Answered step by step

Verified Expert Solution

Question

1 Approved Answer

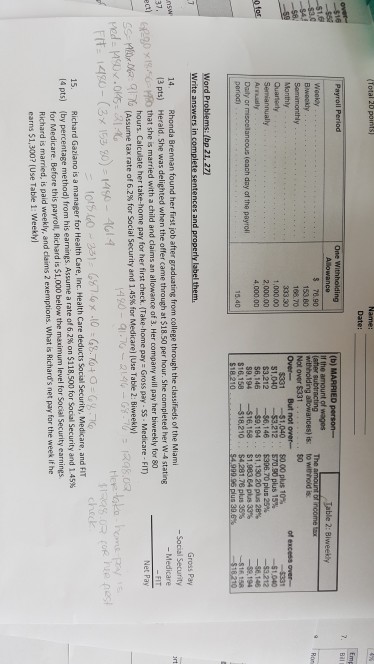

how to do you answer #15 Date: of wagesThe Table 2: Biweekly 5 70.90 153 00 16870 333.30 Semimonthly Not over $331 50 of excess

how to do you answer #15

Date: of wagesThe Table 2: Biweekly 5 70.90 153 00 16870 333.30 Semimonthly Not over $331 50 of excess over.. $331-51040 . $000 plus 10% 570.50 plus 15% $396 70 plus 25% $1.130 20 plus 28% S1.983 64 plus 33% S4281 76plus 35% 1,000.00 2,000.00 4 000.00 $1,040 --$3,212 S3,212--56, 146 S6, 146-89, 184 .. S9.194-$16,158.. S16.158-518.210 $1,040 -$3.212 Arnaly penod -$e.194 15.40 $18.210 999.96 us 396 Word Problems: (bp 21,27 14. 13 pts) Gross Pay - Social Security a Brennan found her first job after graduating from college through the classifieds of the Miami Rhonda Herald. She was delighted when the offer came through at $18.50 per hour. She completed her w-4 stating 600 x1. t that she is married with a child and claims an allowance of 3. Her company will pay her biweekly for 80 FIT hours. Calculate her take-home pay for her first check. (Take-home pay - Gross pay- 55- Medicare-FIT) Assur e tag rate of 6.2% for Social Security and 145% for Medicare | so n rder gi s use Table 2 Bi eekly) ved Richard Gaziano is a manager for Health Care, Inc. Health Care deducts Social Security, Medicare, and FIT (by percentage method) from his earnings Assume a rate of 6.2%onS118.so for Medicare. Before this payroll, Richard is $1,000 below the maximum level for Social Richard is married, is paid weekly, and claims 2 exemptions. What is Richard's net pay for the week if he earns $1,300? (Use Table 1: Weekly 15. 14 pts) for Social Security and 1.45%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started