Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How should you choose the opportunity cost when calculating the present value of a given financial investment? a. Inflation rate is always a proper

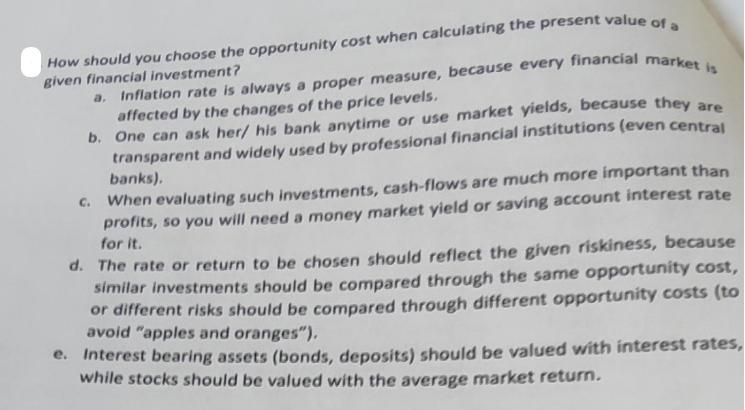

How should you choose the opportunity cost when calculating the present value of a given financial investment? a. Inflation rate is always a proper measure, because every financial market is affected by the changes of the price levels. b. One can ask her/ his bank anytime or use market yields, because they are transparent and widely used by professional financial institutions (even central banks). When evaluating such investments, cash-flows are much more important than profits, so you will need a money market yield or saving account interest rate for it. C. d. The rate or return to be chosen should reflect the given riskiness, because similar investments should be compared through the same opportunity cost, or different risks should be compared through different opportunity costs (to avoid "apples and oranges"). e. Interest bearing assets (bonds, deposits) should be valued with interest rates, while stocks should be valued with the average market return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The image shows a question regarding the choice of opportunity cost when calculating the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started