Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much is Saito Solar worth based on Mr. Suzuki's forecast of a 1-3% growth rate in free cash flows over the next 20 years?

How much is Saito Solar worth based on Mr. Suzuki's forecast of a 1-3% growth rate in free cash flows over the next 20 years? The required rate of return for the owners was 10%.

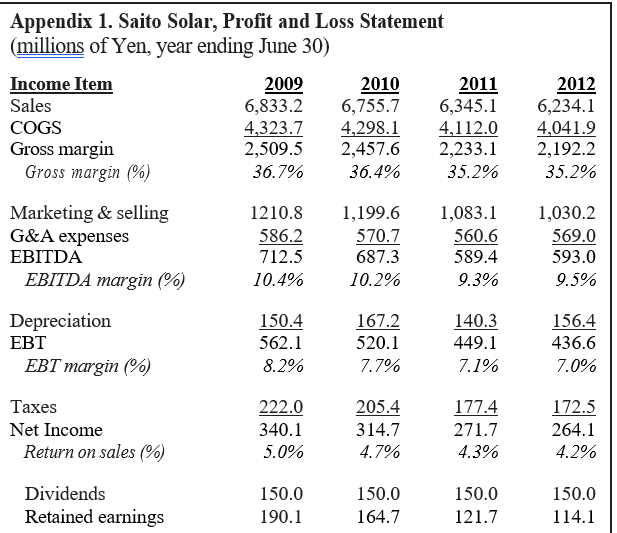

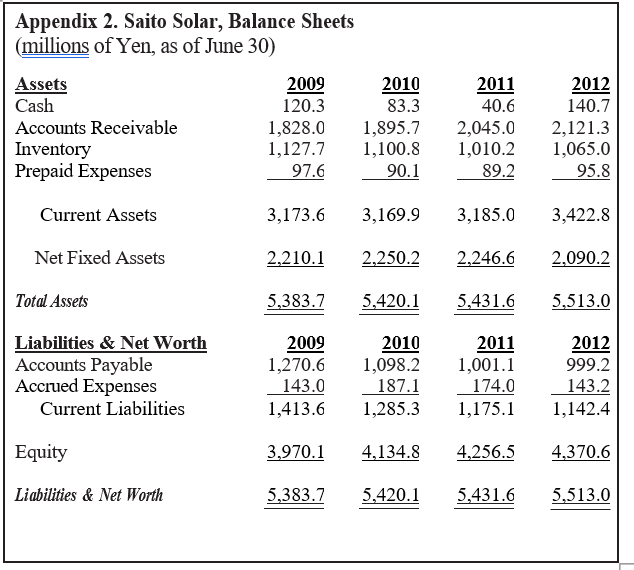

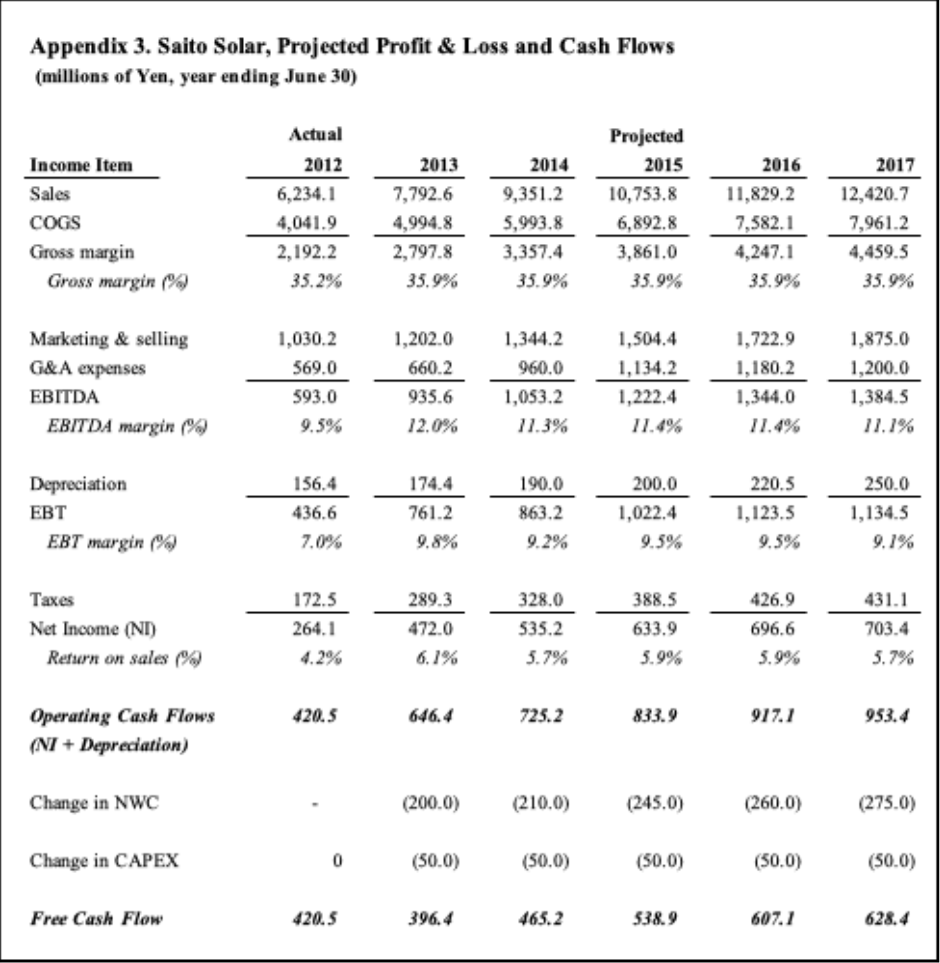

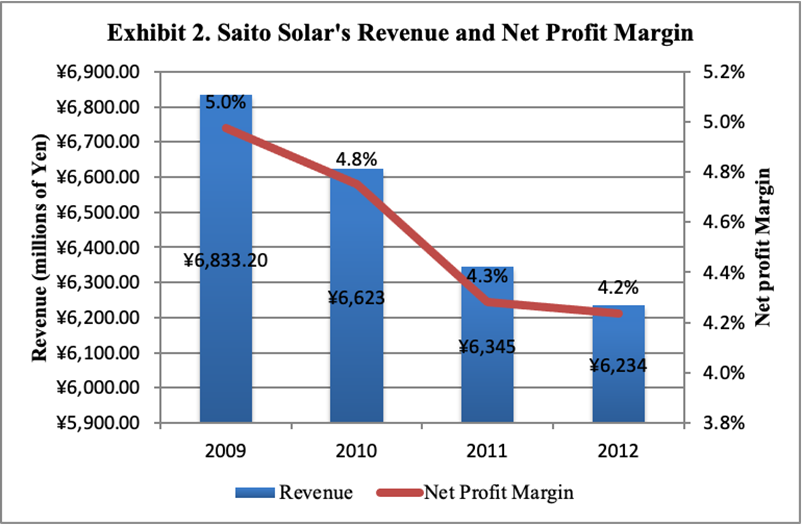

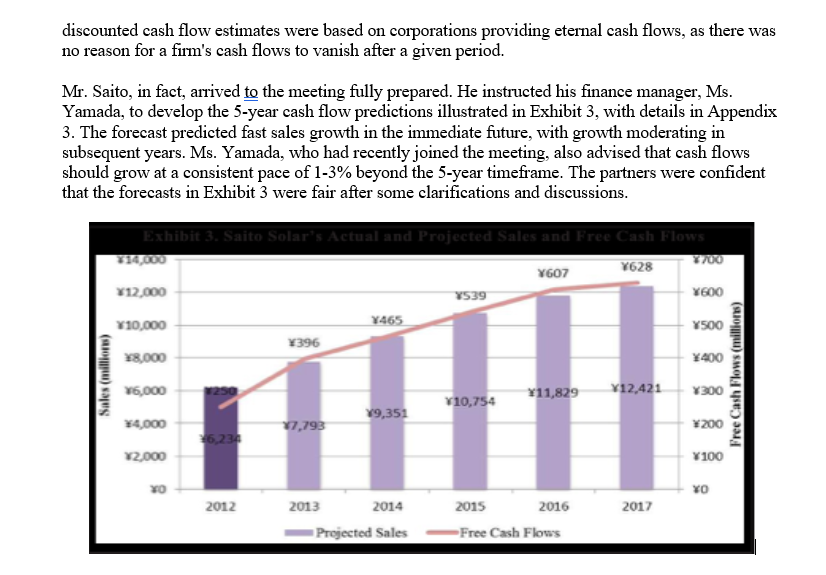

Apbendix 1. Saito Solar. Profit and Loss Statement Appendix 2. Saito Solar, Balance Sheets Appendix 3. Saito Solar, Projected Profit \& Loss and Cash Flows (millions of Yen, year ending June 30) On a late November morning in 2012, a boutique investment bank in Japan approached Mr. Takuya Saito, founder, and CEO of Saito Solar, about selling the company. Mr. Saito had periodically considered selling the firm in the past, but he had never carefully considered who a potential buyer would be or how much the firm could reasonably be sold for. He was encouraged by the investment bank's interest, but he was skeptical about the size of the offer, given the recent decline in sales. Nonetheless, he summoned his two silent partners, Mr. Kenta Suzuki, and Mr. Shinji Yoshida, to meet in his office to examine this uninvited proposal. The Solar Energy Industry and Saito Solar Mr. Takuya Saito started Saito Solar, a privately held photovoltaic (PV) solar panel producer, in 2002. After graduating graduate school in the United States, Mr. Saito worked as an electrical engineer for Monsanto Electronic Materials firm (MEMC), a silicon-wafer firm. MEMC was acquired by Texas Pacific Group, a private equity group, in 2000 for a symbolic dollar plus $150 million in credit lines, following several years of poor financial outcomes. Mr. Saito then decided to return to his home country of Japan. Mr. Saito had always been fascinated by, and a firm believer in, alternative energy while in the United States. He was especially interested in solar energy and had spent many of his spare time researching the various procedures of solar energy production. He knew how solar cells, which are electrical devices that generate electricity from sunlight via the photovoltaic effect, were electrically connected, usually in series as a module. Multiple solar cells were then combined into groups and put on a single plane to produce a solar panel. His research also revealed that most solar panels in the globe were composed of either mono-crystalline or polycrystalline (also known as multi-crystalline) silicon solar cells, with thin-film solar cells accounting for only a small portion of the overall solar market. Mr. Saito believed that if solar panels were durable and economically effective, Japanese residential and commercial premises would use a lot more solar energy. He found that solar panels constructed of polycrystalline silicon cells would have the highest potential in Japan after months of comprehensive industrial investigation. Polycrystalline silicon is less expensive to produce than monocrystalline silicon because it is melted and put into a square mold, which is then cooled and sliced into exactly square wafers, resulting in less waste. While the efficiency level of polycrystalline silicon-based solar panels is slightly lower than that of monocrystalline silicon, they are more cost effective and would be very desirable in Japan, particularly to residential customers. While thin-film solar panels are inexpensive to produce, they provide the least amount of electricity. 1 They require four times the space of mono-crystalline silicon-based panels to produce the same amount of electricity, making them unsuitable for Japanese residential users. Mr. Saito spent the next three months raising funds to launch his company. He met numerous barriers as a novice to the solar industry, particularly from banks and financial organisations. Even though he had saved some money over his 20 years at MEMC, it was insufficient to launch a small-scale solar panel manufacturing company. Finally, he was able to persuade a pair of his father's wealthy, longtime acquaintances, Mr. Suzukki and Mr. Yoshida, to provide the remaining needed funds to create Saito Solar through family relations. Saito Solar was a niche player that served residential and small commercial customers with exceptional customer care. Mr. Saito attracted many of his customers by first educating them on the necessity of alternative energy in Japan and how they might help the environment by using solar energy in their homes or companies. Saito Solar's income more than eight-fold increased from 2002 to 2008, owing to the exponential growth of the Japanese solar sector at the time. It thrived alongside other Japanese industrial leaders such as Sharp, Kyocera, Mitsubishi, and others. The global financial crisis struck in 2008. Energy prices have plummeted, reducing demand for alternative energy sources such as solar power. Simultaneously, numerous Chinese solar businesses, including Suntech, Yingli Solar, and Trina Solar, saturated the market with solar panels that were 30 40% less expensive than those built in Japan.2 Even though Japanese solar panels were thought to be of higher quality, the pricing differential was too great in this quickly commoditizing industry for Japanese enterprises to compete on a global scale. Many Japanese industry leaders, including Sharp and Kyocera, lost market share. Saito Solar struggled to compete as well, with revenue gradually reducing and net profit margins falling to around 4.2% in 2012 (see Exhibit 2). From 2009 to 2012 , crude oil prices began to rise again, hitting more over $100 a barrel in sections of 2011 and the spring of 2012. World demand for solar energy increased significantly once more, bolstered in part by feed-in tariffs introduced by numerous countries across the world. 3 A catastrophic earthquake struck Japan in 2011, producing explosions and issues at certain nuclear power reactors, which were exacerbated by the accompanying tsunami. Exhibit 2. Saito Solar's Revenue and Net Profit Margin Japan had 54 nuclear reactors and 17 power plants at the time of the earthquake, producing around 30% of Japan's electricity.4 Aside from the radiation concern, several sections of Japan were without power. Nearly 16,000 people were killed, and the Japanese economy was badly damaged, costing approximately $300 billion. The earthquake and tsunami heightened Japan's desire to seek alternative energy sources. On June 18, 2012, the Japanese government authorised a new feed-in tariff for solar energy of 42/kWh (about US $0.53/kWh ), which would go into effect on July 1,2012 . This rate was nearly double that of Germany, the country with the biggest solar energy capacity in the world, and three times that of China. According to Bloomberg New Energy Finance, Japan's new tariff is expected to produce at least US $9.6 billion in new investments in solar projects. 5 These investments were planned to yield up to 3.2GW of extra capacity, equivalent to the production of three nuclear power plants, and would place Japan among the world's leaders in solar capacity. Valuation of Saito Solar Mr. Suzuki and Mr. Yoshida, the two silent partners, arrived at Mr. Saito's office in the early afternoon. They were both ecstatic about the solicitation and eager to learn the value of the offer. Mr. Saito indicated that the investment bank would not say anything unless the firm's owners consented to discuss the sale. That was why he wanted to meet with his two partners. Mr. Saito wanted to know if the partners were open to selling the company, as well as how much they were willing to sell it for. Mr. Yoshida's Valuation Mr. Yoshida was particularly interested in selling the company since he needed the funds to invest in his son's new business. He was a former mechanical engineer who made part of his earlier income through a few profitable real estate deals during the late 1980s Japanese real estate boom. He had since made a few investments as a minority, silent partner, including Saito Solar. He estimated that Saito Solar was worth $5 billion. His calculation was straightforward and uncomplicated. He claimed that the company was generating approximately $250 million in net cash flows each year and that these cash flows were projected to continue for the next 20 years. He arrived at 5 billion by multiplying 250 million by 20 . Mr. Suzuki disagreed with Mr. Yoshida's estimation of the firm's value. Mr. Suzuki had been working with a financial counsellor and had learned some financial understanding after inheriting a significant fortune from his father 15 years ago. He contended that because future cash flows are not worth as much as current cash flows, they must be discounted. If future cash flows were constant for the next 20 years, as Mr. Yoshida proposed, the company would be valued significantly less than $5 billion after those cash flows were discounted. However, he did not believe the firm's cash flows would remain constant. He was sure that the recently passed feed-in tariff would enhance demand for solar panels, hence increasing the firm's net cash flows. He predicted that net cash flows will rise by 35% per year over the following 20 years. He only needed to perform that computation after deciding on a discount rate. Mr. Saito's Valuation Mr. Saito was relieved that Mr. Suzuki comprehended the concept of discounted cash flow and its significance in valuing. He agreed that the increased feed-in tariff, which went into effect in July, will provide the company with some much-needed sales increases in the following years. He had seen an increase in sales orders since the new tariff was imposed as the primary owner who managed the dayto-day functioning of Saito Solar. Unlike Mr. Suzuki, he did not anticipate consistent sales growth over the next 20 years. He predicted that sales growth would be strong in the first few years as consumers and businesses adjusted to the new tariff, but that it would thereafter slow. He also did not believe that the company would cease to generate cash flows after 20 years. He contended that the corporation will be in good hands and thus should survive indefinitely. He emphasized that most discounted cash flow estimates were based on corporations providing eternal cash flows, as there was no reason for a firm's cash flows to vanish after a given period. Mr. Saito, in fact, arrived to the meeting fully prepared. He instructed his finance manager, Ms. Yamada, to develop the 5-year cash flow predictions illustrated in Exhibit 3, with details in Appendix 3. The forecast predicted fast sales growth in the immediate future, with growth moderating in subsequent years. Ms. Yamada, who had recently joined the meeting, also advised that cash flows should grow at a consistent pace of 1-3\% beyond the 5 -year timeframe. The partners were confident that the forecasts in Exhibit 3 were fair after some clarifications and discussions. Ms. Yamada then required to calculate the discount rate, which represents the firm's cost of capital. Because Saito Solar was debt-free, the discount rate would be based on what the owners expected to earn in this industry. When the three partners founded the company in 2002, they calculated that a minimum of 10% return on equity capital was required to fully account for the risks inherent in the operation. Ms. Yamada investigated and confirmed that the partners' expectations had not changed throughout the years. Ms. Yamada was able to predict a range of firm valuations for the partners using this final piece of information and some sensitivity studies. Apbendix 1. Saito Solar. Profit and Loss Statement Appendix 2. Saito Solar, Balance Sheets Appendix 3. Saito Solar, Projected Profit \& Loss and Cash Flows (millions of Yen, year ending June 30) On a late November morning in 2012, a boutique investment bank in Japan approached Mr. Takuya Saito, founder, and CEO of Saito Solar, about selling the company. Mr. Saito had periodically considered selling the firm in the past, but he had never carefully considered who a potential buyer would be or how much the firm could reasonably be sold for. He was encouraged by the investment bank's interest, but he was skeptical about the size of the offer, given the recent decline in sales. Nonetheless, he summoned his two silent partners, Mr. Kenta Suzuki, and Mr. Shinji Yoshida, to meet in his office to examine this uninvited proposal. The Solar Energy Industry and Saito Solar Mr. Takuya Saito started Saito Solar, a privately held photovoltaic (PV) solar panel producer, in 2002. After graduating graduate school in the United States, Mr. Saito worked as an electrical engineer for Monsanto Electronic Materials firm (MEMC), a silicon-wafer firm. MEMC was acquired by Texas Pacific Group, a private equity group, in 2000 for a symbolic dollar plus $150 million in credit lines, following several years of poor financial outcomes. Mr. Saito then decided to return to his home country of Japan. Mr. Saito had always been fascinated by, and a firm believer in, alternative energy while in the United States. He was especially interested in solar energy and had spent many of his spare time researching the various procedures of solar energy production. He knew how solar cells, which are electrical devices that generate electricity from sunlight via the photovoltaic effect, were electrically connected, usually in series as a module. Multiple solar cells were then combined into groups and put on a single plane to produce a solar panel. His research also revealed that most solar panels in the globe were composed of either mono-crystalline or polycrystalline (also known as multi-crystalline) silicon solar cells, with thin-film solar cells accounting for only a small portion of the overall solar market. Mr. Saito believed that if solar panels were durable and economically effective, Japanese residential and commercial premises would use a lot more solar energy. He found that solar panels constructed of polycrystalline silicon cells would have the highest potential in Japan after months of comprehensive industrial investigation. Polycrystalline silicon is less expensive to produce than monocrystalline silicon because it is melted and put into a square mold, which is then cooled and sliced into exactly square wafers, resulting in less waste. While the efficiency level of polycrystalline silicon-based solar panels is slightly lower than that of monocrystalline silicon, they are more cost effective and would be very desirable in Japan, particularly to residential customers. While thin-film solar panels are inexpensive to produce, they provide the least amount of electricity. 1 They require four times the space of mono-crystalline silicon-based panels to produce the same amount of electricity, making them unsuitable for Japanese residential users. Mr. Saito spent the next three months raising funds to launch his company. He met numerous barriers as a novice to the solar industry, particularly from banks and financial organisations. Even though he had saved some money over his 20 years at MEMC, it was insufficient to launch a small-scale solar panel manufacturing company. Finally, he was able to persuade a pair of his father's wealthy, longtime acquaintances, Mr. Suzukki and Mr. Yoshida, to provide the remaining needed funds to create Saito Solar through family relations. Saito Solar was a niche player that served residential and small commercial customers with exceptional customer care. Mr. Saito attracted many of his customers by first educating them on the necessity of alternative energy in Japan and how they might help the environment by using solar energy in their homes or companies. Saito Solar's income more than eight-fold increased from 2002 to 2008, owing to the exponential growth of the Japanese solar sector at the time. It thrived alongside other Japanese industrial leaders such as Sharp, Kyocera, Mitsubishi, and others. The global financial crisis struck in 2008. Energy prices have plummeted, reducing demand for alternative energy sources such as solar power. Simultaneously, numerous Chinese solar businesses, including Suntech, Yingli Solar, and Trina Solar, saturated the market with solar panels that were 30 40% less expensive than those built in Japan.2 Even though Japanese solar panels were thought to be of higher quality, the pricing differential was too great in this quickly commoditizing industry for Japanese enterprises to compete on a global scale. Many Japanese industry leaders, including Sharp and Kyocera, lost market share. Saito Solar struggled to compete as well, with revenue gradually reducing and net profit margins falling to around 4.2% in 2012 (see Exhibit 2). From 2009 to 2012 , crude oil prices began to rise again, hitting more over $100 a barrel in sections of 2011 and the spring of 2012. World demand for solar energy increased significantly once more, bolstered in part by feed-in tariffs introduced by numerous countries across the world. 3 A catastrophic earthquake struck Japan in 2011, producing explosions and issues at certain nuclear power reactors, which were exacerbated by the accompanying tsunami. Exhibit 2. Saito Solar's Revenue and Net Profit Margin Japan had 54 nuclear reactors and 17 power plants at the time of the earthquake, producing around 30% of Japan's electricity.4 Aside from the radiation concern, several sections of Japan were without power. Nearly 16,000 people were killed, and the Japanese economy was badly damaged, costing approximately $300 billion. The earthquake and tsunami heightened Japan's desire to seek alternative energy sources. On June 18, 2012, the Japanese government authorised a new feed-in tariff for solar energy of 42/kWh (about US $0.53/kWh ), which would go into effect on July 1,2012 . This rate was nearly double that of Germany, the country with the biggest solar energy capacity in the world, and three times that of China. According to Bloomberg New Energy Finance, Japan's new tariff is expected to produce at least US $9.6 billion in new investments in solar projects. 5 These investments were planned to yield up to 3.2GW of extra capacity, equivalent to the production of three nuclear power plants, and would place Japan among the world's leaders in solar capacity. Valuation of Saito Solar Mr. Suzuki and Mr. Yoshida, the two silent partners, arrived at Mr. Saito's office in the early afternoon. They were both ecstatic about the solicitation and eager to learn the value of the offer. Mr. Saito indicated that the investment bank would not say anything unless the firm's owners consented to discuss the sale. That was why he wanted to meet with his two partners. Mr. Saito wanted to know if the partners were open to selling the company, as well as how much they were willing to sell it for. Mr. Yoshida's Valuation Mr. Yoshida was particularly interested in selling the company since he needed the funds to invest in his son's new business. He was a former mechanical engineer who made part of his earlier income through a few profitable real estate deals during the late 1980s Japanese real estate boom. He had since made a few investments as a minority, silent partner, including Saito Solar. He estimated that Saito Solar was worth $5 billion. His calculation was straightforward and uncomplicated. He claimed that the company was generating approximately $250 million in net cash flows each year and that these cash flows were projected to continue for the next 20 years. He arrived at 5 billion by multiplying 250 million by 20 . Mr. Suzuki disagreed with Mr. Yoshida's estimation of the firm's value. Mr. Suzuki had been working with a financial counsellor and had learned some financial understanding after inheriting a significant fortune from his father 15 years ago. He contended that because future cash flows are not worth as much as current cash flows, they must be discounted. If future cash flows were constant for the next 20 years, as Mr. Yoshida proposed, the company would be valued significantly less than $5 billion after those cash flows were discounted. However, he did not believe the firm's cash flows would remain constant. He was sure that the recently passed feed-in tariff would enhance demand for solar panels, hence increasing the firm's net cash flows. He predicted that net cash flows will rise by 35% per year over the following 20 years. He only needed to perform that computation after deciding on a discount rate. Mr. Saito's Valuation Mr. Saito was relieved that Mr. Suzuki comprehended the concept of discounted cash flow and its significance in valuing. He agreed that the increased feed-in tariff, which went into effect in July, will provide the company with some much-needed sales increases in the following years. He had seen an increase in sales orders since the new tariff was imposed as the primary owner who managed the dayto-day functioning of Saito Solar. Unlike Mr. Suzuki, he did not anticipate consistent sales growth over the next 20 years. He predicted that sales growth would be strong in the first few years as consumers and businesses adjusted to the new tariff, but that it would thereafter slow. He also did not believe that the company would cease to generate cash flows after 20 years. He contended that the corporation will be in good hands and thus should survive indefinitely. He emphasized that most discounted cash flow estimates were based on corporations providing eternal cash flows, as there was no reason for a firm's cash flows to vanish after a given period. Mr. Saito, in fact, arrived to the meeting fully prepared. He instructed his finance manager, Ms. Yamada, to develop the 5-year cash flow predictions illustrated in Exhibit 3, with details in Appendix 3. The forecast predicted fast sales growth in the immediate future, with growth moderating in subsequent years. Ms. Yamada, who had recently joined the meeting, also advised that cash flows should grow at a consistent pace of 1-3\% beyond the 5 -year timeframe. The partners were confident that the forecasts in Exhibit 3 were fair after some clarifications and discussions. Ms. Yamada then required to calculate the discount rate, which represents the firm's cost of capital. Because Saito Solar was debt-free, the discount rate would be based on what the owners expected to earn in this industry. When the three partners founded the company in 2002, they calculated that a minimum of 10% return on equity capital was required to fully account for the risks inherent in the operation. Ms. Yamada investigated and confirmed that the partners' expectations had not changed throughout the years. Ms. Yamada was able to predict a range of firm valuations for the partners using this final piece of information and some sensitivity studies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started