how to determine whether the payoff diagram is below ZERO! and how to determine the ZCB FV I should use? Thank you . I need explanation instead of question answer , thank you!

how to determine whether the payoff diagram is below ZERO! and how to determine the ZCB FV I should use? Thank you . I need explanation instead of question answer , thank you!

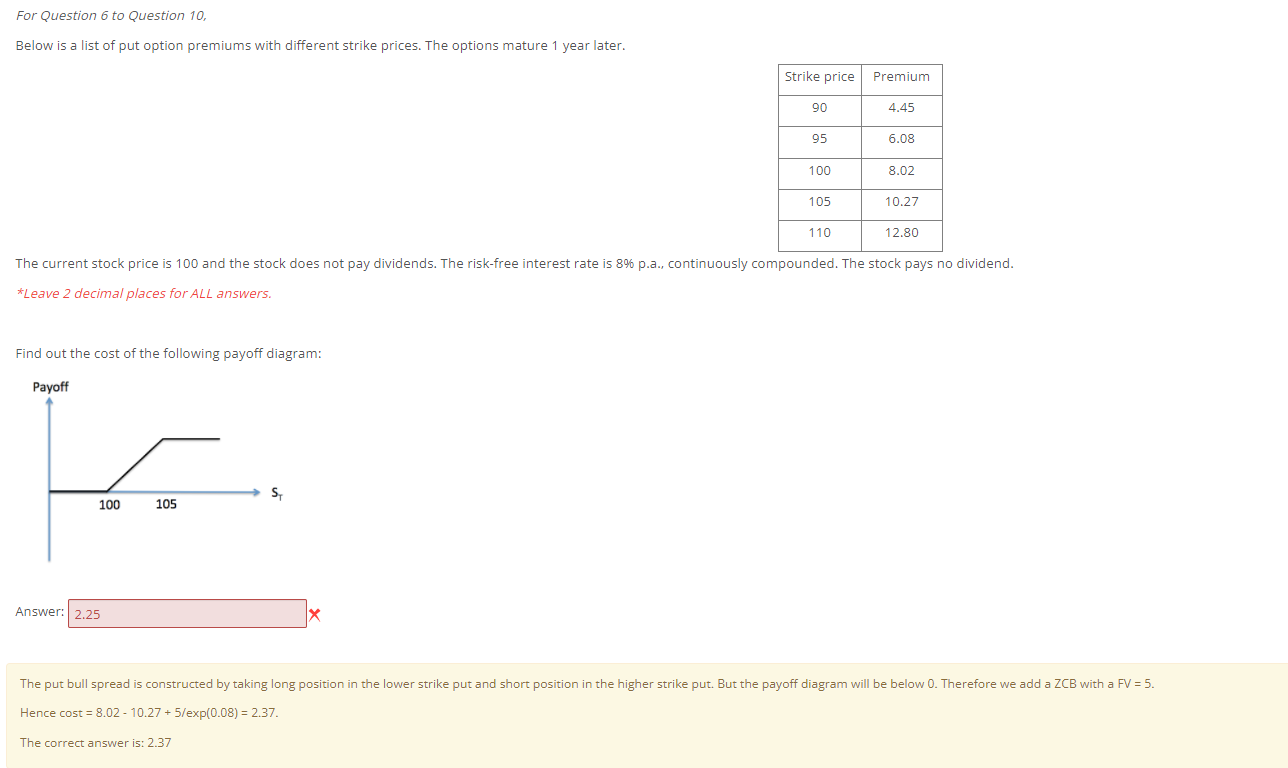

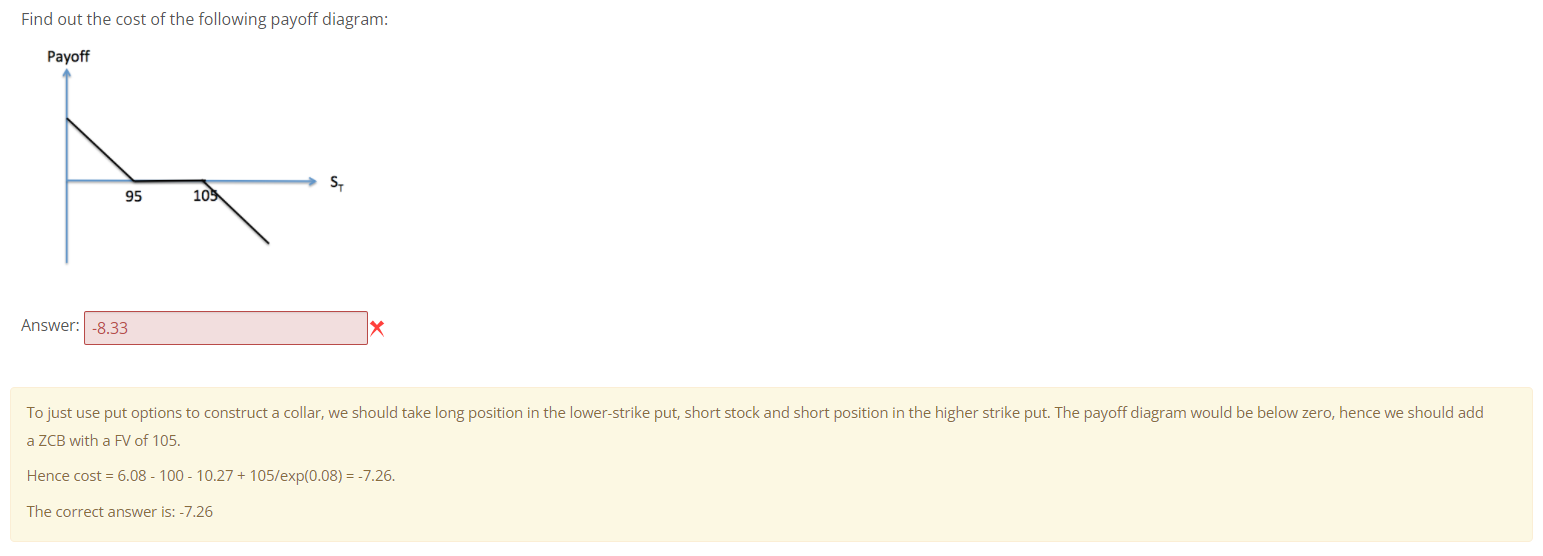

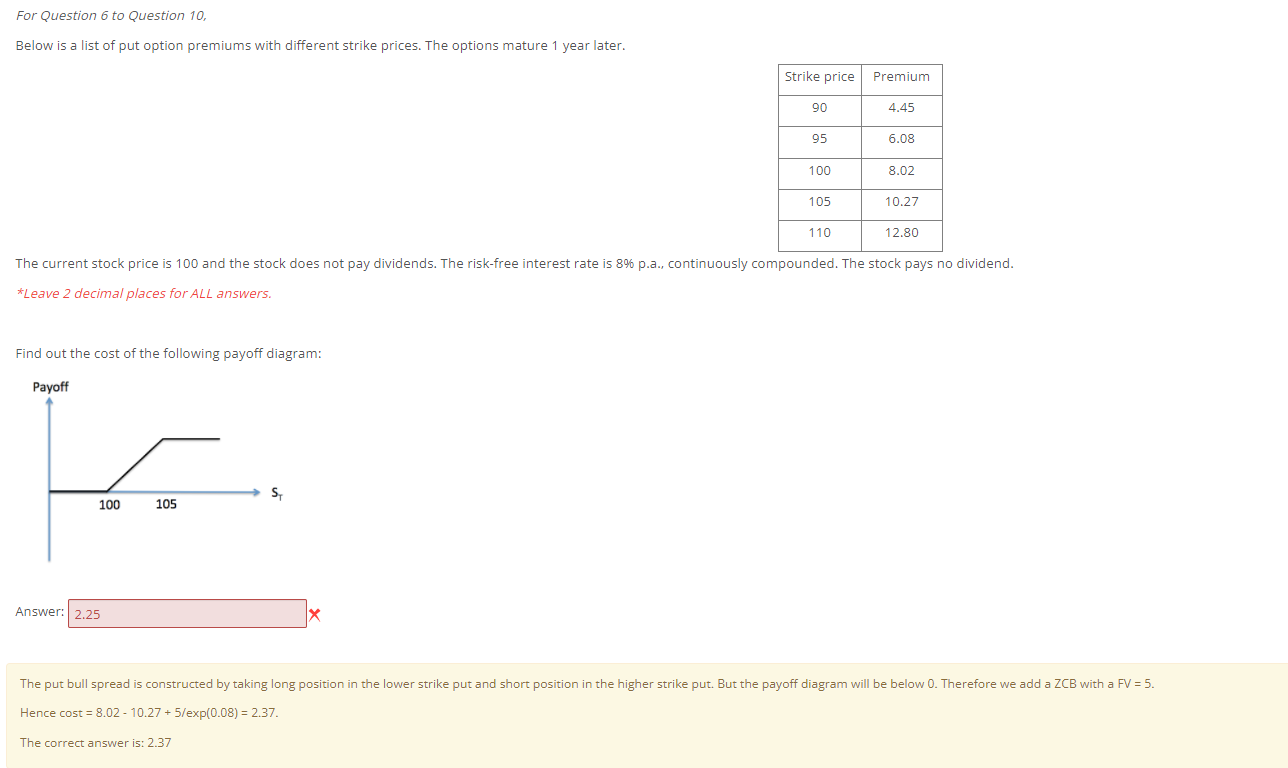

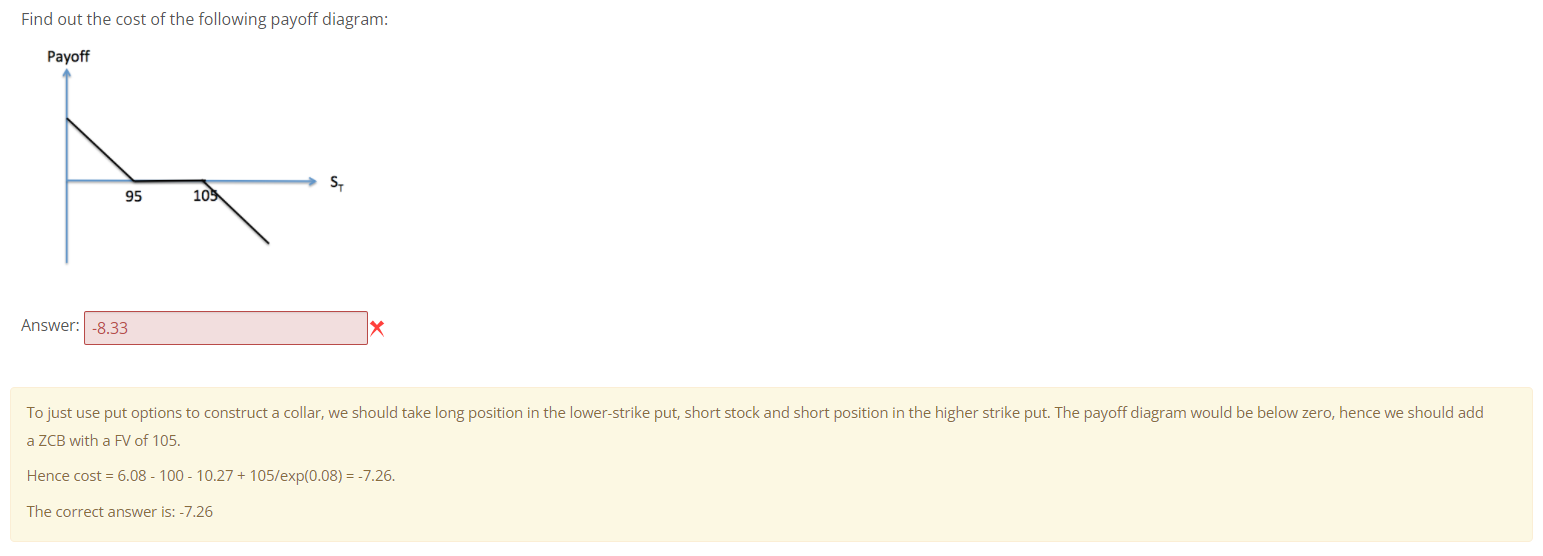

For Question 6 to Question 10, Below is a list of put option premiums with different strike prices. The options mature 1 year later. Strike price Premium 90 4.45 95 6.08 100 8.02 105 10.27 110 12.80 The current stock price is 100 and the stock does not pay dividends. The risk-free interest rate is 8% p.a., continuously compounded. The stock pays no dividend. *Leave 2 decimal places for ALL answers. Find out the cost of the following payoff diagram: Payoff S. 100 105 Answer: 2.25 The put bull spread is constructed by taking long position in the lower strike put and short position in the higher strike put. But the payoff diagram will be below 0. Therefore we add a ZCB with a FV = 5. Hence cost = 8.02 - 10.27 +5/exp(0.08) = 2.37. The correct answer is: 2.37 Find out the cost of the following payoff diagram: Payoff S, 95 105 Answer: -8.33 To just use put options to construct a collar, we should take long position in the lower-strike put, short stock and short position in the higher strike put. The payoff diagram would be below zero, hence we should add a ZCB with a FV of 105. Hence cost = 6.08 - 100 - 10.27 + 105/exp(0.08) =-7.26. The correct answer is: -7.26 For Question 6 to Question 10, Below is a list of put option premiums with different strike prices. The options mature 1 year later. Strike price Premium 90 4.45 95 6.08 100 8.02 105 10.27 110 12.80 The current stock price is 100 and the stock does not pay dividends. The risk-free interest rate is 8% p.a., continuously compounded. The stock pays no dividend. *Leave 2 decimal places for ALL answers. Find out the cost of the following payoff diagram: Payoff S. 100 105 Answer: 2.25 The put bull spread is constructed by taking long position in the lower strike put and short position in the higher strike put. But the payoff diagram will be below 0. Therefore we add a ZCB with a FV = 5. Hence cost = 8.02 - 10.27 +5/exp(0.08) = 2.37. The correct answer is: 2.37 Find out the cost of the following payoff diagram: Payoff S, 95 105 Answer: -8.33 To just use put options to construct a collar, we should take long position in the lower-strike put, short stock and short position in the higher strike put. The payoff diagram would be below zero, hence we should add a ZCB with a FV of 105. Hence cost = 6.08 - 100 - 10.27 + 105/exp(0.08) =-7.26. The correct answer is: -7.26

how to determine whether the payoff diagram is below ZERO! and how to determine the ZCB FV I should use? Thank you . I need explanation instead of question answer , thank you!

how to determine whether the payoff diagram is below ZERO! and how to determine the ZCB FV I should use? Thank you . I need explanation instead of question answer , thank you!