Answered step by step

Verified Expert Solution

Question

1 Approved Answer

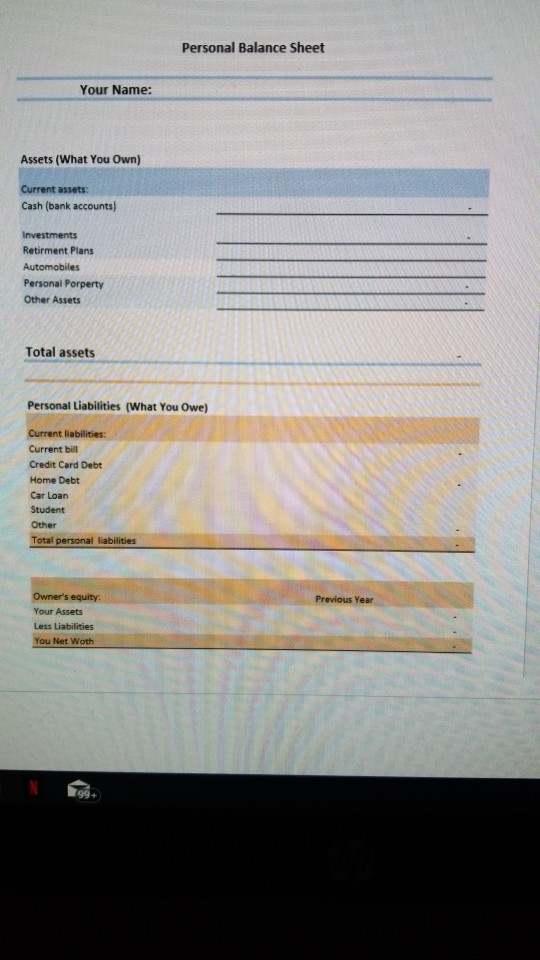

how to create a balance sheet and an income statement with the information provided? Personal Balance Sheet Your Name: Assets (What You Own) Current assets:

how to create a balance sheet and an income statement with the information provided?

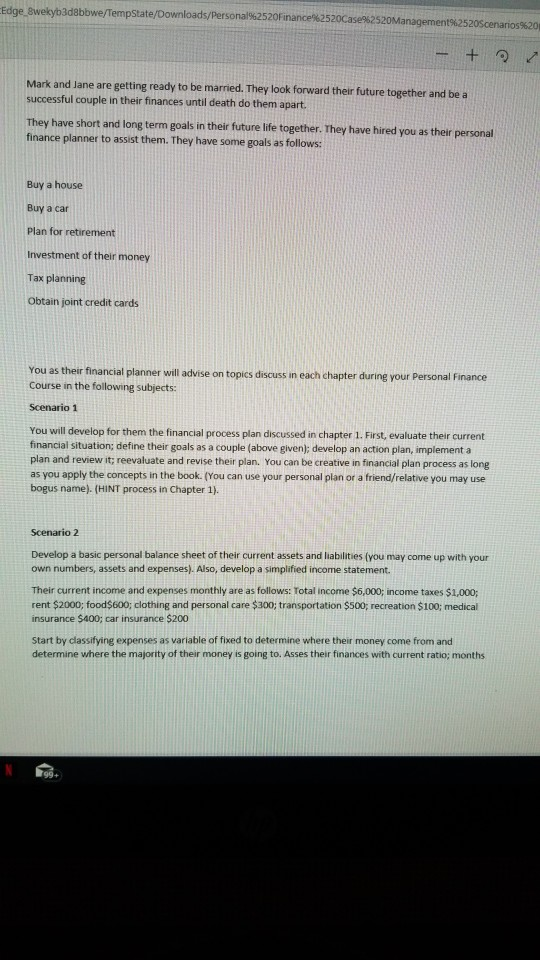

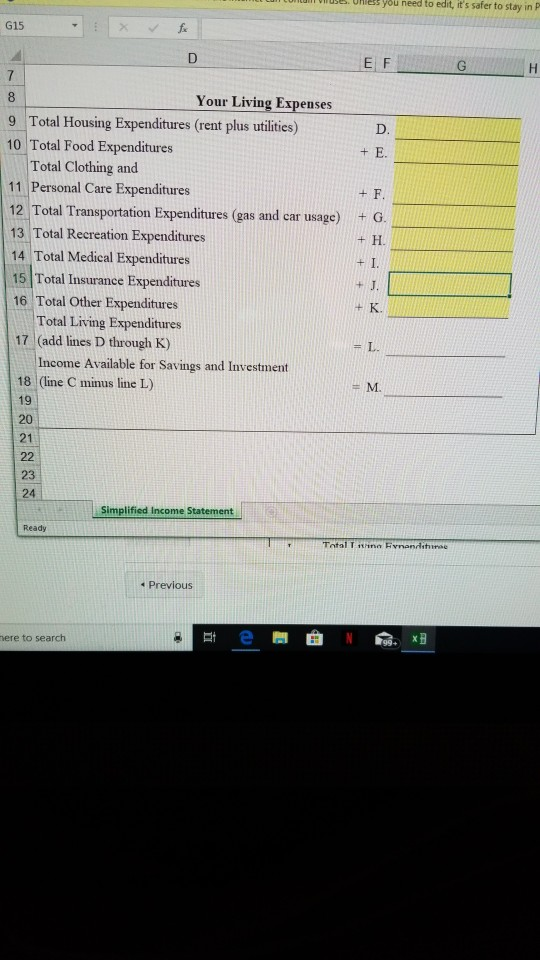

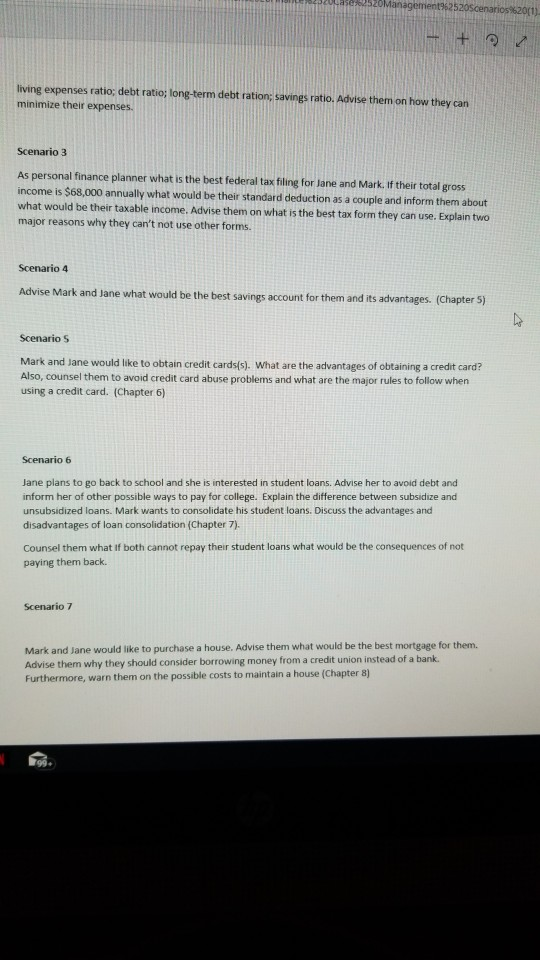

Personal Balance Sheet Your Name: Assets (What You Own) Current assets: Cash (bank accounts) Investments Retirment Plans Automobiles Personal Porperty Other Assets Total assets Personal Liabilities (What You Owe) Current liabilities: Current bill Credit Card Debt Home Debt Car Loan Student Other Total personal liabilities Owner's equity Previous Year Your Assets Less Liabilities You Net Woth you need to edit, it's safer to stay in P fe G15 D E F H 7 Your Living Expenses 9 Total Housing Expenditures (rent plus utilities) D. 10 Total Food Expenditures Total Clothing and 11 Personal Care Expenditures 12 Total Transportation Expenditures (gas and car usage) 13 Total Recreation Expenditures 14 Total Medical Expenditures +E + F. +G. + H +I. 15 Total Insurance Expenditures +J. 16 Total Other Expenditures Total Living Expenditures 17 (add lines D through K) Income Available for Savings and Investment +K. 18 (line C minus line L) Simplified Income Statement Ready Total T nna Exnenditirae Previous 799+ nere to search 18988282 Management arios %20(1). living expenses ratio; debt ratio; long-term debt ration; savings ratio. Advise them on how they can minimize their expenses Scenario 3 As personal finance planner what is the best federal tax filing for Jane and Mark. If their total gross income is $68,000 annually what would be their standard deduction as a couple and inform them about what would be their taxable income. Advise them on what is the best tax form they can use. Explain two major reasons why they can't not use other forms Scenario 4 Advise Mark and Jane what would be the best savings account for them and its advantages. (Chapter 5) Scenario S Mark and Jane would like to obtain credit cards(s). What are the advantages of obtaining a credit card? Also, counsel them to avoid credit card abuse problems and what are the major rules to follow when using a credit card. (Chapter 6) Scenario 6 Jane plans to go back to school and she is interested in student loans. Advise her to avoid debt and inform her of other possible ways to pay for college. Explain the difference between subsidize and unsubsidized loans. Mark wants to consolidate his student loans. Discuss the advantages and disadvantages of loan consolidation (Chapter 7). Counsel them what If both cannot repay their student loans what would be the consequences of not paying them back. Scenario 7 Mark and Jane would like to purchase a house. Advise them what would be the best mortgage for them. Advise them why they should consider borrowing money from a credit union instead of a bank Furthermore, warn them on the possible costs to maintain a house (Chapter 8) Scenario 8 Advise them on how they should invest their money on stocks, bonds or mutual funds topic discussed in chapter 11 thru chapter 14. Select one to two options and in your opinion, what explain why is the best investment for them and its advantages? Scenario 9 Advise Mark and Jane what is the best plan of retirement for them (chapter 15) Mark and Jane would like to get assistance with estate planning process (chapter 16) 99. Personal Balance Sheet Your Name: Assets (What You Own) Current assets: Cash (bank accounts) Investments Retirment Plans Automobiles Personal Porperty Other Assets Total assets Personal Liabilities (What You Owe) Current liabilities: Current bill Credit Card Debt Home Debt Car Loan Student Other Total personal liabilities Owner's equity Previous Year Your Assets Less Liabilities You Net Woth you need to edit, it's safer to stay in P fe G15 D E F H 7 Your Living Expenses 9 Total Housing Expenditures (rent plus utilities) D. 10 Total Food Expenditures Total Clothing and 11 Personal Care Expenditures 12 Total Transportation Expenditures (gas and car usage) 13 Total Recreation Expenditures 14 Total Medical Expenditures +E + F. +G. + H +I. 15 Total Insurance Expenditures +J. 16 Total Other Expenditures Total Living Expenditures 17 (add lines D through K) Income Available for Savings and Investment +K. 18 (line C minus line L) Simplified Income Statement Ready Total T nna Exnenditirae Previous 799+ nere to search 18988282 Management arios %20(1). living expenses ratio; debt ratio; long-term debt ration; savings ratio. Advise them on how they can minimize their expenses Scenario 3 As personal finance planner what is the best federal tax filing for Jane and Mark. If their total gross income is $68,000 annually what would be their standard deduction as a couple and inform them about what would be their taxable income. Advise them on what is the best tax form they can use. Explain two major reasons why they can't not use other forms Scenario 4 Advise Mark and Jane what would be the best savings account for them and its advantages. (Chapter 5) Scenario S Mark and Jane would like to obtain credit cards(s). What are the advantages of obtaining a credit card? Also, counsel them to avoid credit card abuse problems and what are the major rules to follow when using a credit card. (Chapter 6) Scenario 6 Jane plans to go back to school and she is interested in student loans. Advise her to avoid debt and inform her of other possible ways to pay for college. Explain the difference between subsidize and unsubsidized loans. Mark wants to consolidate his student loans. Discuss the advantages and disadvantages of loan consolidation (Chapter 7). Counsel them what If both cannot repay their student loans what would be the consequences of not paying them back. Scenario 7 Mark and Jane would like to purchase a house. Advise them what would be the best mortgage for them. Advise them why they should consider borrowing money from a credit union instead of a bank Furthermore, warn them on the possible costs to maintain a house (Chapter 8) Scenario 8 Advise them on how they should invest their money on stocks, bonds or mutual funds topic discussed in chapter 11 thru chapter 14. Select one to two options and in your opinion, what explain why is the best investment for them and its advantages? Scenario 9 Advise Mark and Jane what is the best plan of retirement for them (chapter 15) Mark and Jane would like to get assistance with estate planning process (chapter 16) 99Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started