Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to answer the following question? I just don't really expert the step. Thank you. ST2.9 The trial balance for Rosie Ltd which provides image

How to answer the following question? I just don't really expert the step. Thank you.

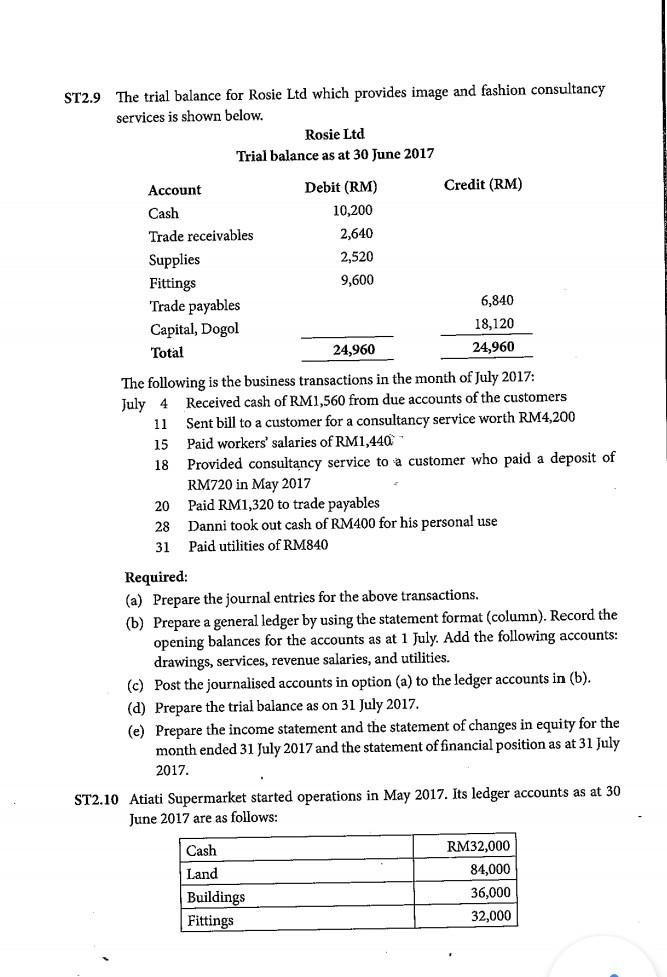

ST2.9 The trial balance for Rosie Ltd which provides image and fashion consultancy services is shown below. Rosie Ltd Trial balance as at 30 June 2017 Credit (RM) Account Cash Trade receivables Supplies Fittings Trade payables Capital, Dogol Total Debit (RM) 10,200 2,640 2,520 9,600 6,840 18,120 24,960 24,960 The following is the business transactions in the month of July 2017: July 4 Received cash of RM1,560 from due accounts of the customers 11 Sent bill to a customer for a consultancy service worth RM4,200 15 Paid workers' salaries of RM1,440 18 Provided consultancy service customer who paid a deposit of RM720 in May 2017 20 Paid RM1,320 to trade payables 28 Danni took out cash of RM400 for his personal use 31 Paid utilities of RM840 Required: (a) Prepare the journal entries for the above transactions. (b) Prepare a general ledger by using the statement format (column). Record the opening balances for the accounts as at 1 July. Add the following accounts: drawings, services, revenue salaries, and utilities. (c) Post the journalised accounts in option (a) to the ledger accounts in (b). (d) Prepare the trial balance as on 31 July 2017 (e) Prepare the income statement and the statement of changes in equity for the month ended 31 July 2017 and the statement of financial position as at 31 July 2017 ST2.10 Atiati Supermarket started operations in May 2017. Its ledger accounts as at 30 June 2017 are as follows: Cash Land Buildings Fittings RM32,000 84,000 36,000 32,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started