Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much is the Equity shareholders of ?? On 1 January 2008, Chicago Ltd acquired 90% of the shares of Austin Ltd when Austin Ltd's

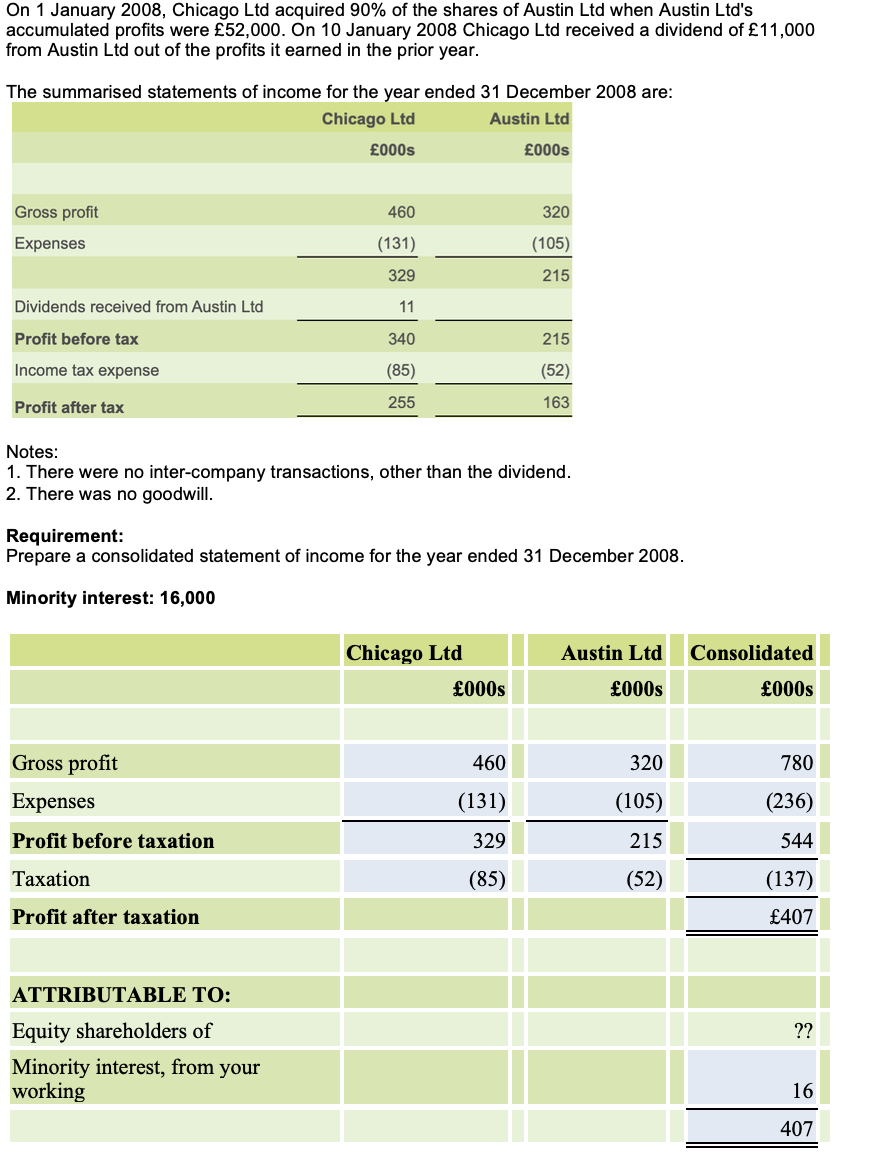

How much is the Equity shareholders of ??

On 1 January 2008, Chicago Ltd acquired 90% of the shares of Austin Ltd when Austin Ltd's accumulated profits were 52,000. On 10 January 2008 Chicago Ltd received a dividend of 11,000 from Austin Ltd out of the profits it earned in the prior year. The summarised statements of income for the year ended 31 December 2008 are: Chicago Ltd Austin Ltd 000s 000s Gross profit Expenses 460 (131) 329 320 (105) 215 Dividends received from Austin Ltd 11 Profit before tax 215 340 (85) Income tax expense (52) 163 Profit after tax 255 Notes: 1. There were no inter-company transactions, other than the dividend. 2. There was no goodwill. Requirement: Prepare a consolidated statement of income for the year ended 31 December 2008. Minority interest: 16,000 Chicago Ltd 000s Austin Ltd 000s Consolidated 000s 320 780 (105) (236) Gross profit Expenses Profit before taxation Taxation Profit after taxation 460 (131) 329 (85) 544 215 (52) (137) 407 ATTRIBUTABLE TO: Equity shareholders of Minority interest, from your working 407Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started