Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to calculate the answer 8? COMMODITY DERIVATIVES - Practice Problems one Raffi Musicale is the portfolio manager for a defined benefit pension plan. He

how to calculate the answer 8?

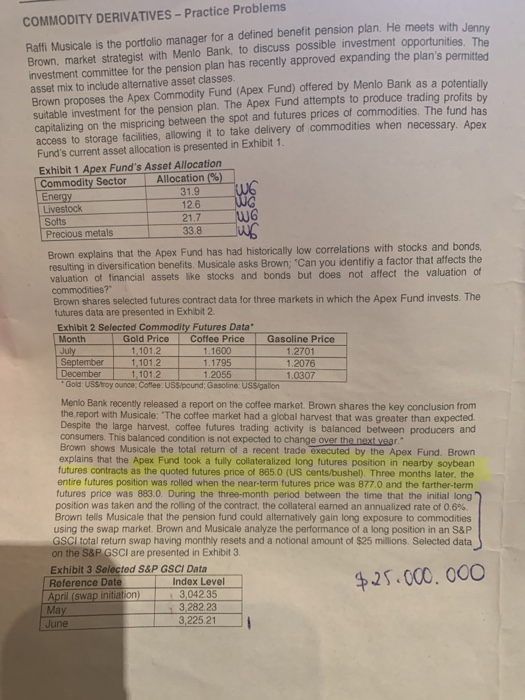

COMMODITY DERIVATIVES - Practice Problems one Raffi Musicale is the portfolio manager for a defined benefit pension plan. He meets with Brown market strategist with Menlo Bank to discuss possible investment opportunities. The investment committee for the pension plan has recently approved expanding the plan's permitted asset mix to include alternative asset classes Brown proposes the Apex Commodity Fund (Apex Fund) offered by Menlo Bank as a potential suitable investment for the pension plan. The Apex Fund attempts to produce trading profits bu capitalizing on the mispricing between the spot and futures prices of commodities. The fund had access to storage facilities, allowing it to take delivery of commodities when necessary. Anay Fund's current asset allocation is presented in Exhibit 1. Exhibit 1 Apex Fund's Asset Allocation Commodity Sector Allocation (%) Energy 31.9 16 Livestock 12.6 W0 Softs 21.7 16 Precious metals 33.8 Brown explains that the Apex Fund has had historically low correlations with stocks and bonds. resulting in diversification benefits. Musicale asks Brown; "Can you identifiy a factor that affects the valuation of financial assets like stocks and bonds but does not affect the valuation of commodities? Brown shares selected futures contract data for three markets in which the Apex Fund invests. The futures data are presented in Exhibit 2. Exhibit 2 Selected Commodity Futures Data Month Gold Price Coffee Price Gasoline Price July 1, 101.2 1.1600 1.2701 September 1, 101.2 1.1795 1.2076 December 1,101.2 1.2055 1.0307 Gold: USStroy ounce, Cottee:USSIpound: Gasoline:USS/gallon Menlo Bank recently released a report on the coffee market Brown shares the key conclusion from the report with Musicale: "The coffee market had a global harvest that was greater than expected Despite the large harvest, coffee futures trading activity is balanced between producers and consumers. This balanced condition is not expected to change over the next year." Brown shows Musicale the total return of a recent trade executed by the Apex Fund. Brown explains that the Apex Fund took a fully collateralized long futures position in nearby soybean futures contracts as the quoted futures price of 865.0 (US cents/bushel). Three months later, the entire futures position was rolled when the near term futures price was 877.0 and the farther-term futures price was 883.0. During the three-month period between the time that the initial long position was taken and the rolling of the contract, the collateral earned an annualized rate of 0.6%. Brown tells Musicale that the pension fund could alternatively gain long exposure to commodities using the swap market. Brown and Musicale analyze the performance of a long position in an S&P GSCI total return swap having monthly resets and a notional amount of $25 millions. Selected data on the S&P GSCI are presented in Exhibit 3 Exhibit 3 Selected S&P GSCI Data Reference Date Index Level April (swap initiation) 3,04235 May 3,282.23 June 3,225.21 $225.000.000 8. Based on Exhibit 3, on the June settlement date, the party that is long the S&P GSCI total re swap will A owe a payment of $434,308.38 B. receive a payment of $1.502,621.33 C. receive a payment of $1,971,173.60 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started