Answered step by step

Verified Expert Solution

Question

1 Approved Answer

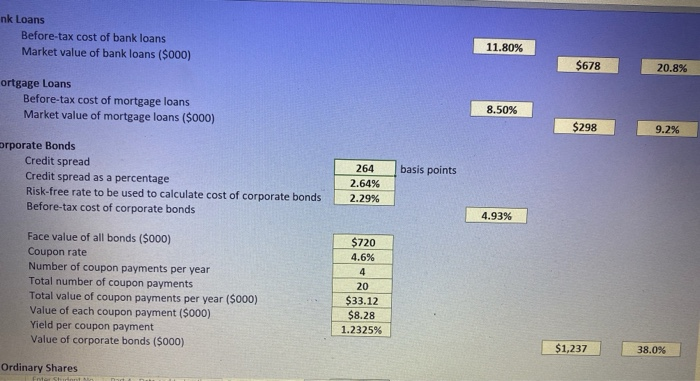

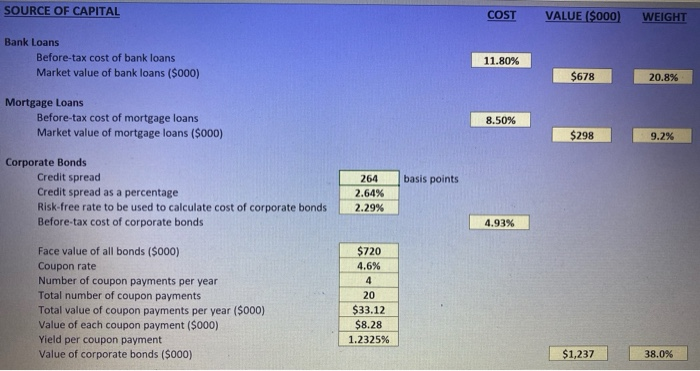

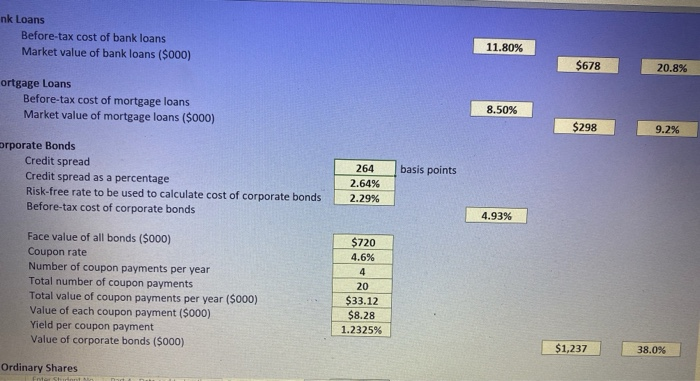

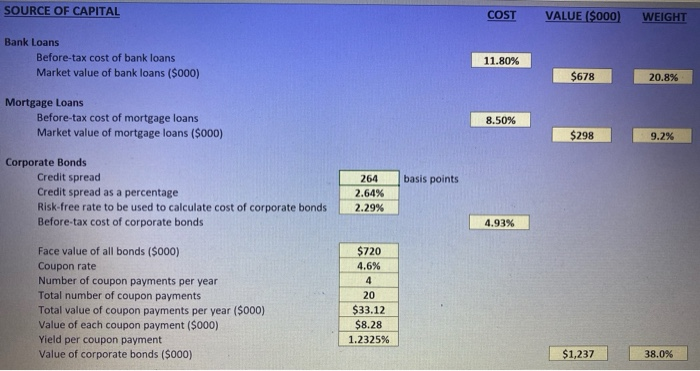

how to calculate yeild per coupon rate and cost of corporate bond? nk Loans Before-tax cost of bank loans Market value of bank loans ($000)

how to calculate yeild per coupon rate and cost of corporate bond?

nk Loans Before-tax cost of bank loans Market value of bank loans ($000) 11.80% $678 20.8% ortgage Loans Before-tax cost of mortgage loans Market value of mortgage loans ($000) 8.50% $298 9.2% basis points orporate Bonds Credit spread Credit spread as a percentage Risk-free rate to be used to calculate cost of corporate bonds Before-tax cost of corporate bonds 264 2.64% 2.29% 4.93% $720 4.6% Face value of all bonds ($000) Coupon rate Number of coupon payments per year Total number of coupon payments Total value of coupon payments per year (5000) Value of each coupon payment (5000) Yield per coupon payment Value of corporate bonds (5000) 20 $33.12 $8.28 1.2325% $1,237 38.0% Ordinary Shares SOURCE OF CAPITAL COST VALUE ($000) WEIGHT Bank Loans Before-tax cost of bank loans Market value of bank loans ($000) $678 Mortgage Loans Before-tax cost of mortgage loans Market value of mortgage loans ($000) $298 basis points Corporate Bonds Credit spread Credit spread as a percentage Risk-free rate to be used to calculate cost of corporate bonds Before-tax cost of corporate bonds 264 2.64% 2.29% $720 4.6% Face value of all bonds ($000) Coupon rate Number of coupon payments per year Total number of coupon payments Total value of coupon payments per year ($000) Value of each coupon payment ($000) Yield per coupon payment Value of corporate bonds ($000) 20 $33.12 $8.28 1.2325% $1,237 38.0% nk Loans Before-tax cost of bank loans Market value of bank loans ($000) 11.80% $678 20.8% ortgage Loans Before-tax cost of mortgage loans Market value of mortgage loans ($000) 8.50% $298 9.2% basis points orporate Bonds Credit spread Credit spread as a percentage Risk-free rate to be used to calculate cost of corporate bonds Before-tax cost of corporate bonds 264 2.64% 2.29% 4.93% $720 4.6% Face value of all bonds ($000) Coupon rate Number of coupon payments per year Total number of coupon payments Total value of coupon payments per year (5000) Value of each coupon payment (5000) Yield per coupon payment Value of corporate bonds (5000) 20 $33.12 $8.28 1.2325% $1,237 38.0% Ordinary Shares SOURCE OF CAPITAL COST VALUE ($000) WEIGHT Bank Loans Before-tax cost of bank loans Market value of bank loans ($000) $678 Mortgage Loans Before-tax cost of mortgage loans Market value of mortgage loans ($000) $298 basis points Corporate Bonds Credit spread Credit spread as a percentage Risk-free rate to be used to calculate cost of corporate bonds Before-tax cost of corporate bonds 264 2.64% 2.29% $720 4.6% Face value of all bonds ($000) Coupon rate Number of coupon payments per year Total number of coupon payments Total value of coupon payments per year ($000) Value of each coupon payment ($000) Yield per coupon payment Value of corporate bonds ($000) 20 $33.12 $8.28 1.2325% $1,237 38.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started