Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much do credit card companies know about you? When Kevin Johnson returned from his honeymoon, a letter from American Express awaited him, informing

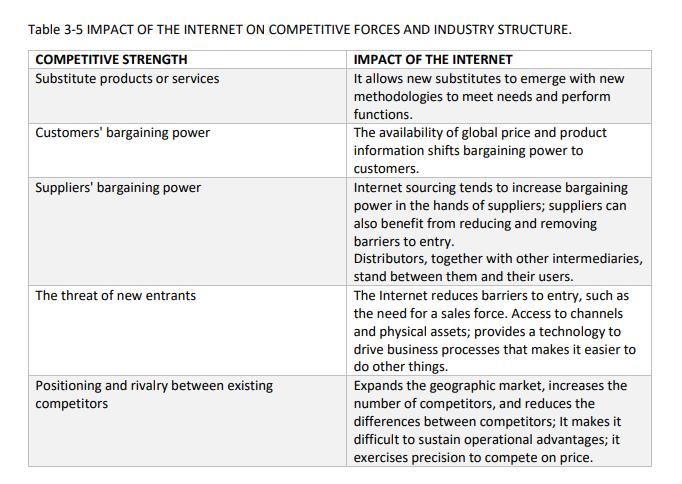

How much do credit card companies know about you? When Kevin Johnson returned from his honeymoon, a letter from American Express awaited him, informing him that AmEx was cutting his credit limit by 60 percent. Why? It wasn't because Johnson had missed a payment or had bad credit. The letter read: "Other customers who have used your card at locations where you made recent purchases and have a poor payment history with American Express." Johnson had started shopping at Walmart. Welcome to the new era of credit card profiles. Each time you purchase with a credit card, a record of that sale is recorded in a massive data warehouse maintained by the card issuer. Each purchase is assigned a four-digit category code that describes the type of purchase that was made. There are separate codes for grocery stores, fast food restaurants, doctors, bars, finance payments, and appointment and escort services. Together, these codes allow credit card companies to learn a lot about each of their customers at a glance. Credit card companies use this data for various purposes. First, they use it to target invoice promotions for additional products accurately. For example, users who buy airline tickets could receive frequent flyer mileage promotions. The data helps card issuers protect against credit card fraud by identifying purchases that seem unusual compared to the regular purchase history of an ambient card. Credit card companies also flag users who frequently exceed their credit limit or demonstrate erratic spending habits. Finally, law enforcement authorities use these records to track down criminals. Debt cards, those who never pay their balances in full and therefore have to pay monthly interest charges and other fees, have been a significant source of profit for credit card issuers. However, the recent financial crisis and credit crunch have disadvantaged them because many people are missing their payments and filing for bankruptcy. So, credit card companies focus on extracting credit card data to predict the most high-risk cards. Using mathematical formulas and behavioral science insights, these companies are developing more detailed and finer profiles to help them get into their customers' heads. The data provides new insights into the relationship between certain types of purchases to a customer's ability or inability to pay credit card balances and other debts. Credit card companies now use this information to deny credit card applications or reduce the amount of credit available to high-risk customers. These companies are generalizing based on certain purchases that can unfairly characterize responsible cardholders as risky. Second-hand clothing purchases, financial services, massages, or gambling could cause credit card issuers to identify you as a risk, even if you keep your money out responsibly from month to month. Other behaviors that generate suspicion are: using your credit card to renew your tires, paying for drinks at a bar, paying for marriage orientation, or getting a cash advance. Paying speeding tickets with your card raises suspicions because they may indicate an irrational or impulsive personality. In light of the subprime mortgage crisis, credit card companies have even begun to consider individuals from Florida, Nevada, California, and other states where they reside. The same detailed profile also identifies the most trusted cardholders worthy of receiving credits. For example, credit card companies found that people who buy high-quality birdseed and snow rakes to sweep snow from their roofs are more likely to pay off their debts and never miss their payments. Credit card companies even use their detailed knowledge about cardholder behavior to make personal connections with customers who owe them money and convince them to pay their balances. A 49-year-old woman from Missouri, suffering from her divorce, owed $40,000 to various credit card companies at one point, including $28,000 to Bank of America. A Bank of America customer service representative, studied the woman's profile, spoke to her many times, and even pointed out a case in which she was mistakenly charged twice. The representative forged a bond with the cardholder and paid the $28,000 he owed (even though he did not pay much of the remainder to other credit companies). This example illustrates something credit card companies now know: When cardholders become more comfortable with companies due to a good relationship with a Customer Service Representative or for any other reason, they are more likely to pay off their debts. A common practice of card companies is to use this information to get a better idea of the consumer trend, but should they be able to use it to deny credit upfront or adjust the terms of agreements? Authorities aren't allowed to profile individuals, but credit card companies are doing just that. In June 2008, the FTC filed a lawsuit against CompuCredi, a subprime credit card marketer. CompuCredit had been using a sophisticated scoring model based on risky buying behavior, lowering these customers' credit limits. CompuCredir settled the lawsuit by crediting $114 million to the accounts of these alleged risky customers and paying a fine of $2.5 million. Congress is investigating how credit card companies use profiles to determine interest rates and policies for their cardholders. The new credit card reform law signed by President Barack Obama in May 2009 requires federal regulators to investigate this. Regulators must also determine whether they created adverse profiles of minority cardholders because of these criteria. The new legislation also prohibits credit card companies from raising interest rates on their customers at any time and for any reason. In the future, you're likely to receive far fewer credit card offers in the mail, and few interest-free cards offers with skyrocketing rates after an initial grace period. You'll also see fewer policies aimed at deceiving or disappointing customers, like cashback rewards for balances that haven't been covered, which encourage cardholders not to pay what they owe. However, credit card companies say that to offset these changes; they will need to raise rates overall, even for good customers. Sources: Betty Schiffman, "Who knows better? Your credit card company or your Spouse?", Daily Fiance, April 13, 2010; Charles Duhigg, "What Does Your Credit-Card Company Know About You?". The New York Times, June 17, 2009, and Credit-Cards.com, "Can Your Lifestyle Hurt Your Credit?", MSN Money, June 30, 2009 CASE STUDY QUESTIONS 1. What competitive strategy do credit card companies pursue? How do information systems support this strategy? 2. How do businesses benefit from analyzing customer purchase data and building profiles about behavior? 3. Are these practices of credit card companies ethical? Are they an invasion of privacy? Why if or why not? MIS IN ACTION 1. If you have a credit card, make a detailed list of all your purchases over the past six months. Then write a paragraph indicating what credit card companies learned about their interests and behavior from these purchases. 2. How would this information benefit credit card companies? What other companies would be interested? Table 3-5 IMPACT OF THE INTERNET ON COMPETITIVE FORCES AND INDUSTRY STRUCTURE. IMPACT OF THE INTERNET COMPETITIVE STRENGTH Substitute products or services It allows new substitutes to emerge with new methodologies to meet needs and perform functions. Customers' bargaining power Suppliers' bargaining power The threat of new entrants Positioning and rivalry between existing competitors The availability of global price and product information shifts bargaining power to customers. Internet sourcing tends to increase bargaining power in the hands of suppliers; suppliers can also benefit from reducing and removing barriers to entry. Distributors, together with other intermediaries, stand between them and their users. The Internet reduces barriers to entry, such as the need for a sales force. Access to channels and physical assets; provides a technology to drive business processes that makes it easier to do other things. Expands the geographic market, increases the number of competitors, and reduces the differences between competitors; It makes it difficult to sustain operational advantages; it exercises precision to compete on price.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

What competitive strategy do credit card companies pursue How do information systems support this strategy The combined information from various sources is then used to establish a persons behavioral ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

640ef52aa15c1_109073.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started