Answered step by step

Verified Expert Solution

Question

1 Approved Answer

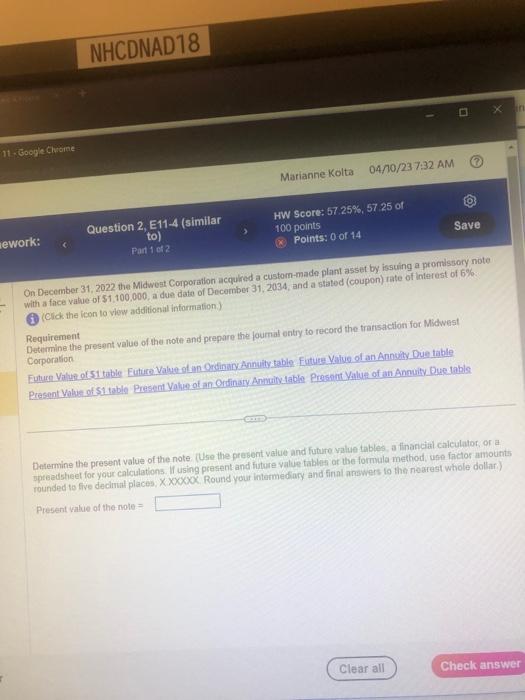

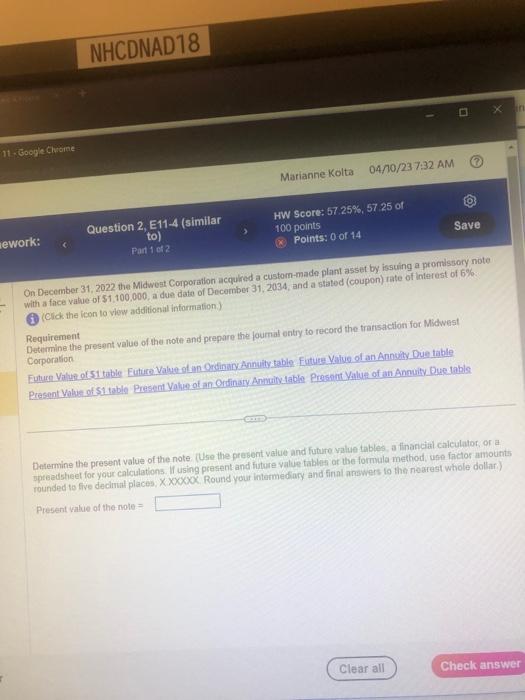

how to calculate present value of the note? On Diecember 31, 2022 the Midwest Corporitlon acquined a custom-made plant asset by ibsuing a promlssory note

how to calculate present value of the note?

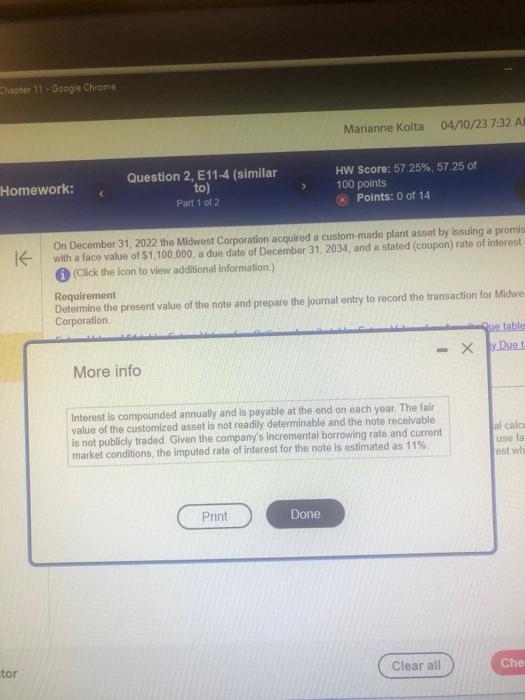

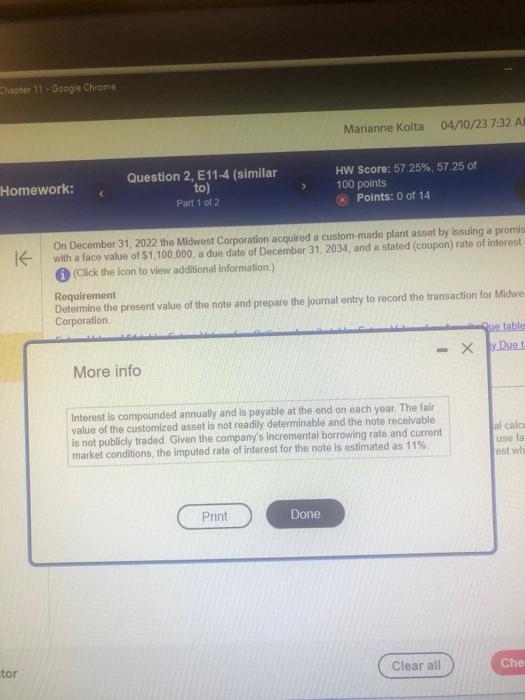

On Diecember 31, 2022 the Midwest Corporitlon acquined a custom-made plant asset by ibsuing a promlssory note With a fhce value of $1,100,000, a due date of December 31,2034 , and a statod (Coupon) rate of interest of 6%. (2) (elick the icon to vlew additionial information) Dettimine the present value of the note and prepare the joumal enty to record the transaction for Midwest Requirement Futurn Value of Si table Euture Value of an Orcinary Annuity table Future Vatue of an Annulty Due table Corporation Presant Walue of St table Present Yalue of an Orfinaty Anmuily table Prosent Yillue of an Annuity Due table Determins the present value of the note (Use the present value and future value tables, a financial calculator, or a ipteadsheet for your calculations. If using present and future value tablen of the formula method, uge factor amounts rounded to five decirut places, XXOXXOC. Round your intermediary and firnal answers to the nearest whole dollar:) Present value of the nole = On December 31, 2022 the Midwest Corporation acquired a custom-made plant asset by issuing a promis with a face value of $1,100,000, a due date of December 31, 2034, and a stated (coupon) rate of interest (Cick the icon to view additional information.) Determine the present value of the note and prepare the joumal entry to record the transaction for Midve Requirement Corporation More info Interest is compounded annually and is payable at the end on each year. The falf value of the customized asset is not readily deteminable and the note recelvable is not publicly traded. Glven the company's incremental borrowing rate and current market conditions, the imputed rate of intereat for the note is estimated as 11\%. On Diecember 31, 2022 the Midwest Corporitlon acquined a custom-made plant asset by ibsuing a promlssory note With a fhce value of $1,100,000, a due date of December 31,2034 , and a statod (Coupon) rate of interest of 6%. (2) (elick the icon to vlew additionial information) Dettimine the present value of the note and prepare the joumal enty to record the transaction for Midwest Requirement Futurn Value of Si table Euture Value of an Orcinary Annuity table Future Vatue of an Annulty Due table Corporation Presant Walue of St table Present Yalue of an Orfinaty Anmuily table Prosent Yillue of an Annuity Due table Determins the present value of the note (Use the present value and future value tables, a financial calculator, or a ipteadsheet for your calculations. If using present and future value tablen of the formula method, uge factor amounts rounded to five decirut places, XXOXXOC. Round your intermediary and firnal answers to the nearest whole dollar:) Present value of the nole = On December 31, 2022 the Midwest Corporation acquired a custom-made plant asset by issuing a promis with a face value of $1,100,000, a due date of December 31, 2034, and a stated (coupon) rate of interest (Cick the icon to view additional information.) Determine the present value of the note and prepare the joumal entry to record the transaction for Midve Requirement Corporation More info Interest is compounded annually and is payable at the end on each year. The falf value of the customized asset is not readily deteminable and the note recelvable is not publicly traded. Glven the company's incremental borrowing rate and current market conditions, the imputed rate of intereat for the note is estimated as 11\%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started