Answered step by step

Verified Expert Solution

Question

1 Approved Answer

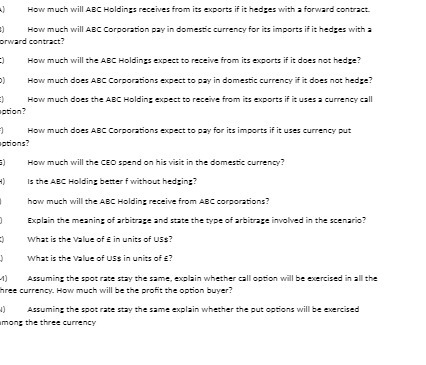

=) =) How much will ABC Holdings receives from its exports if it hedges with a forward contract. How much will ABC Corporation pay

=) =) How much will ABC Holdings receives from its exports if it hedges with a forward contract. How much will ABC Corporation pay in domestic currency for its imports if it hedges with a orward contract? C) How much will the ABC Holdings expect to receive from its exports if it does not hedge? D) 0 ption? ptions? (5 +) How much does ABC Corporations expect to pay in domestic currency if it does not hedge? How much does the ABC Holding expect to receive from its exports if it uses a currency call How much does ABC Corporations expect to pay for its imports if it uses currency put How much will the CEO spend on his visit in the domestic currency? Is the ABC Holding better f without hedging? how much will the ABC Holding receive from ABC corporations? Explain the meaning of arbitrage and state the type of arbitrage involved in the scenario? + -1) What is the Value of in units of USS? What is the value of USS in units of ? Assuming the spot rate stay the same, explain whether call option will be exercised in all the Three currency. How much will be the profit the option buyer? 1) Assuming the spot rate stay the same explain whether the put options will be exercised mong the three currency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ill provide responses to the questions youve asked but please note that without any specific details about the scenarios I can only provide general information If you have more detailed information ab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started