Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to calculate the value of piece of land Assume the same data as given in Problem 3. Le suppose that you consider to buy

how to calculate the value of piece of land

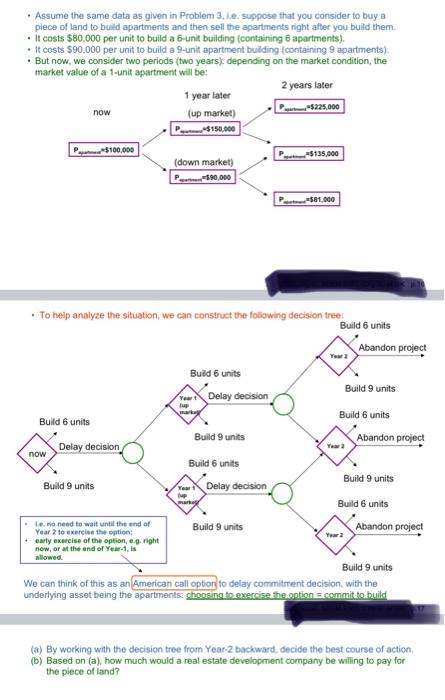

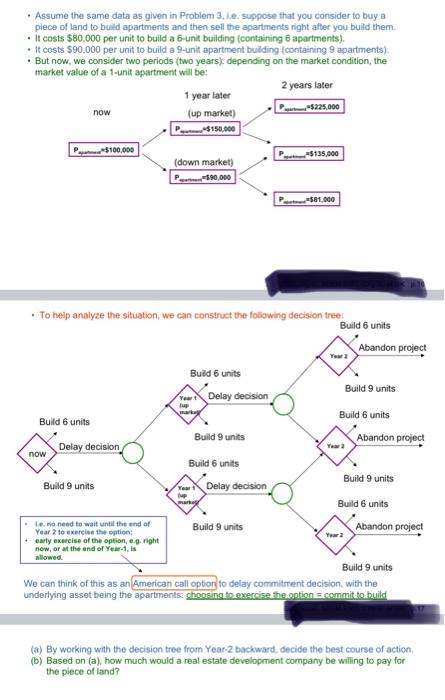

Assume the same data as given in Problem 3. Le suppose that you consider to buy a piece of land to build apartments and then sell the apartments right after you build them. . It costs $80.000 per unit to build a 6-unit building (containing 6 apartments). . it costs $90.000 per unit to build a 9-unit apartment building containing 9 apartments) . But now, we consider two periods (two years, depending on the market condition, the market value of a 1-unit apartment will be 2 years later 1 year later now (up market) D. $225,000 150,000 P3100,000 P$135.000 (down market) P. 590,000 P-581.000 To help analyze the situation, we can construct the following decision trees Build 6 units Abandon project Buid 6 units Delay decision Build 9 units Build 6 units Build 6 units Build 9 units Abandon project Delay decision now Build 6 units Build 9 units Build 9 units Delay decision Build 6 units . Le no need to wait until the end of Build 9 units Year 2 to exercise the option: Abandon project Yara early exercise of the option, e.g. right now, or at the end of Year1.is allowed Build 9 units We can think of this as an American call option to delay commitment decision, with the underlying asset being the apartments: choosing to exercise the entions committo build (a) By working with the decision tree from Year-2 backward, decide the best course of action (b) Based on (a), how much would a real estate development company be willing to pay for the piece of land? Assume the same data as given in Problem 3. Le suppose that you consider to buy a piece of land to build apartments and then sell the apartments right after you build them. . It costs $80.000 per unit to build a 6-unit building (containing 6 apartments). . it costs $90.000 per unit to build a 9-unit apartment building containing 9 apartments) . But now, we consider two periods (two years, depending on the market condition, the market value of a 1-unit apartment will be 2 years later 1 year later now (up market) D. $225,000 150,000 P3100,000 P$135.000 (down market) P. 590,000 P-581.000 To help analyze the situation, we can construct the following decision trees Build 6 units Abandon project Buid 6 units Delay decision Build 9 units Build 6 units Build 6 units Build 9 units Abandon project Delay decision now Build 6 units Build 9 units Build 9 units Delay decision Build 6 units . Le no need to wait until the end of Build 9 units Year 2 to exercise the option: Abandon project Yara early exercise of the option, e.g. right now, or at the end of Year1.is allowed Build 9 units We can think of this as an American call option to delay commitment decision, with the underlying asset being the apartments: choosing to exercise the entions committo build (a) By working with the decision tree from Year-2 backward, decide the best course of action (b) Based on (a), how much would a real estate development company be willing to pay for the piece of land

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started