Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to do all of these question please an answer all question and explain it. just want to answer question 1 what information are missed

how to do all of these question please an answer all question and explain it.

just want to answer question 1

what information are missed

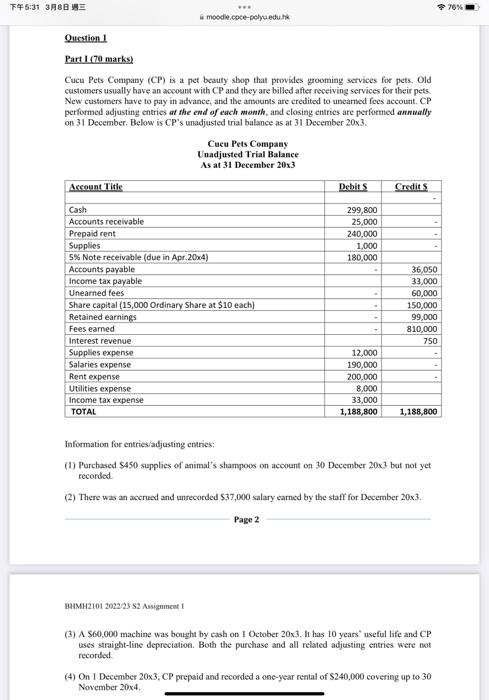

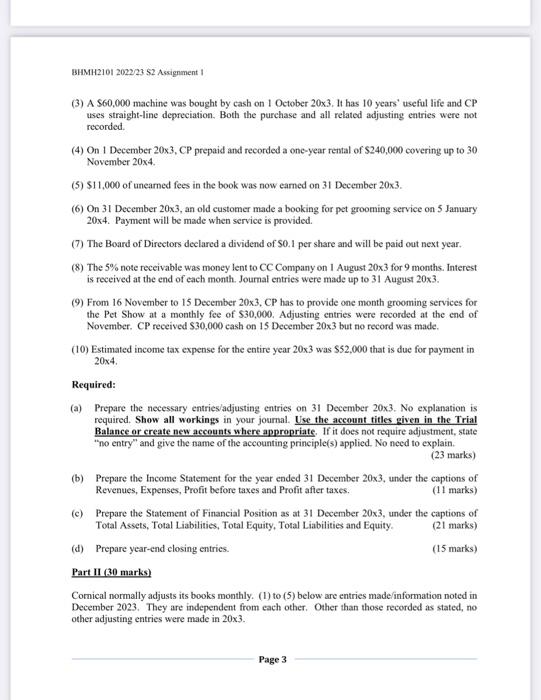

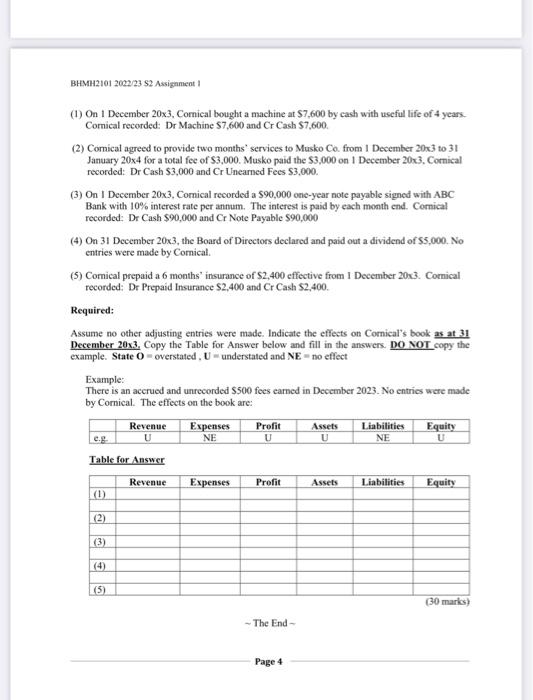

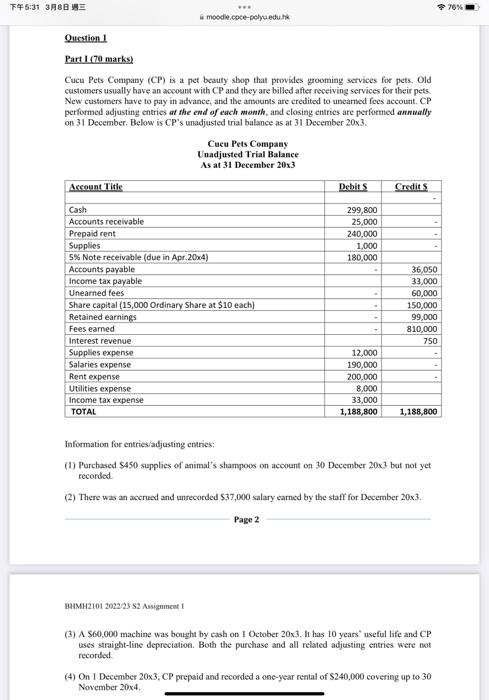

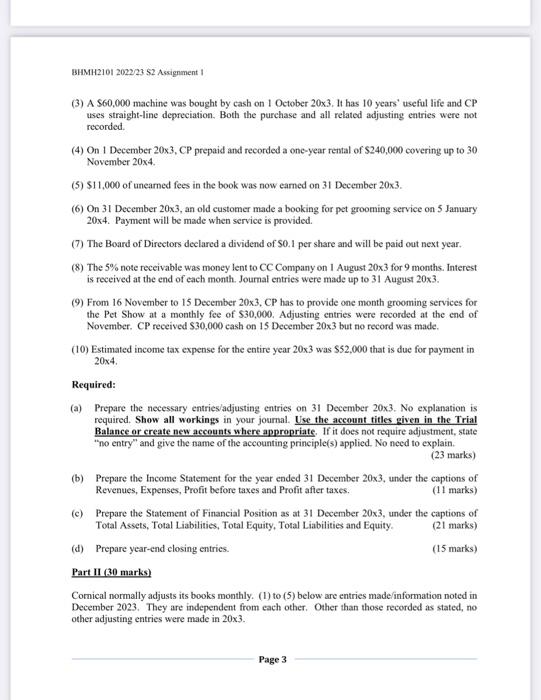

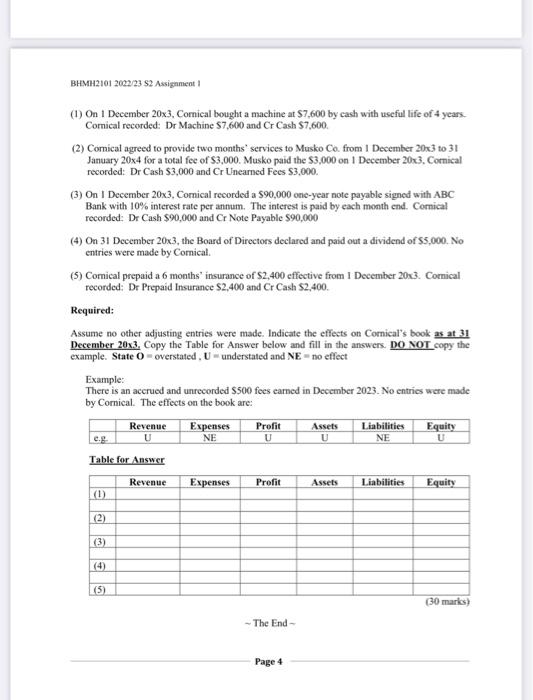

Cucu Pets Company (CP) is a pet beauty shop that provides grooming services for pets. Old customers usually have an accoent with CP and they are billed after receiving services for their pets. New customers have to pay in advance, and the amounts are credited to unearned fees account. CP performed adjusting entries at the end of each month, and closing entries are performed annually on 31 December. Below is CP's unadjusted trial balance as at 31 December 203. Cuca Pets Company Unadjusted Trial Balance As at 31 December 203 Information for entrics/adjusting cntries: (1) Purchased $450 supplies of animal's shampoos on account on 30 December 203 bet not yet recorded. (2) There was an acerued and unrecorded $37,000 salary earned by the staff for December 203. Page 2 BMMH2101 202223 S2 Assignmeat I (3) A $60,000 machine was bought by cash on 1 October 203. Ht has 10 years' useful life and CP uses straight-line depreciation. Both the purchase and all related adjusting entries were not recorded. (4) On I Decenber 20x3, CP prepaid and recorded a one-year rental of $240,000 covering up to 30 November 204, BHMH2101 2022/23 $2 Assignment I (3) A $60,000 machine was bought by cash on 1 October 20x3. It has 10 years' useful life and CP uses straight-line depreciation. Both the purchase and all related adjusting entries were not recorded. (4) On 1 December 20x3, CP prepaid and recorded a one-year rental of $240,000 covering up to 30 November 20x4. (5) $11,000 of unearned fees in the book was now earned on 31 December 203. (6) On 31 Deeember 203, an old customer made a booking for pet grooming service on 5 January 204. Payment will be made when service is provided. (7) The Board of Directors deelared a dividend of $0.1 per share and will be paid oat next year. (8) The 5% note receivable was money lent to CC Company on I August 203 for 9 months. Interest is received at the end of each month. Journal entries were made up to 31 August 203. (9) From 16 November to 15 December 203, CP has to provide one month grooming services for the Pet Show at a monthly fee of $30,000. Adjusting entries were recorded at the end of November. CP received $30,000 cash on 15 December 203 but no record was made. (10) Estimated income tax expense for the entire year 203 was $52,000 that is due for payment in 20x4 Required: (a) Prepare the necessary entries/adjusting entries on 31 December 203. No explanation is required. Show all workings in your journal. Use the account titles given in the Trial Balance or create new accounts where appropriate. If it does not require adjustment, state "no entry" and give the name of the accounting principle(s) applied. No need to explain. ( 23 marks) (b) Prepare the Income Statement for the year ended 31 December 203, under the captions of Revenues, Expenses, Profit before taxes and Profit after taxes. (11 marks) Total Assets, Total Liabilities, Total Equity, Total Liabilities and Equity. (21 marks) (d) Prepare year-end closing entries. (15 marks) Part II (30 marks) Comical normally adjusts its books monthly. (1) to (5) below are entries made/information noted in December 2023. They are independent from each other. Other than those recorded as stated, no other adjusting entries were made in 203. Page 3 BHMH2101 2022/23 \$2 Assignment 1 (1) On 1 December 20x3, Comical bought a machine at 57,600 by cash with useful life of 4 years. Comical recorded: Dr Machine $7,600 and Cr Cash \$7,600. (2) Comical agreed to provide two months' services to Musko Co. from 1 December 203 to 31 January 20x4 for a total fee of $3,000. Musko paid the \$3,000 on 1 December 20x3. Cornical recorded: Dr Cash \$3,000 and Cr Unearned Fees $3,000. (3) On I December 20x3, Comical reconded a $90,000 one-year note payable signed with ABC Bank with 10% interest rate per annum. The interest is paid by each month end. Cornical recorded: Dr Cash $90,000 and Cr Note Payable $90,000 (4) On 31 December 203, the Board of Directors declared and paid out a dividend of 55,000 . No entries were made by Comical. (5) Comical prepaid a 6 months' insurance of $2,400 effective from 1 December 20 3. Comical recorded: Dr Prepaid Insurance $2,400 and Cr Cash $2,400. Required: Assume no other adjusting entries were made. Indicate the effects on Cornical's book as at 31 December 20x3. Copy the Table for Answer below and fill in the answers. DO NOT copy the example. State O= overstated , U= understated and NE= no effect Example: There is an accrued and unrecorded $500 fees camed in December 2023. No entries were made by Cornical. The effects on the book are: Table for Answer The End - Page 4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started