Question

How much will be recorded as a deduction from retained earnings on the books of Bravo, Inc on the date of declaration? How much would

How much will be recorded as a deduction from retained earnings on the books of Bravo, Inc on the date of declaration?

How much would be the amount on property Dividends that would be distributed by Alpha on August 5?

How many shares of property dividends would be distributed by Alpha on the date of declaration on August 5?

How many shares would be the balance of investment of Alpha with Bravo after the property dividends were distributed to its shareholders?

How much would be recorded by Alpha Corp. as Dividend Revenue on June 3?

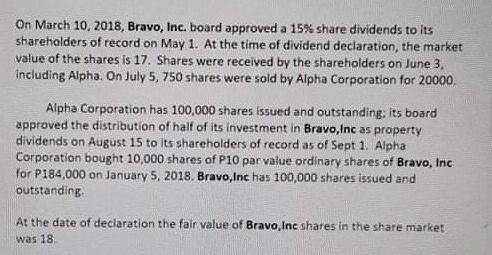

On March 10, 2018, Bravo, Inc. board approved a 15% share dividends to its shareholders of record on May 1. At the time of dividend declaration, the market value of the shares is 17. Shares were received by the shareholders on June 3, including Alpha. On July 5, 750 shares were sold by Alpha Corporation for 20000, Alpha Corporation has 100,000 shares issued and outstanding; its board approved the distribution of half of its investment in Bravo,Inc as property dividends on August 15 to its shareholders of record as of Sept 1. Alpha Corporation bought 10,000 shares of P10 par value ordinary shares of Bravo, Inc for P184,000 on January 5, 2018. Bravo,Inc has 100,000 shares issued and outstanding. At the date of declaration the fair value of Bravo, Inc shares in the share market was 18.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate what wll be recorded as a deduction from retained earnings on the books of Bravo Inc on the date of declaration Number of shares to be dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started