Answered step by step

Verified Expert Solution

Question

1 Approved Answer

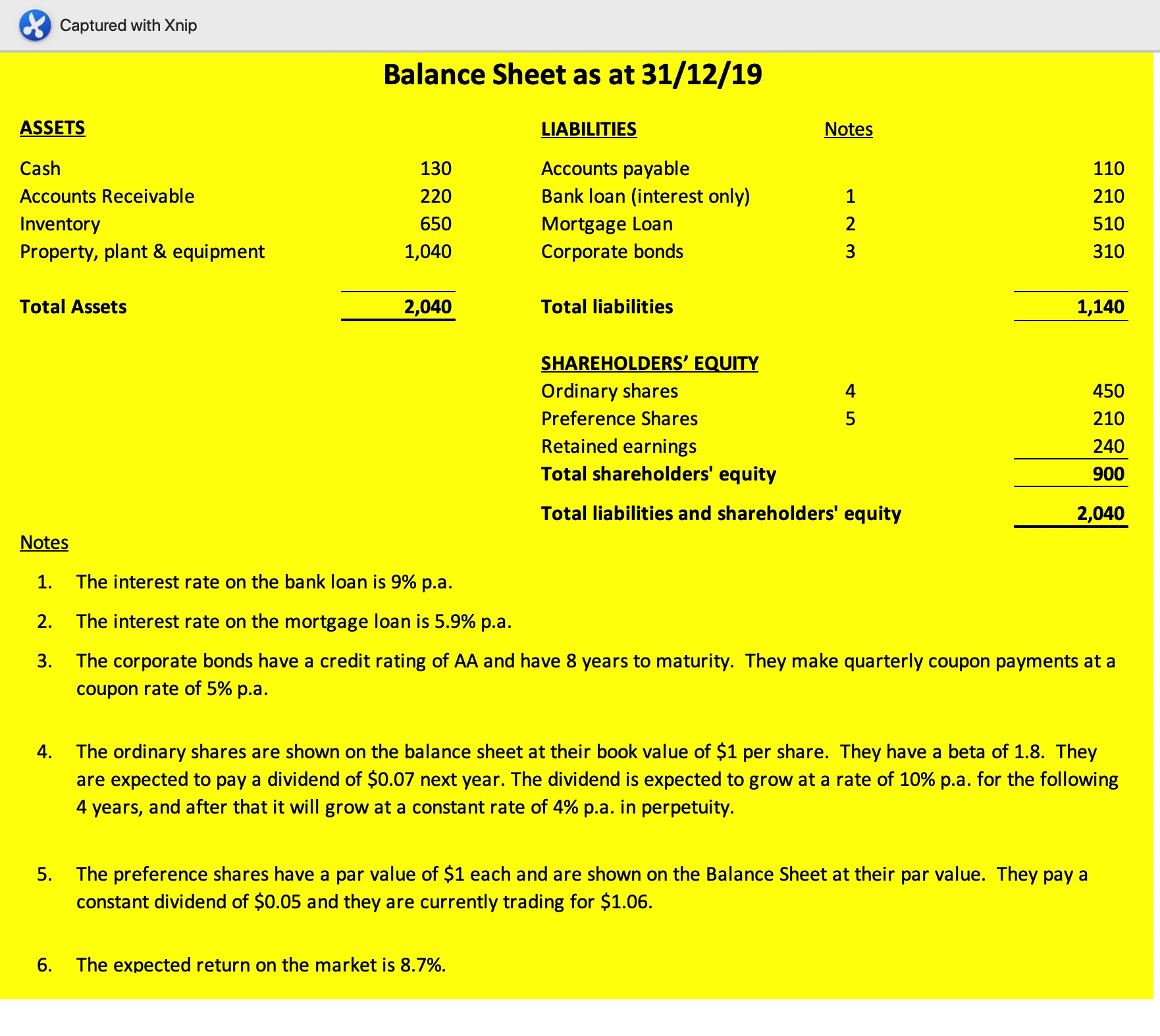

How to calculate the before tax bank loan and the market value of bank loan? Captured with Xnip ASSETS Balance Sheet as at 31/12/19 LIABILITIES

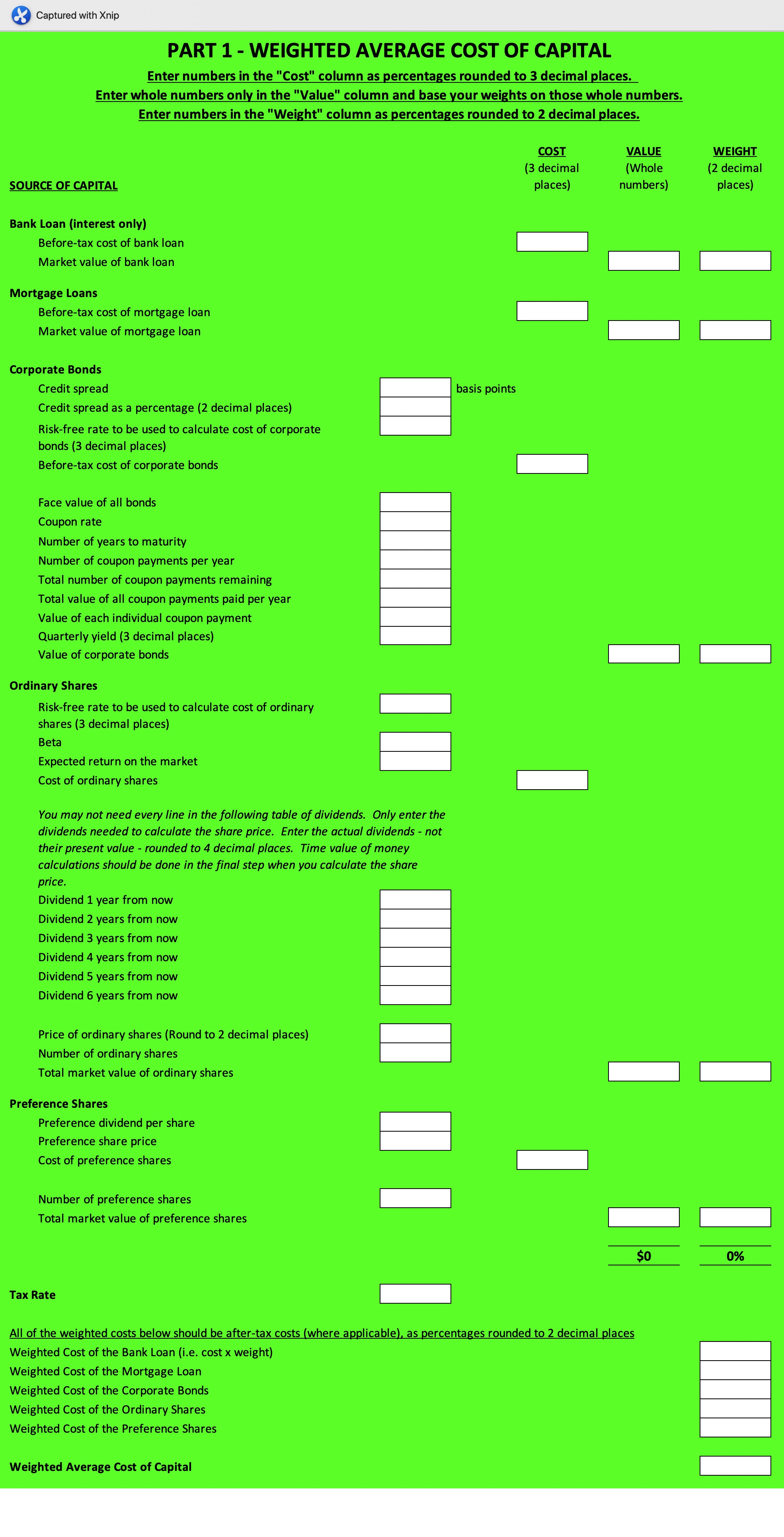

How to calculate the before tax bank loan and the market value of bank loan?

Captured with Xnip ASSETS Balance Sheet as at 31/12/19 LIABILITIES Accounts payable Bank loan (interest only) Cash 130 Accounts Receivable 220 Inventory 650 Mortgage Loan Property, plant & equipment 1,040 Corporate bonds Total Assets 2,040 Total liabilities Notes 1. The interest rate on the bank loan is 9% p.a. 2. The interest rate on the mortgage loan is 5.9% p.a. Notes 110 123 210 2 510 310 1,140 SHAREHOLDERS' EQUITY Ordinary shares 4 450 Preference Shares 5 210 Retained earnings 240 Total shareholders' equity 900 Total liabilities and shareholders' equity 2,040 3. 4. 5. The corporate bonds have a credit rating of AA and have 8 years to maturity. They make quarterly coupon payments at a coupon rate of 5% p.a. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.8. They are expected to pay a dividend of $0.07 next year. The dividend is expected to grow at a rate of 10% p.a. for the following 4 years, and after that it will grow at a constant rate of 4% p.a. in perpetuity. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.05 and they are currently trading for $1.06. 6. The expected return on the market is 8.7%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started