Question

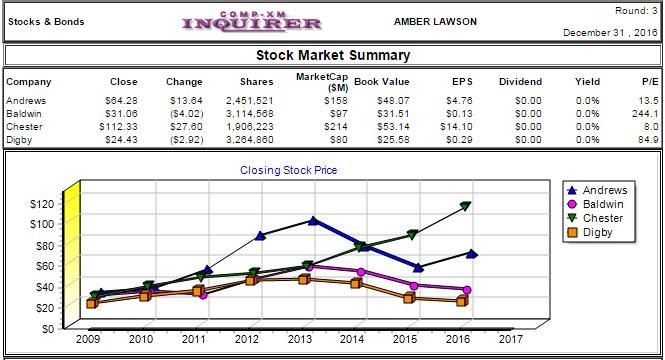

How much would it cost for Chester Corporation to repurchase all its outstanding shares if the price went up by 10%? Assume no brokerage fees.

How much would it cost for Chester Corporation to repurchase all its outstanding shares if the price went up by 10%? Assume no brokerage fees.

Select: 1

$235.5 million

$101.3 million

$214.1 million

$111.4 million

Round: 3 COMP-XM INQUIRER Stocks & Bonds AMBER LAWSON December 31, 2016 Stock Market Summary MarketCap (SM) Company Close Change Shares Book Value EPS Dividend Yield P/E Andrews $84.28 $13.84 2,451,521 3,114,508 1,908,223 $158 $48.07 $4.76 s0.00 0.0% 13.5 Baldwin $31.08 (S4.02) $97 $31.51 S0. 13 $0.00 0.0% 244.1 Chester $112.33 $27.60 $214 $53.14 $14.10 s0.00 0.0% 8.0 Digby $24.43 (52.92) 3,264,880 $80 $25.58 $0.20 $0.00 0.0% 84.9 Closing Stock Price * Andrews $120 Baldwin * Chester Digby $100 S80 S60 $40 $20 SO 2009 2010 2011 2012 2013 2014 2015 2016 2017

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

University Physics with Modern Physics

Authors: Hugh D. Young, Roger A. Freedman, Lewis Ford

12th Edition

978-0321501479, 9780805321876, 321501470, 978-0321501219

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App