Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to do calculate Bad debit expense, total accounts receivable is 14300 a. At the end of January, exist4, 100 of accounts receivable are past

How to do calculate Bad debit expense, total accounts receivable is 14300

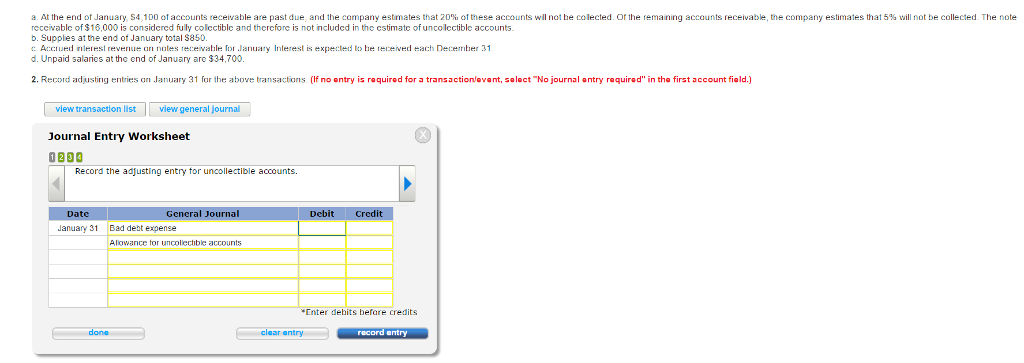

a. At the end of January, exist4, 100 of accounts receivable are past due, and the company estimates that 20% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note receivable of exist16,000 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. b. Supplies at the end of January total exist850. c. Accrued interest revenue on notes receivable for January interest is expected to be received each December 31 d. Unpaid salaries at the end of January are exist34, 700. Record adjusting entries on January 31 for the above transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started