Answered step by step

Verified Expert Solution

Question

1 Approved Answer

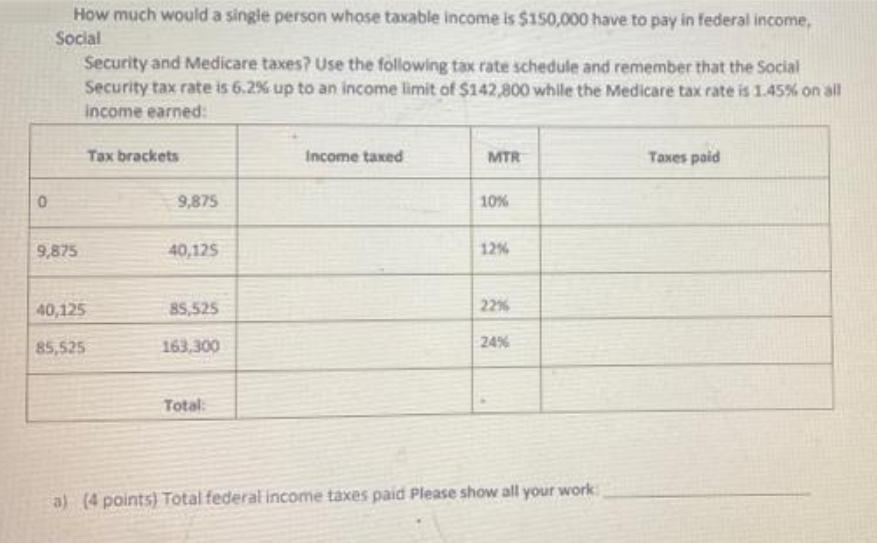

How much would a single person whose taxable income is $150,000 have to pay in federal income, Social Security and Medicare taxes? Use the

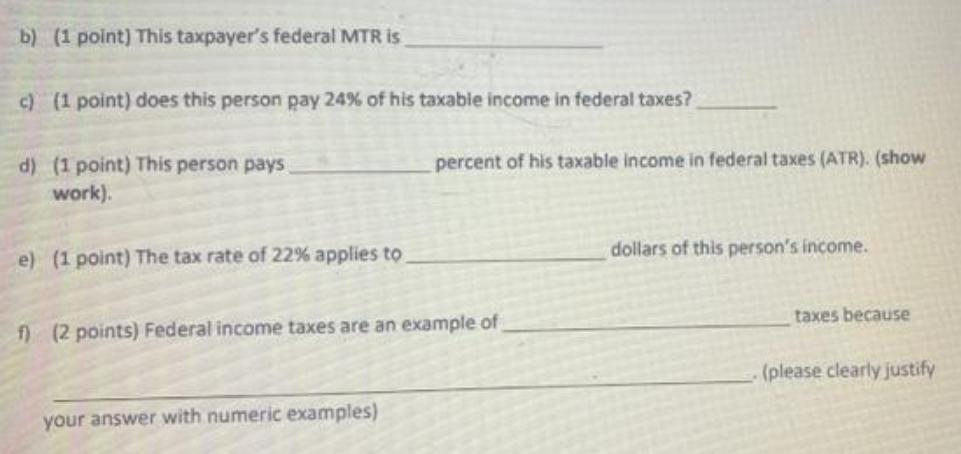

How much would a single person whose taxable income is $150,000 have to pay in federal income, Social Security and Medicare taxes? Use the following tax rate schedule and remember that the Social Security tax rate is 6.2% up to an income limit of $142,800 while the Medicare tax rate is 1.45% on all income earned: Tax brackets Income taxed MTR Taxes paid 9,875 10% 9,875 40,125 12% 40,125 8S,525 22% 85,525 163,300 24% Total: a) (4 points) Total federal income taxes paid Please show all your work b) (1 point) This taxpayer's federal MTR is c) (1 point) does this person pay 24% of his taxable income in federal taxes? percent of his taxable income in federal taxes (ATR). (show d) (1 point) This person pays work). dollars of this person's income. e) (1 point) The tax rate of 22% applies to taxes because f) (2 points) Federal income taxes are an example of (please clearly justify your answer with numeric examples) R) (5 points) This tax payer pays (please show your work) In Social Security taxes with a SS MTR of and a SS ATR of (show work) The Social Security tax paid by this tax payer is because (justify the tax system that applies), h) (5 points) This tax payer pays in Medicare taxes (please show work) with a Medicare MTR of and a Medicare ATR of (show work). The Medicare tax paid by this tax payer is because (justify the tax system that applies)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Total taxable income 150000 Calculation of federal income tax Tax brackets income taxed MTR taxes pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started