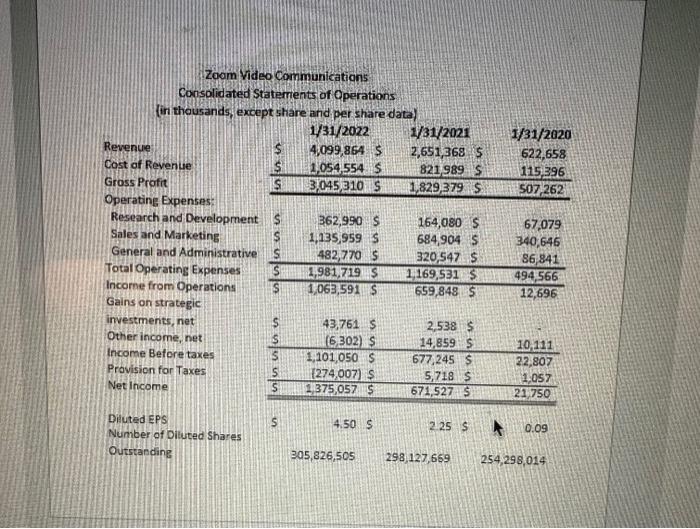

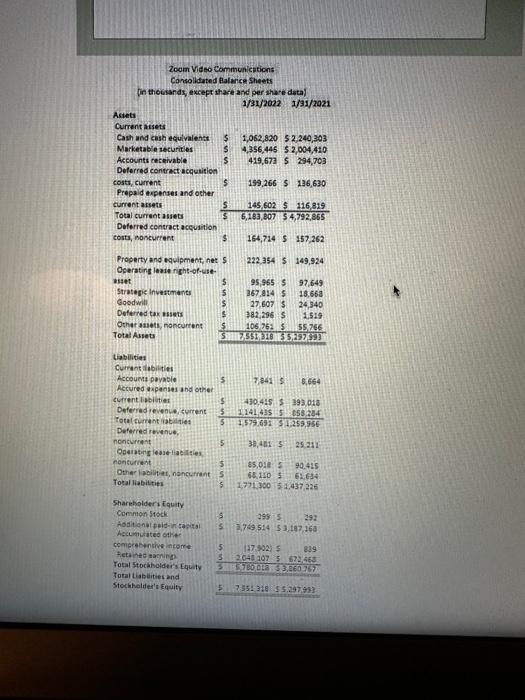

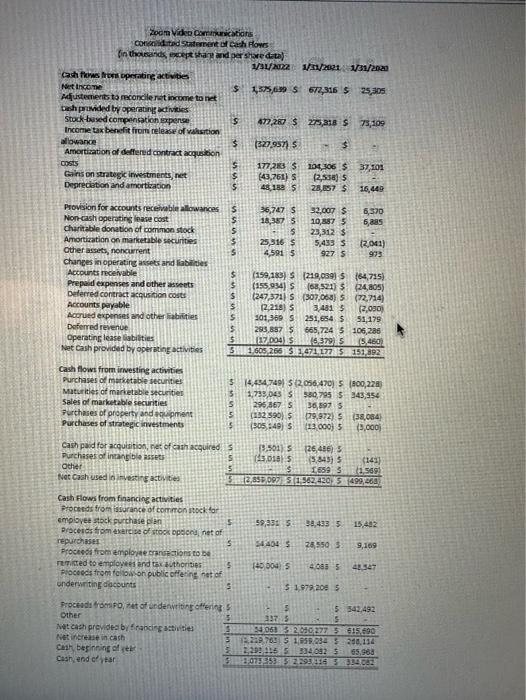

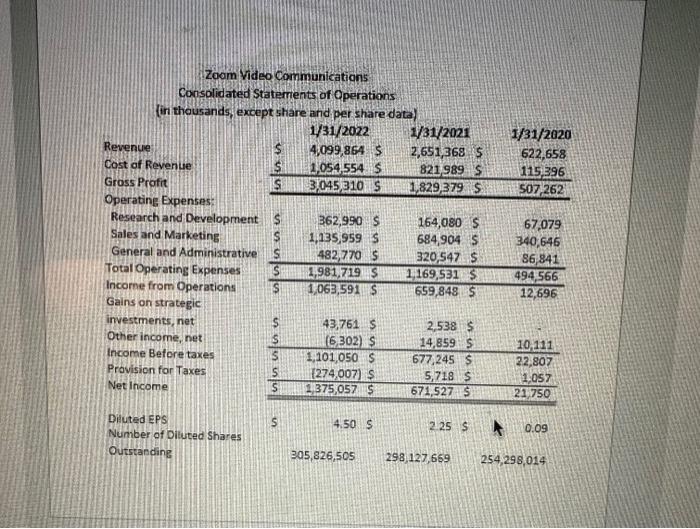

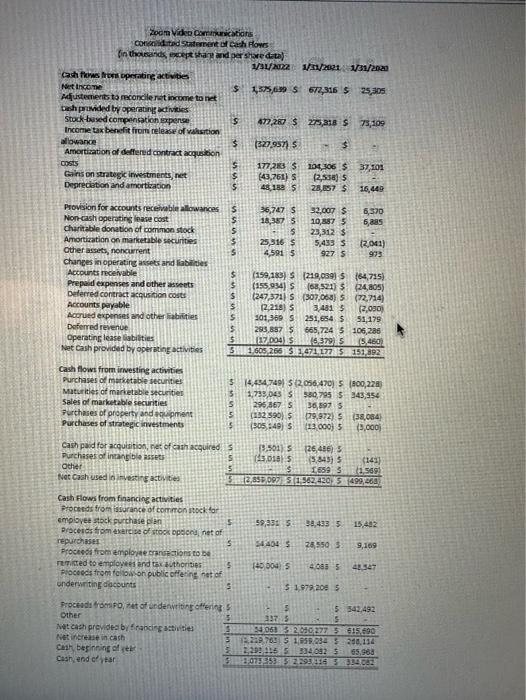

How much is it worth? You are applying for a job as an equity analyst. The company has given you an Excel spreadsheet Download Excel spreadsheet with some financial information about Zoom. Knowing that demand for the companys only product exploded with the pandemic, the company wants to know what you think the stock price should be. The company does not pay a dividend, so you are forced to use a Discounted Cash Flow Analysis to determine the value of the company. Project Hints You can find all three items (net income, depreciation, and capital expenditures) on the cash flow statement. Due to its business, appropriate capital expenditures include Purchase of property and equipment, Cash paid for acquisition, Purchases of strategic investments, and Purchases of intangible assets. *Note: in finance, defining Capex, is often subjective. Project Instructions In this Assignment, you will use the information given in the Excel document above to determine the company's value and create a write-up explaining your thoughts. Excel File Download the Excel file above. Isolate Net Income, Depreciation, and Capital Expenditures (do not worry about changes in working capital) and calculate Cash Flow from these items (*hint: Capital Expenditures Deprecation is net investment).

Use a cost of capital of 10% to calculate the discounted cash flows. Determine your estimated price per share value. Compare your estimated price to the current price of the stock. You can look it up at any financial website such as CNBCLinks to an external site.. Remember, the ticker symbol for this Zoom is ZM. Word Document Using Word, make your own assumptions about how much Net Income and Net Investment will grow over the next five years and what they will grow in perpetuity. That is a total of 12 assumptions (one for each year and one for perpetuity for two items). In your write up explain the reasoning behind those choices, using your own ideas of how companies (and universities, for that matter) will use Zoom in the future.

Why do you think it's different? What does that say about your estimates compared to what the market is estimating will happen with Zoom. Submission Instructions Submit your well-formatted Excel worksheet, showing your discounted cash flow analysis. Submit your Word Document justifying your assumptions and comparing your estimated value to the current market price.

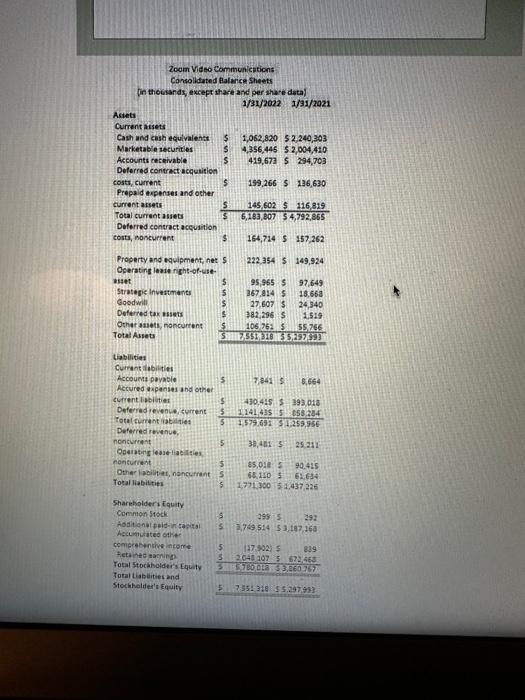

Zoom video Communications Consolidated Statements of Operations Zoom Video Communications Consoliduted flalunce Sheets (in thowands, except thare and per thare datal 1/31/20221/31/2021 Astets Current atsets Cash and cash equlvalehts $1,062,820$2,240,303 Marketable steurities 54,356,445$2,004,410 \begin{tabular}{l|l|l|l} Accounta reteivable & 519,673 & 5 & 294,703 \\ Doferred contract acquaition \end{tabular} costs, cument 5199,266$536,630 Prepaid wexpenses and other current arsets Total current assets Deferred contract aceusition. \begin{tabular}{l|l|l|l|l} corts, noncurraet & 5 & 164,714 & 5 & 157,262 \end{tabular} Property and oquipment, net 5222,354 5 149,924 Operating leaie richt-of-use- tiabilitias Current abilitiei curent lubiation s 430,445 \$ 193,013 Deferred revenue. nonsureat 535,4d1 \$ 25211 Oparaeing ieaseliaeiries Shareholderifiquity Common s1sck Aecumblated other cemerebenthe income fictainec zacning Total Stockholdei's Equity Total tiab lities and Stociholder's Equity 5. 2.551.318 is. 5.297933 Zocm Videp oimanicatichs cotion ititad strtement if cech flows fin thousends, exeept way and per store dotol y/yfara: 1/ry/anat isu/zanai cadi flaws from operatirg activities Nert thacone Pdfustements ta meconcile ret income to net coch prubided by operating activites stock taised compensation expense 547,268 \$ 20,348 is 13,109 Inconie tax bencefit foun release of wastion: albvance Amortiation of defered contract acquibion. costs Gins on sun tegici invertments, net Degrecistion and amartiation changes in operating asisets and labilides Cash fows from investing activities Purchases of motketable securities Maturitier of marketabie yetwritier Purchases of stratepic investments in Cash flows from financing actuvities fiocects trom isdarance of cormen alock far pesceres tom aleic ie of stoes opsens, net of repurchaset 5 Stiou; 528,550 3. 9,169 piocoedi from fol ow on public offecing net of onderuriting dacounts 5 initiris 51,0792065 mroceudi tromapo, tet of undenviting oftering, 558 in 5.542/492 other Mut caeh proviots by f raocing activitie! tiet increale in cash cent begineing of yek cashend ctiks Zoom video Communications Consolidated Statements of Operations Zoom Video Communications Consoliduted flalunce Sheets (in thowands, except thare and per thare datal 1/31/20221/31/2021 Astets Current atsets Cash and cash equlvalehts $1,062,820$2,240,303 Marketable steurities 54,356,445$2,004,410 \begin{tabular}{l|l|l|l} Accounta reteivable & 519,673 & 5 & 294,703 \\ Doferred contract acquaition \end{tabular} costs, cument 5199,266$536,630 Prepaid wexpenses and other current arsets Total current assets Deferred contract aceusition. \begin{tabular}{l|l|l|l|l} corts, noncurraet & 5 & 164,714 & 5 & 157,262 \end{tabular} Property and oquipment, net 5222,354 5 149,924 Operating leaie richt-of-use- tiabilitias Current abilitiei curent lubiation s 430,445 \$ 193,013 Deferred revenue. nonsureat 535,4d1 \$ 25211 Oparaeing ieaseliaeiries Shareholderifiquity Common s1sck Aecumblated other cemerebenthe income fictainec zacning Total Stockholdei's Equity Total tiab lities and Stociholder's Equity 5. 2.551.318 is. 5.297933 Zocm Videp oimanicatichs cotion ititad strtement if cech flows fin thousends, exeept way and per store dotol y/yfara: 1/ry/anat isu/zanai cadi flaws from operatirg activities Nert thacone Pdfustements ta meconcile ret income to net coch prubided by operating activites stock taised compensation expense 547,268 \$ 20,348 is 13,109 Inconie tax bencefit foun release of wastion: albvance Amortiation of defered contract acquibion. costs Gins on sun tegici invertments, net Degrecistion and amartiation changes in operating asisets and labilides Cash fows from investing activities Purchases of motketable securities Maturitier of marketabie yetwritier Purchases of stratepic investments in Cash flows from financing actuvities fiocects trom isdarance of cormen alock far pesceres tom aleic ie of stoes opsens, net of repurchaset 5 Stiou; 528,550 3. 9,169 piocoedi from fol ow on public offecing net of onderuriting dacounts 5 initiris 51,0792065 mroceudi tromapo, tet of undenviting oftering, 558 in 5.542/492 other Mut caeh proviots by f raocing activitie! tiet increale in cash cent begineing of yek cashend ctiks