Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to answer the question e? 2. Aaron, 34 and Rita, 31 considering to buy their first house. The couple has two kids. Aaron and

How to answer the question e?

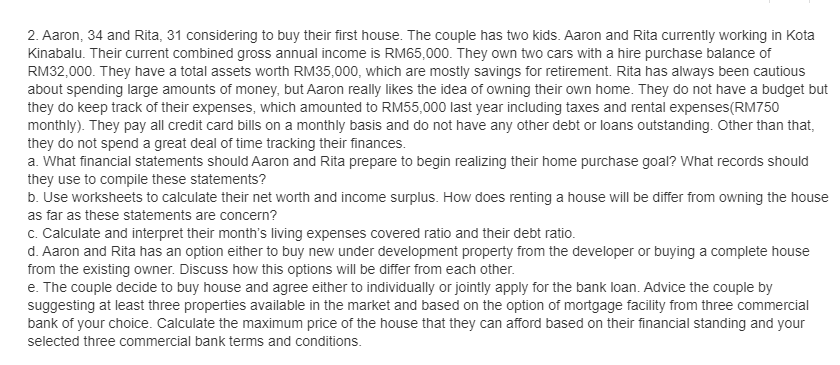

2. Aaron, 34 and Rita, 31 considering to buy their first house. The couple has two kids. Aaron and Rita currently working in Kota Kinabalu. Their current combined gross annual income is RM65,000. They own two cars with a hire purchase balance of RM32,000. They have a total assets worth RM35,000, which are mostly savings for retirement. Rita has always been cautious about spending large amounts of money, but Aaron really likes the idea of owning their own home. They do not have a budget but they do keep track of their expenses, which amounted to RM55,000 last year including taxes and rental expenses(RM750 monthly). They pay all credit card bills on a monthly basis and do not have any other debt or loans outstanding. Other than that, they do not spend a great deal of time tracking their finances a. What financial statements should Aaron and Rita prepare to begin realizing their home purchase goal? What records should they use to compile these statements? b. Use worksheets to calculate their net worth and income surplus. How does renting a house will be differ from owning the house as far as these statements are concern? c. Calculate and interpret their month's living expenses covered ratio and their debt ratio. d. Aaron and Rita has an option either to buy new under development property from the developer or buying a complete house from the existing owner. Discuss how this options will be differ from each other. e. The couple decide to buy house and agree either to individually or jointly apply for the bank loan. Advice the couple by suggesting at least three properties available in the market and based on the option of mortgage facility from three commercial bank of your choice. Calculate the maximum price of the house that they can afford based on their financial standing and your selected three commercial bank terms and conditions 2. Aaron, 34 and Rita, 31 considering to buy their first house. The couple has two kids. Aaron and Rita currently working in Kota Kinabalu. Their current combined gross annual income is RM65,000. They own two cars with a hire purchase balance of RM32,000. They have a total assets worth RM35,000, which are mostly savings for retirement. Rita has always been cautious about spending large amounts of money, but Aaron really likes the idea of owning their own home. They do not have a budget but they do keep track of their expenses, which amounted to RM55,000 last year including taxes and rental expenses(RM750 monthly). They pay all credit card bills on a monthly basis and do not have any other debt or loans outstanding. Other than that, they do not spend a great deal of time tracking their finances a. What financial statements should Aaron and Rita prepare to begin realizing their home purchase goal? What records should they use to compile these statements? b. Use worksheets to calculate their net worth and income surplus. How does renting a house will be differ from owning the house as far as these statements are concern? c. Calculate and interpret their month's living expenses covered ratio and their debt ratio. d. Aaron and Rita has an option either to buy new under development property from the developer or buying a complete house from the existing owner. Discuss how this options will be differ from each other. e. The couple decide to buy house and agree either to individually or jointly apply for the bank loan. Advice the couple by suggesting at least three properties available in the market and based on the option of mortgage facility from three commercial bank of your choice. Calculate the maximum price of the house that they can afford based on their financial standing and your selected three commercial bank terms and conditionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started