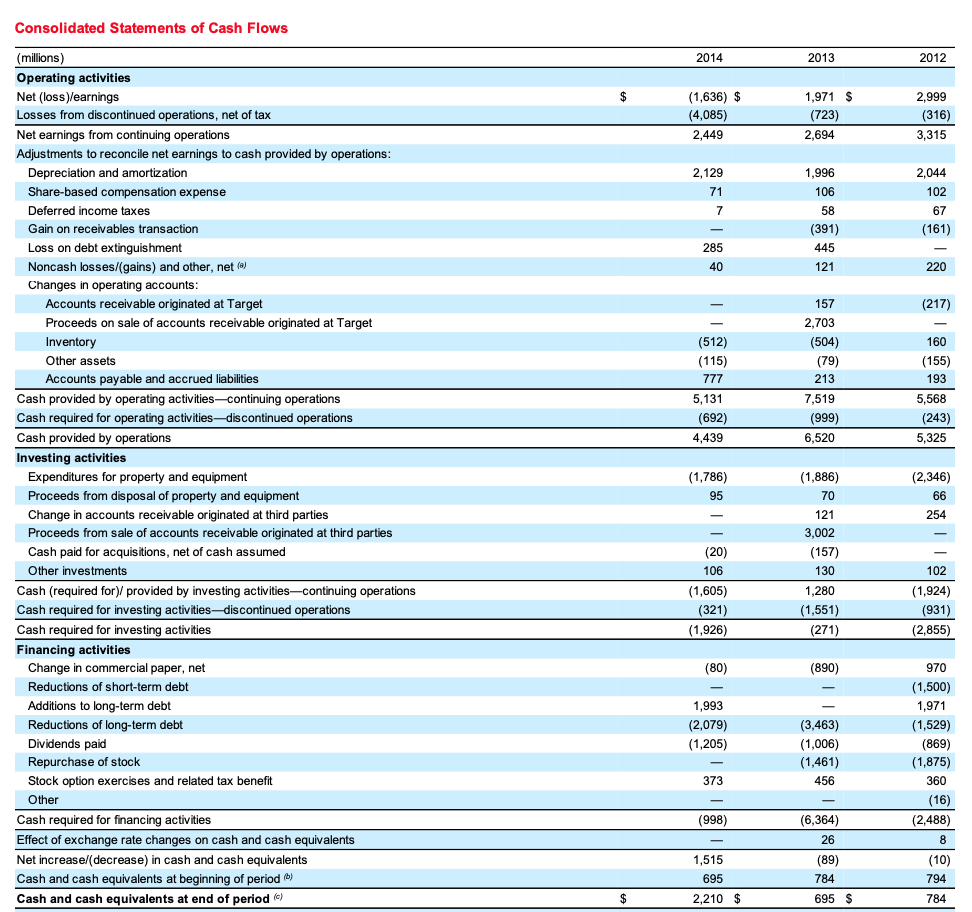

Consolidated Statements of Financial Position January 31, 2015 February 1, 2014 $ 2,210 $ 8,790 1,333 1,754 14,087 670 8,278 793 1,832 11,573 (millions, except footnotes) Assets Cash and cash equivalents, including short-term investments of $1,520 and $3 Inventory Assets of discontinued operations Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Noncurrent assets of discontinued operations Other noncurrent assets Total assets 6,127 26,614 5,346 2,553 424 (15,106) 25,958 442 917 41,404 $ 6,143 25,984 5,199 2,395 757 (14,066) 26,412 5,461 1,107 44,553 $ Consolidated Statements of Cash Flows 2014 2013 2012 $ (1,636) $ (4,085) 2,449 1,971 $ (723) 2,694 2,999 (316) 3,315 1,996 2,129 71 106 2,044 102 67 (161) 7 58 (391) 285 445 40 121 220 (217) (512) (115) 777 5,131 (692) 4,439 157 2,703 (504) (79) 213 7,519 (999) 6,520 160 (155) 193 5,568 (243) 5,325 (millions) Operating activities Net (loss)learnings Losses from discontinued operations, net of tax Net earnings from continuing operations Adjustments to reconcile net earnings to cash provided by operations: Depreciation and amortization Share-based compensation expense Deferred income taxes Gain on receivables transaction Loss on debt extinguishment Noncash losses/gains) and other, net ) Changes in operating accounts: Accounts receivable originated at Target Proceeds on sale of accounts receivable originated at Target Inventory Other assets Accounts payable and accrued liabilities Cash provided by operating activities-continuing operations Cash required for operating activities-discontinued operations Cash provided by operations Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment Change in accounts receivable originated at third parties Proceeds from sale of accounts receivable originated at third parties Cash paid for acquisitions, net of cash assumed Other investments Cash (required for) provided by investing activities-continuing operations Cash required for investing activities-discontinued operations Cash required for investing activities Financing activities Change in commercial paper, net Reductions of short-term debt Additions to long-term debt Reductions of long-term debt Dividends paid Repurchase of stock Stock option exercises and related tax benefit Other Cash required for financing activities Effect of exchange rate changes on cash and cash equivalents Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period b) Cash and cash equivalents at end of period (6) (1,786) 95 (2,346) 66 254 (1,886) 70 121 3,002 (157) 130 1,280 (1,551) (271) (20) 106 (1,605) (321) (1,926) 102 (1,924) (931) (2,855) (80) (890) 1,993 (2,079) (1,205) (3,463) (1,006) (1,461) 456 970 (1,500) 1,971 (1,529) (869) (1,875) 360 (16) (2,488) 8 (10) 794 373 (998) (6,364) 26 (89) 784 1,515 695 2.210 $ $ 695 $ 784