How much would M2 be if M1 were $500; small-denomination time deposits, savings deposits, and money market mutual funds held by individuals totaled $1,200;

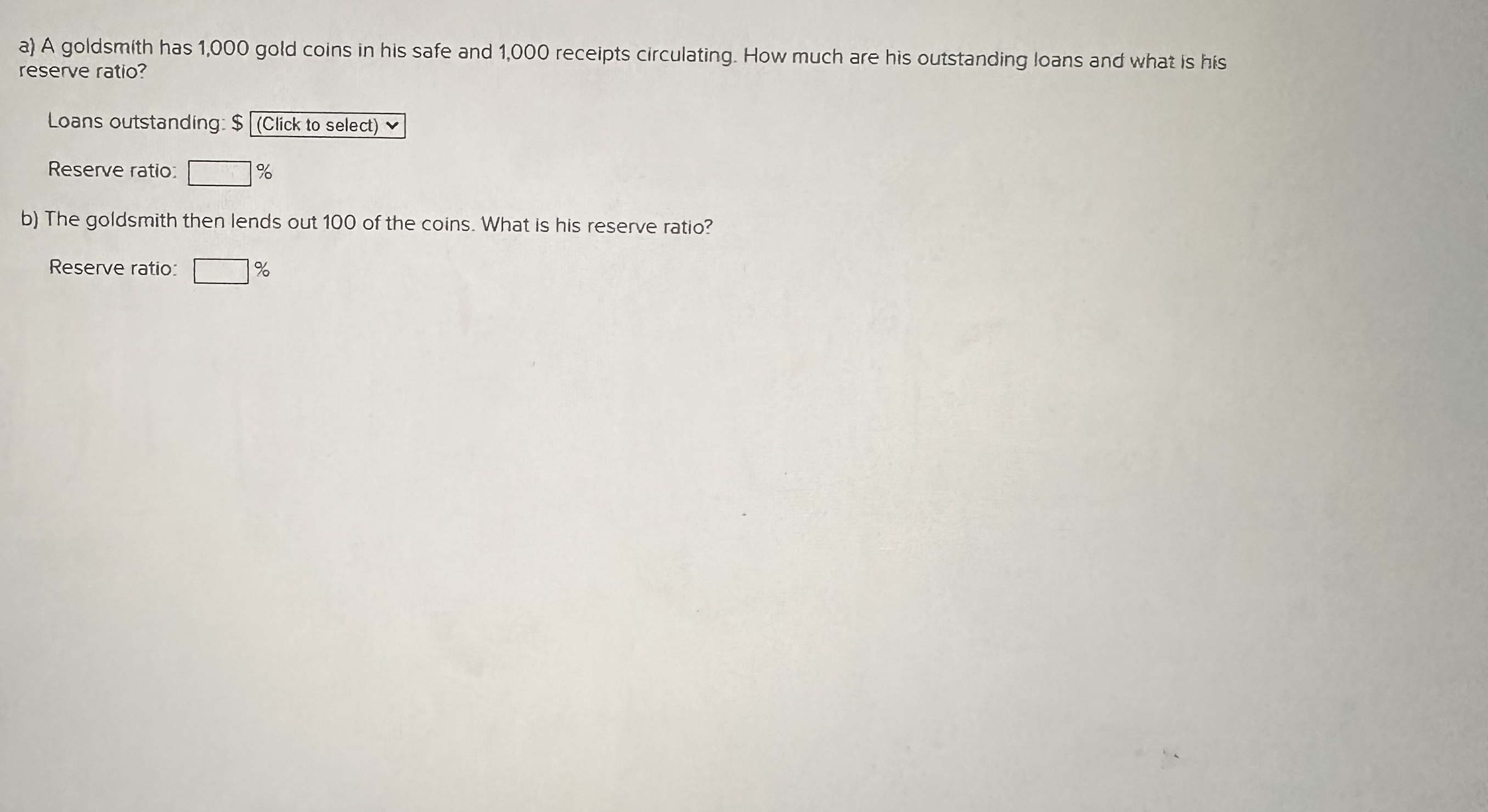

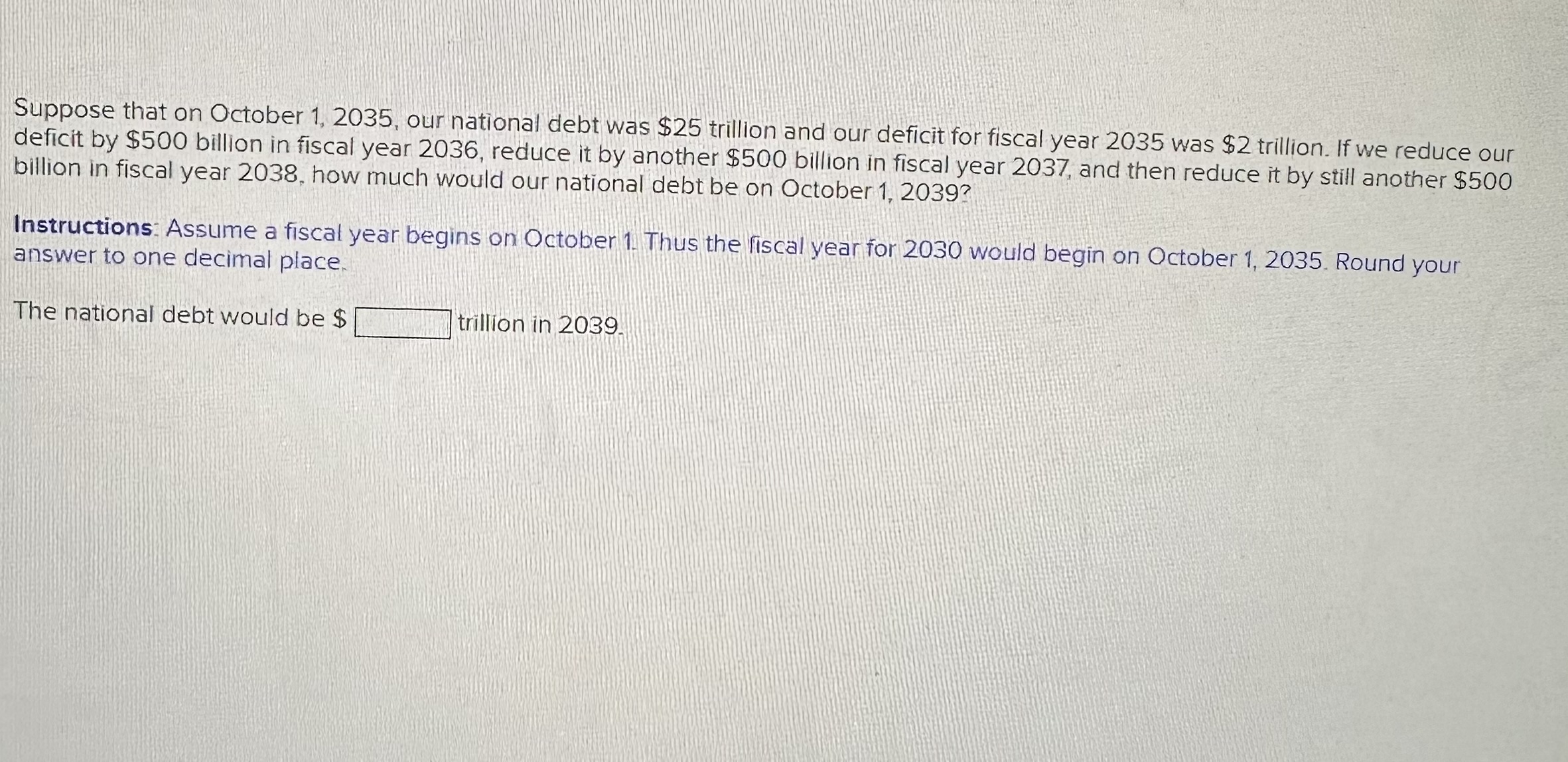

How much would M2 be if M1 were $500; small-denomination time deposits, savings deposits, and money market mutual funds held by individuals totaled $1,200; and large-denomination time deposits were $300? M2 amount would be $ If the MPC is 0.6, how much is the multiplier? Instructions: Round your answer to one decimal place. Multiplier is Initially M1 is 1,000 and M2 is 4,000. Find the size of M1 and M2 if demand deposits rise by 100. M1 amount would be $ M2 amount would be $ a) A goldsmith has 1,000 gold coins in his safe and 1,000 receipts circulating. How much are his outstanding loans and what is his reserve ratio? Loans outstanding: $ (Click to select) Reserve ratio: % b) The goldsmith then lends out 100 of the coins. What is his reserve ratio? Reserve ratio: % Suppose that on October 1, 2035, our national debt was $25 trillion and our deficit for fiscal year 2035 was $2 trillion. If we reduce our deficit by $500 billion in fiscal year 2036, reduce it by another $500 billion in fiscal year 2037, and then reduce it by still another $500 billion in fiscal year 2038, how much would our national debt be on October 1, 2039? Instructions: Assume a fiscal year begins on October 1. Thus the fiscal year for 2030 would begin on October 1, 2035. Round your answer to one decimal place. The national debt would be $ trillion in 2039. When the MPC is 0.8, how much is the multiplier? Instructions: Round your answer to the nearest whole number. Multiplier is A goldsmith has 100 gold coins in his safe. If there are 500 receipts in circulation, how much is his reserve ratio? Reserve ratio is %.

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

in the image solutions there 1 to 6 7 a To calculate the goldsmiths outstanding loans and reserve ra...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started