how to calculate NPV and Pv of incremental FCF's?? can the project be accepted??

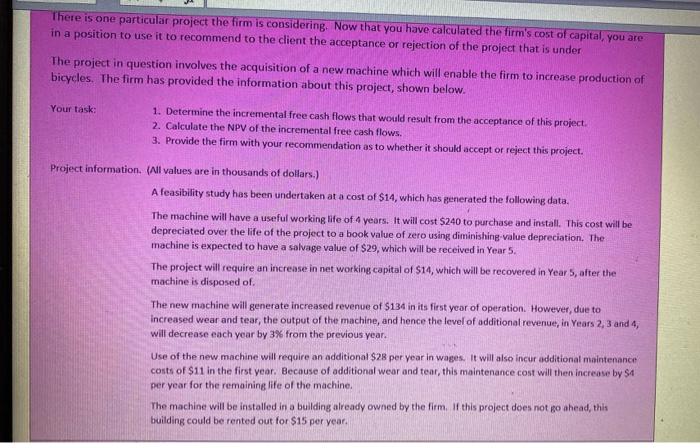

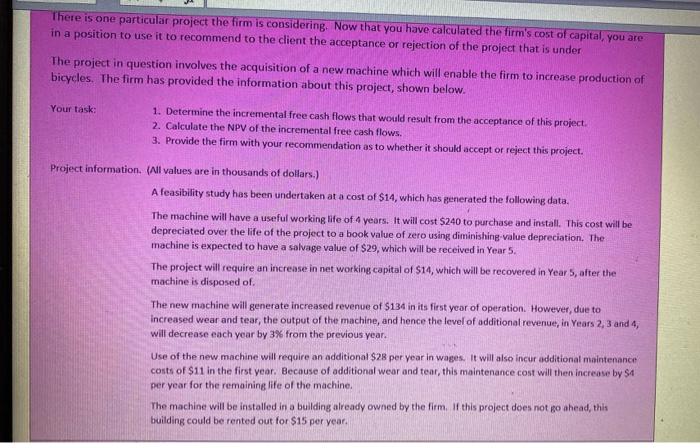

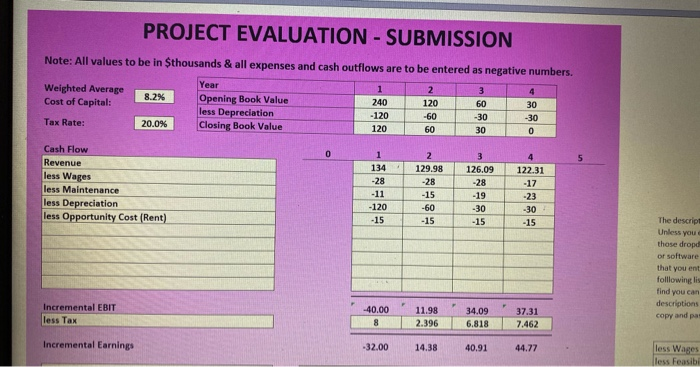

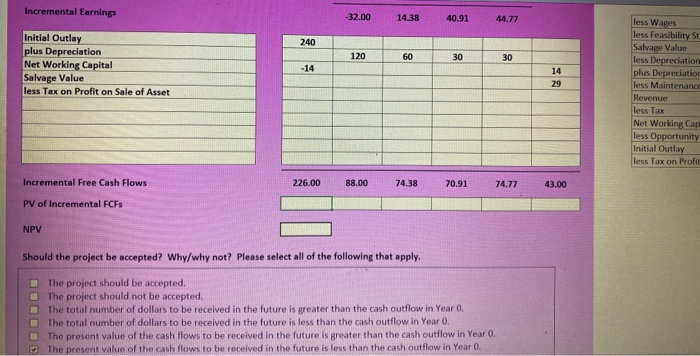

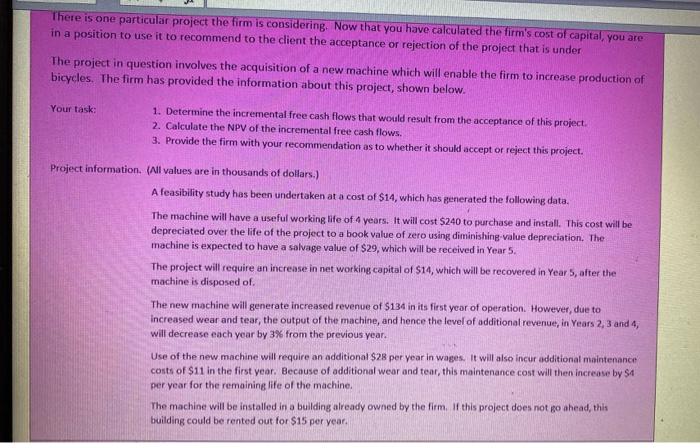

There is one particular project the firm is considering. Now that you have calculated the firm's cost of capital, you are in a position to use it to recommend to the client the acceptance or rejection of the project that is under The project in question involves the acquisition of a new machine which will enable the firm to increase production of bicycles. The firm has provided the information about this project, shown below. 1. Determine the incremental free cash flows that would result from the acceptance of this project 2. Calculate the NPV of the incremental free cash flows Your task: 3. Provide the firm with your recommendation as to whether it should accept or reject this project. Project information. (All values are in thousands of dollars.) A feasibility study has been undertaken at a cost of $14, which has generated the following data. The machine will have a useful working life of 4 years. It will cost $240 to purchase and install. This cost will be depreciated over the life of the project to a book value of zero using diminishing-value depreciation. The machine is expected to have a salvage value of $29, which will be received in Year 5. The project will require an increase in net working capital of $14, which will be recovered in Year 5, after the machine is disposed of. The new machine will generate increased revenue of $134 in its first year of operation. However, due to increased wear and tear, the output of the machine, and hence the level of additional revenue, in Years 2, 3 and 4, will decrease each year by 3 % from the previous year. Use of the new machine will require an additional $28 per year in wages. It will also incur additional maintenance costs of $11 in the first year. Because of additional wear and tear, this maintenance cost will then increase by $4 per year for the remaining life of the machine. The machine will be installed in a building already owned by the firm. If this project does not go ahead, this building could be rented out for $15 per year. PROJECT EVALUATION-SUBMISSION Note: All values to be in $thousands & all expenses and cash outflows are to be entered as negative numbers. Year Opening Book Value less Depreciation Closing Book Value Weighted Average Cost of Capital: 1 2 3 4 8.2 % 240 120 60 30 -120 -60 -30 -30 Tax Rate: 20.0% 120 60 30 C Cash Flow 1 2 4 Revenue 134 129.98 126.09 122.31 less Wages less Maintenance less Depreciation less Opportunity Cost (Rent) -28 -28 -28 -17 -11 -15 -19 -23 -120 -60 -30 -30 The descript -15 -15 -15 -15 Unless you e those dropd or software that you ent: folllowing lis find you can descriptions copy and pas Incremental EBIT 40.00 11.98 34.09 37.31 less Tax 8 2.396 6.818 7.462 Incremental Earnings less Wages less Feasibi -32.00 14.38 40.91 44.77 Incremental Earnings -32.00 14.38 40.91 44.77 less Wages less Feasibility St Salvage Value less Depreciatiore plus Depreciation Initial Outlay plus Depreciation Net Working Capital Salvage Value less Tax on Profit on Sale of Asset 240 120 60 30 30 -14 14 29 less Maintenance Revenue less Tax Net Working Cap less Opportunity Initial Outlay less Tax on Profit Incremental Free Cash Flows 226.00 88.00 74.38 70.91 43.00 74.77 PV of Incremental FCFs NPV Should the project be accepted? Why/why not? Please select all of the following that apply. The project should be accepted. The project should not be accepted. The total number of dollars to be received in the future is greater than the cash outflow in Year 0. The total number of dollars to be received in the future is less than the cash outflow in Year 0. The present value of the cash flows to be received in the future is greater than the cash outflow in Year 0. The present value of the cash flows to be received in the future is less than the cash outflow in Year 0. 2