How to calculate these rations from the income and balance statement for 2019

| Profitability Ratios |

| Net Profit Margin Ratio |

| Total Asset Turnover |

| Return on Assets |

| Operating Income Margin |

| Sales to Fixed Assets |

| ROE |

| Return on Common Equity |

| Gross Profit Margin |

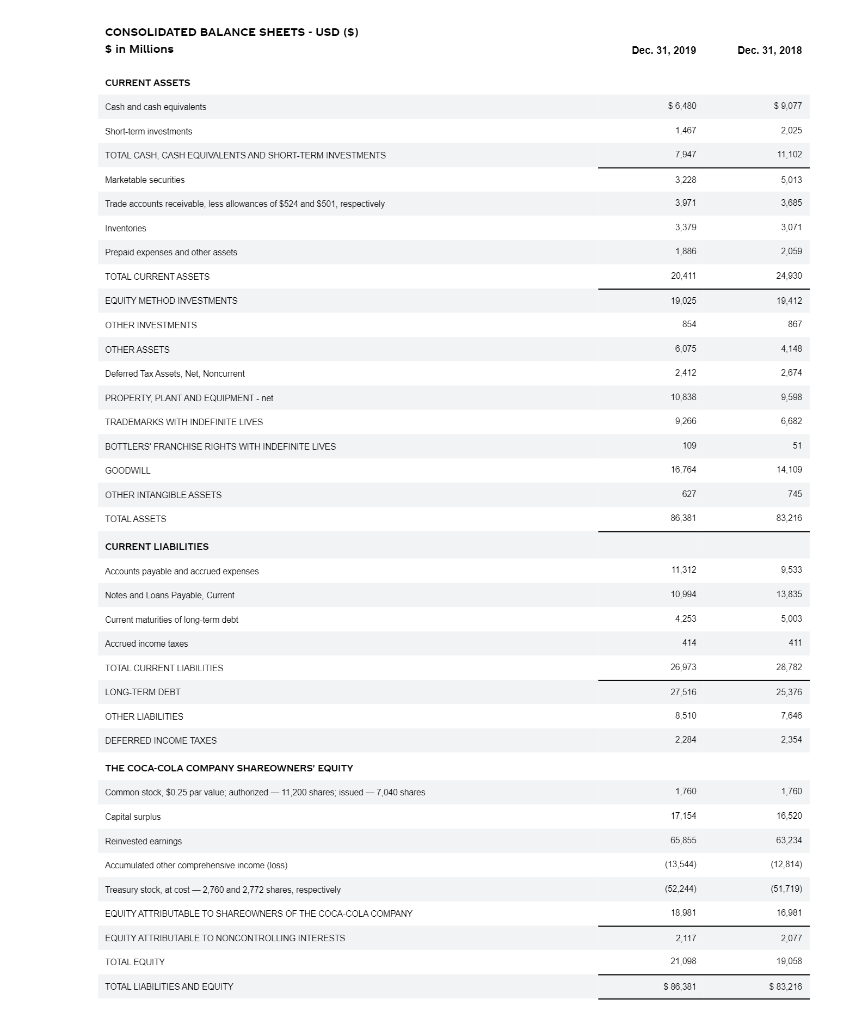

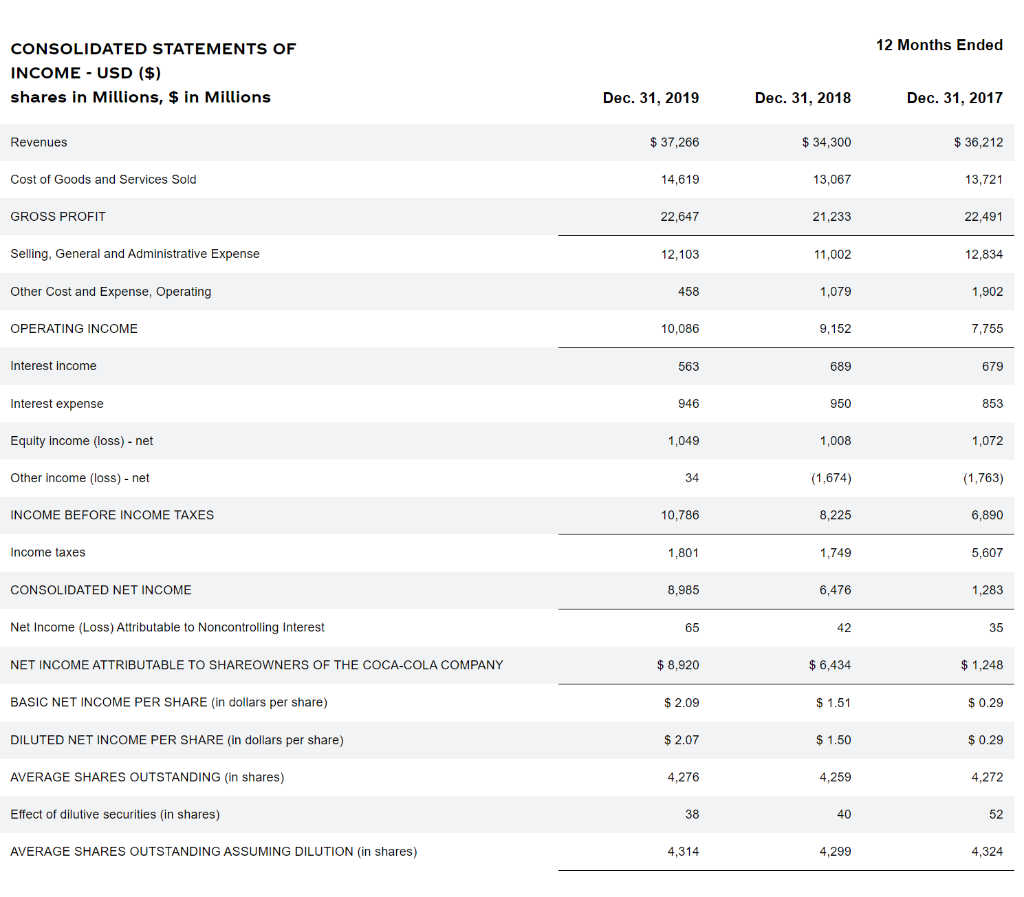

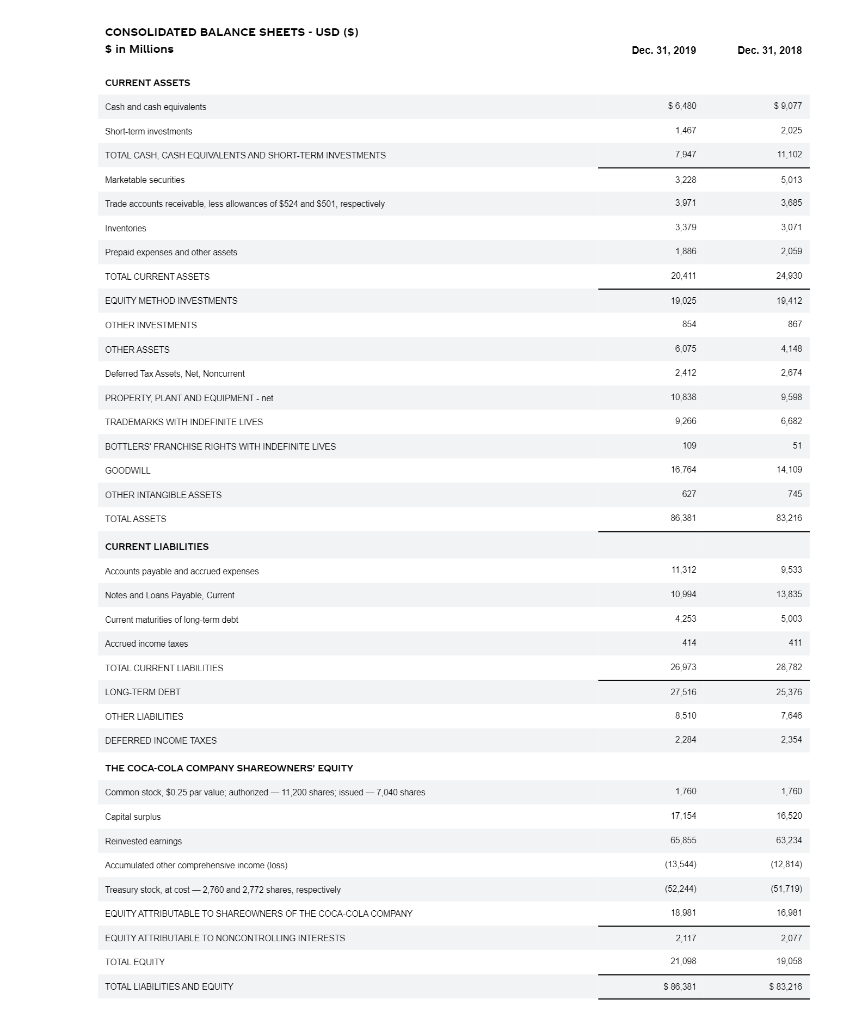

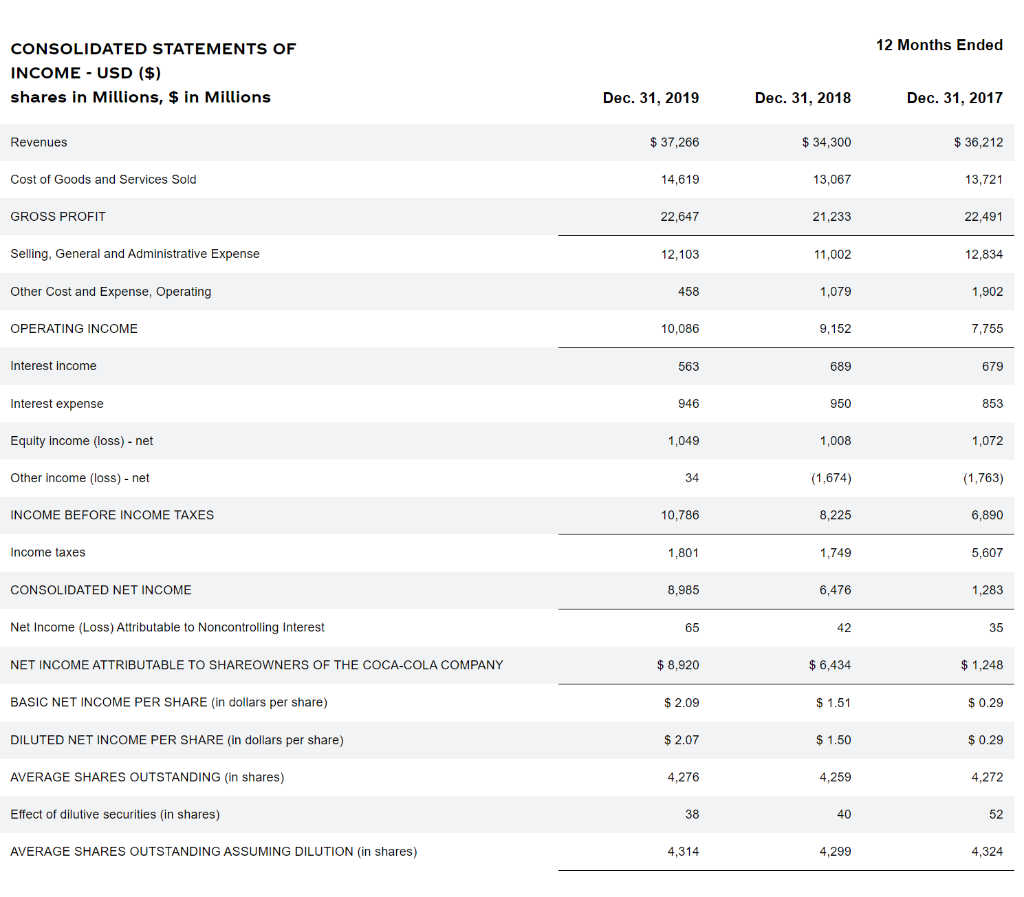

CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions Dec. 31, 2019 Dec. 31, 2018 CURRENT ASSETS Cash and cash equivalents $6.480 $9.077 Short-term investments 1,467 2025 TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 7,947 11 102 Marketable securities 3 228 5.013 Trade accounts receivable less allowances of $524 and S501, respectively 3.971 3,685 Inventories 3,379 3071 Prepaid expenses and other assets 1 886 2059 TOTAL CURRENT ASSETS 20,411 24.930 EQUITY METHOD INVESTMENTS 19,025 19.412 OTHER INVESTMENTS 854 867 OTHER ASSETS 6,075 4,146 Deferred Tax Assets, Net, Noncurrent 2,412 2,674 PROPERTY, PLANT AND EQUIPMENT - net 10 838 9,598 TRADEMARKS WITH INDEFINITE LIVES 9,266 6682 BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES 109 51 GOODWILL 16,764 14,109 OTHER INTANGIBLE ASSETS 627 745 TOTAL ASSETS 86 381 83,216 CURRENT LIABILITIES Accounts payable and accrued expenses 11,312 9.533 Notes and loans Payable, Current 10994 13835 Current maturities of long-term debt 4.253 5,003 Accrued income taxes 414 411 TOTAL CURRENT LIABILITIES 26,973 28 782 LONG-TERM DEBT 27516 25376 OTHER LIABILITIES 8,510 7.646 DEFERRED INCOME TAXES 2,204 2.354 THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock $0.25 par value authorized - 11,200 shares, issued - 7,040 shares 1,760 1,760 Capital surplus 17,154 16,520 Reinvested canings 65 855 63 234 Accumulated other comprehensive income (1035) (13544) (12 814) Treasury stock, at cost-2.760 and 2,772 shares, respectively (52,244) (51,719) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 18,981 16,901 EQUITY ATTRIBUTARLE TO NONCONTROLLING INTERESIS 2.117 2017 TOTAL EQUITY 21 098 19068 TOTAL LIABILITIES AND EQUITY $ 88,381 $ 63.216 12 Months Ended CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions Dec. 31, 2019 Dec. 31, 2018 Dec. 31, 2017 Revenues $ 37,266 $ 34,300 $36,212 Cost of Goods and Services Sold 14,619 13,067 13,721 GROSS PROFIT 22,647 21,233 22,491 Selling, General and Administrative Expense 12,103 11,002 12,834 Other Cost and Expense, Operating 458 1,079 1,902 OPERATING INCOME 10,086 9,152 7,755 Interest income 563 689 679 Interest expense 946 950 853 Equity income (loss) - net 1,049 1,008 1,072 Other Income (loss) - net 34 (1,674) (1,763) INCOME BEFORE INCOME TAXES 10,786 8,225 6,890 Income taxes 1,801 1,749 5,607 CONSOLIDATED NET INCOME 8,985 6,476 1,283 Net Income (Loss) Attributable to Noncontrolling Interest 65 42 35 NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY $ 8,920 $ 6,434 $ 1,248 BASIC NET INCOME PER SHARE (in dollars per share) $ 2.09 $ 1.51 $ 0.29 DILUTED NET INCOME PER SHARE (in dollars per share) $2.07 $ 1.50 $ 0.29 AVERAGE SHARES OUTSTANDING (in shares) 4,276 4,259 4,272 Effect of dilutive securities (in shares) 38 40 52 AVERAGE SHARES OUTSTANDING ASSUMING DILUTION (in shares) 4,314 4,299 4,324