HOW TO FILL THE TABLES?THE RELATIVE INFORMATIONS ARE BELOW

HERE IS INFORMATION MAY USE:

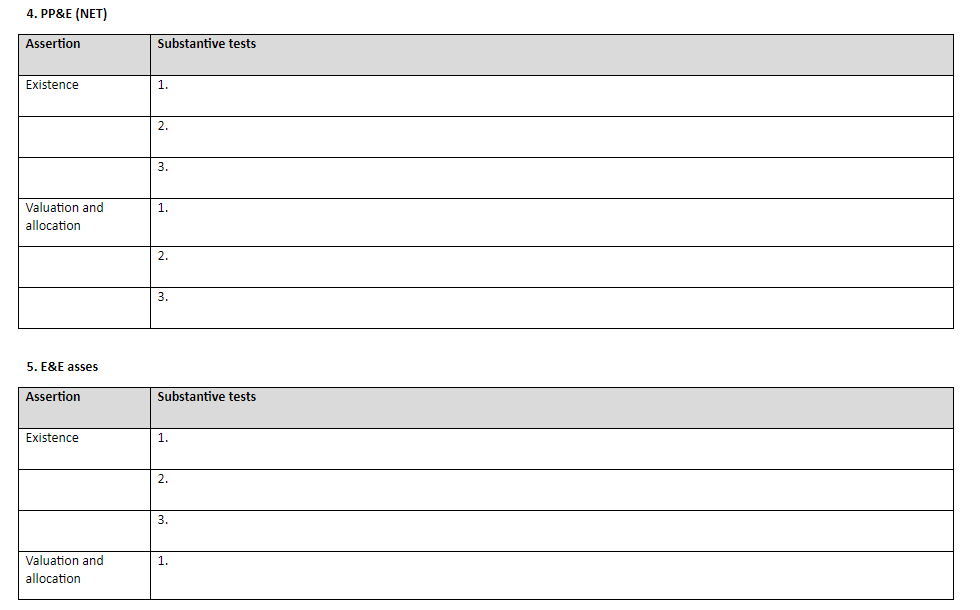

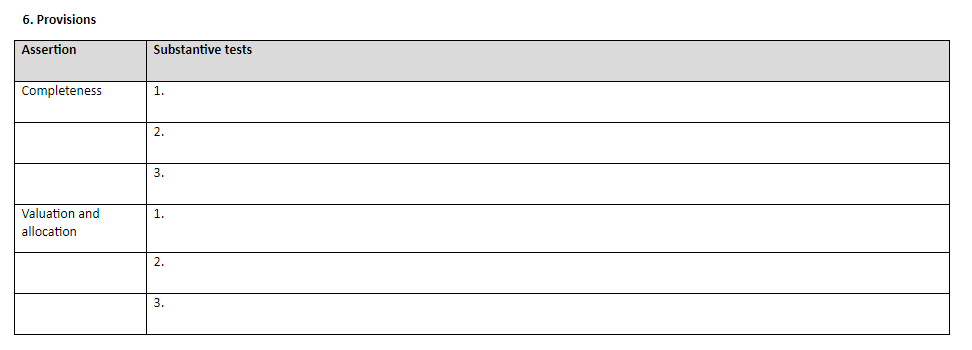

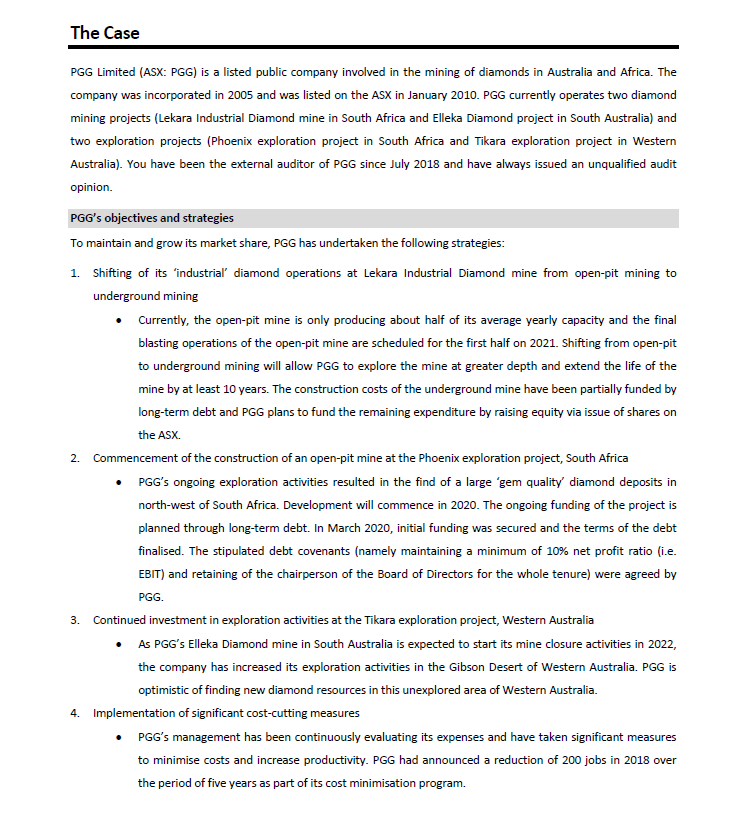

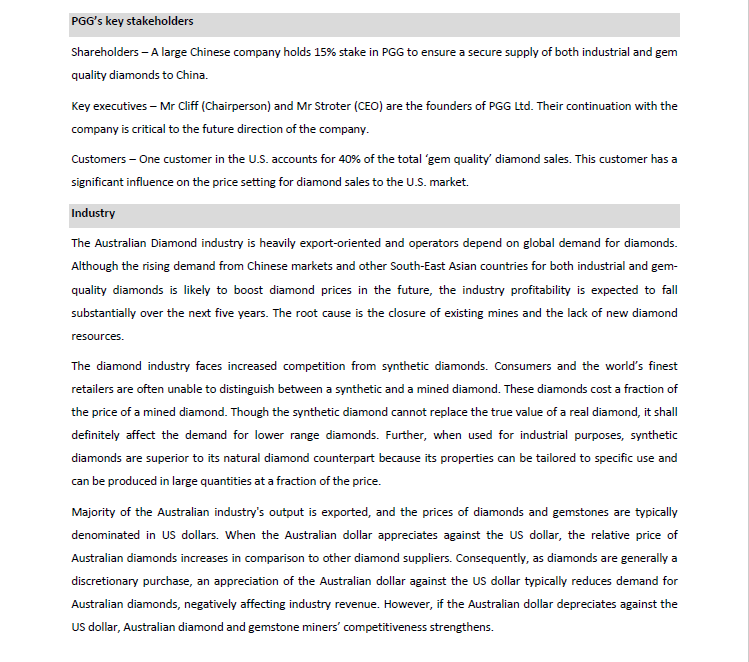

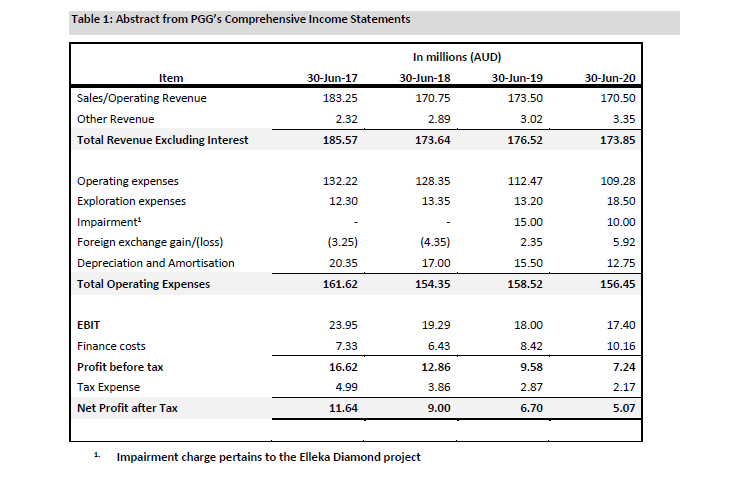

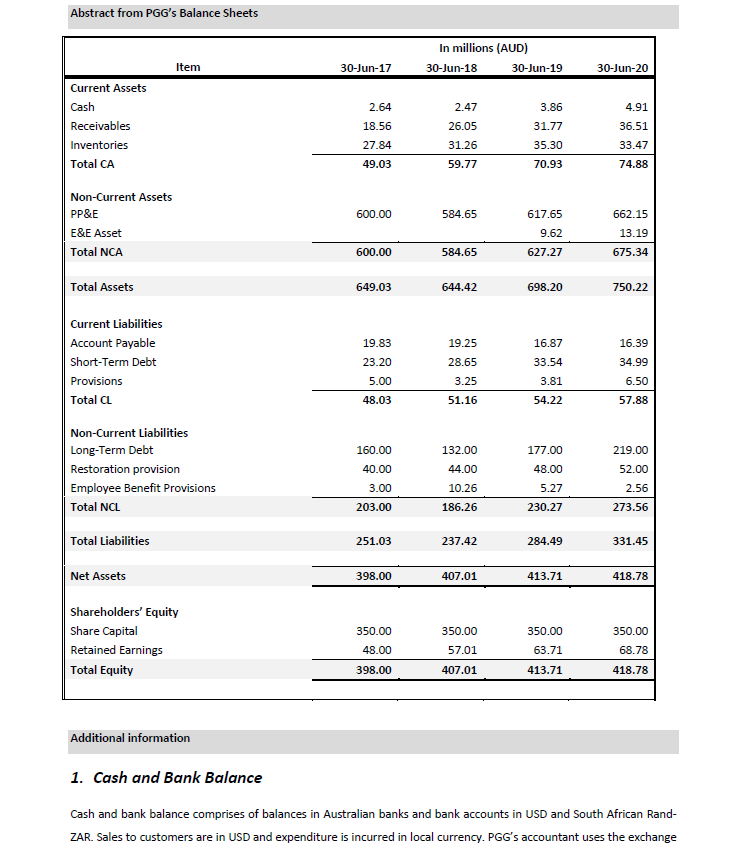

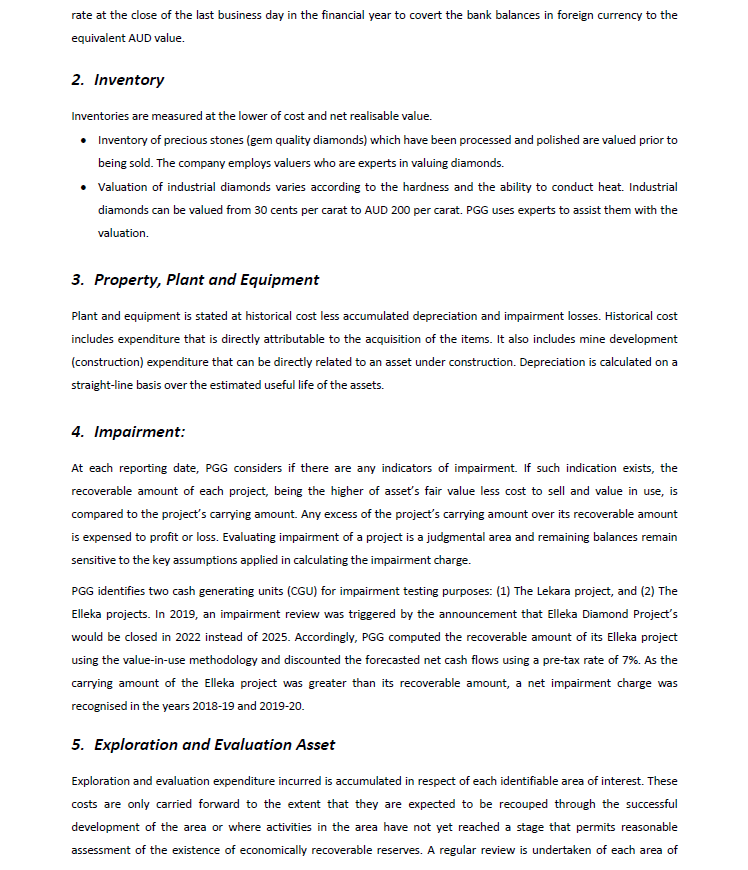

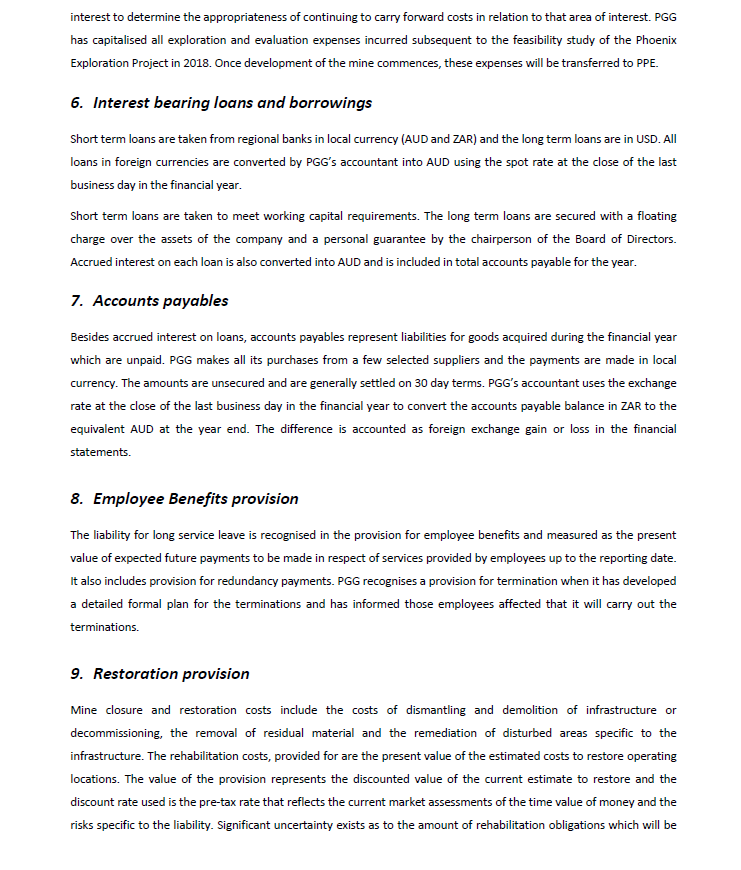

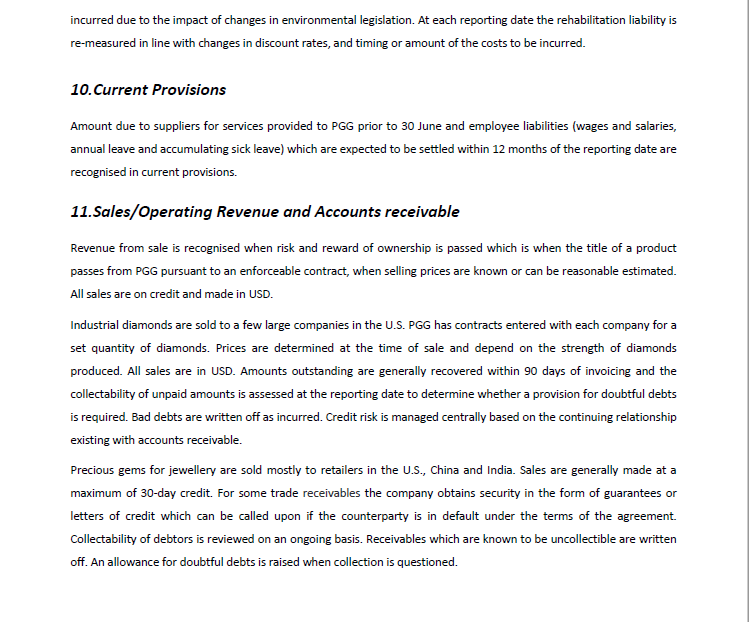

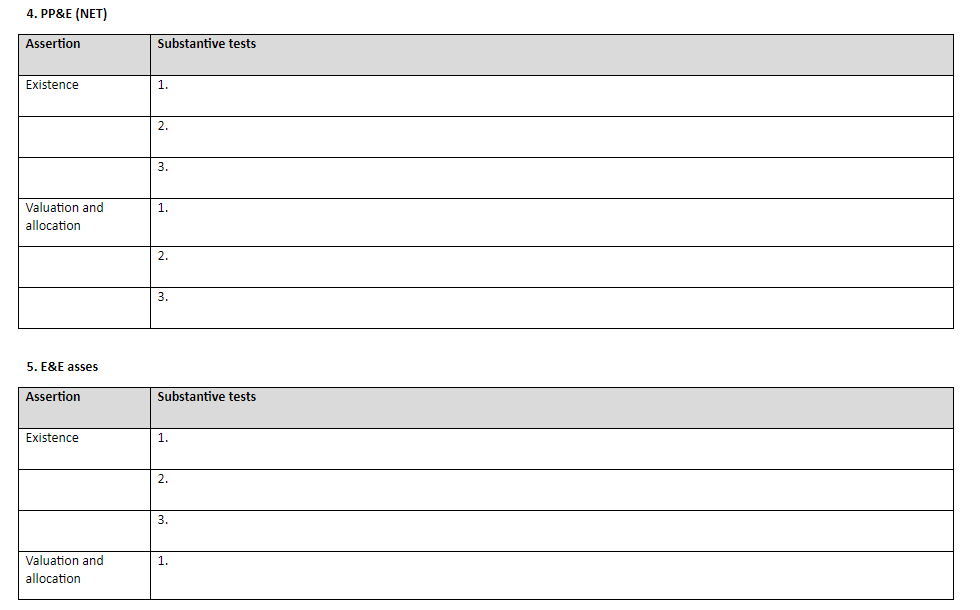

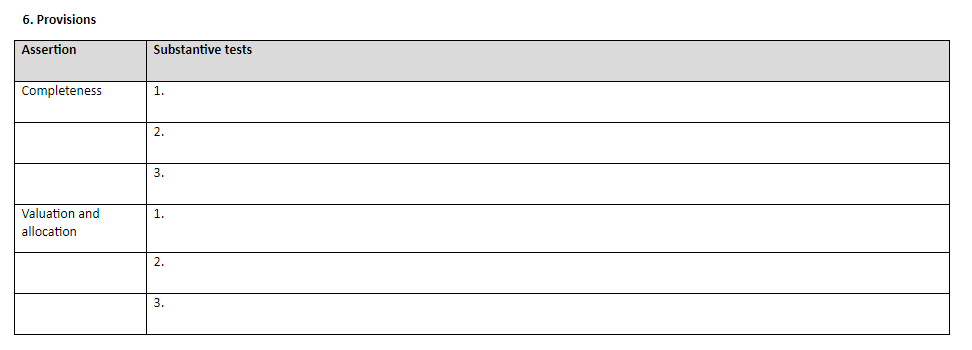

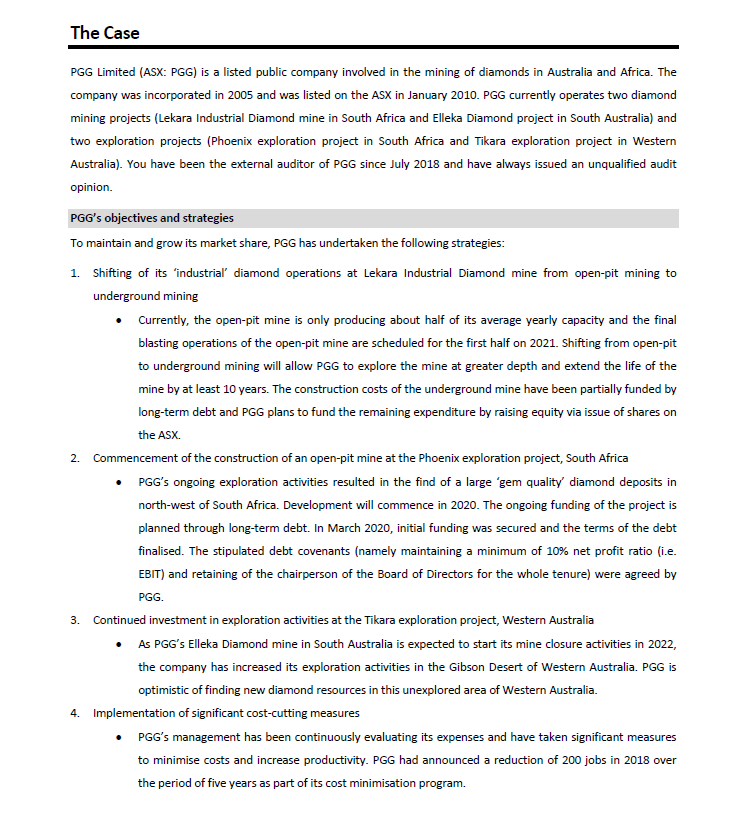

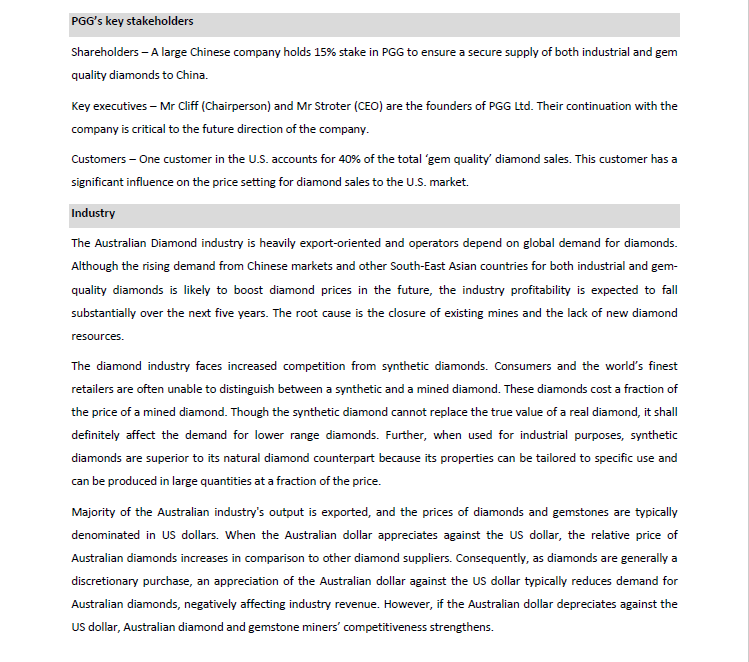

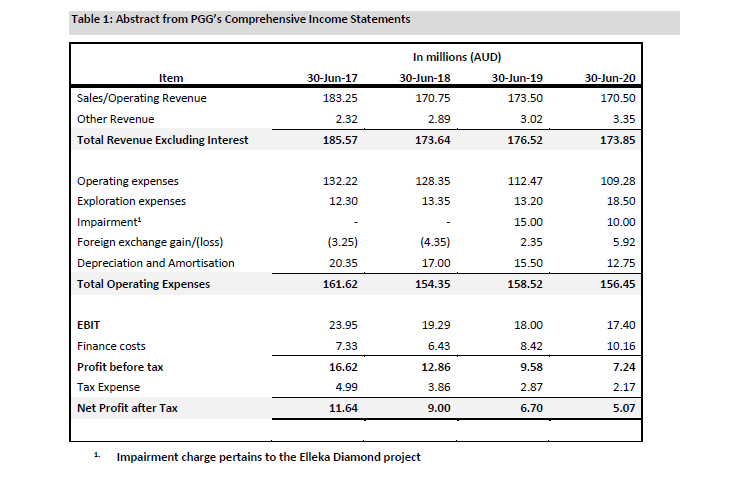

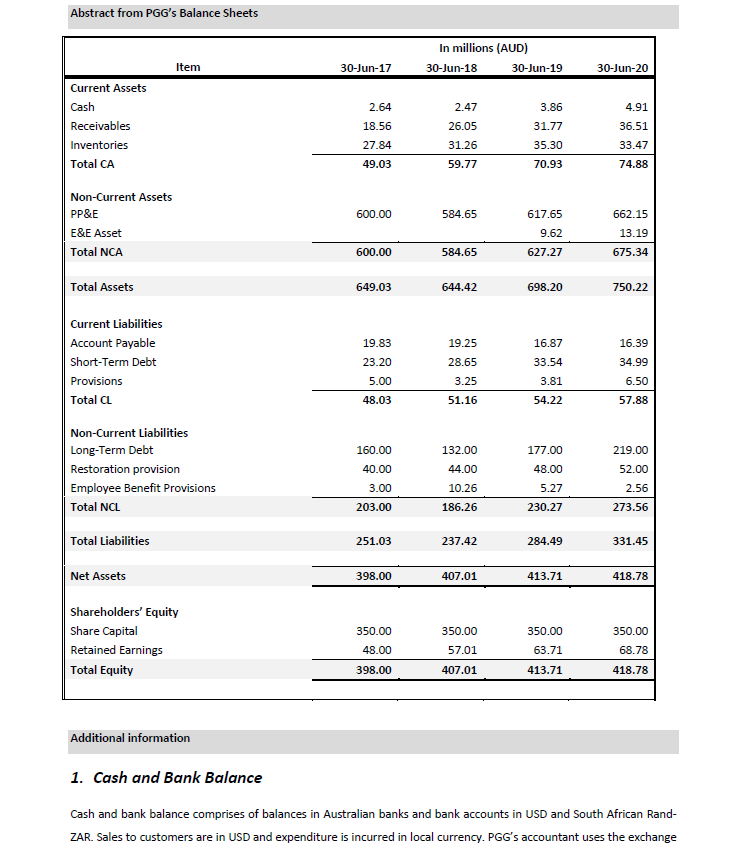

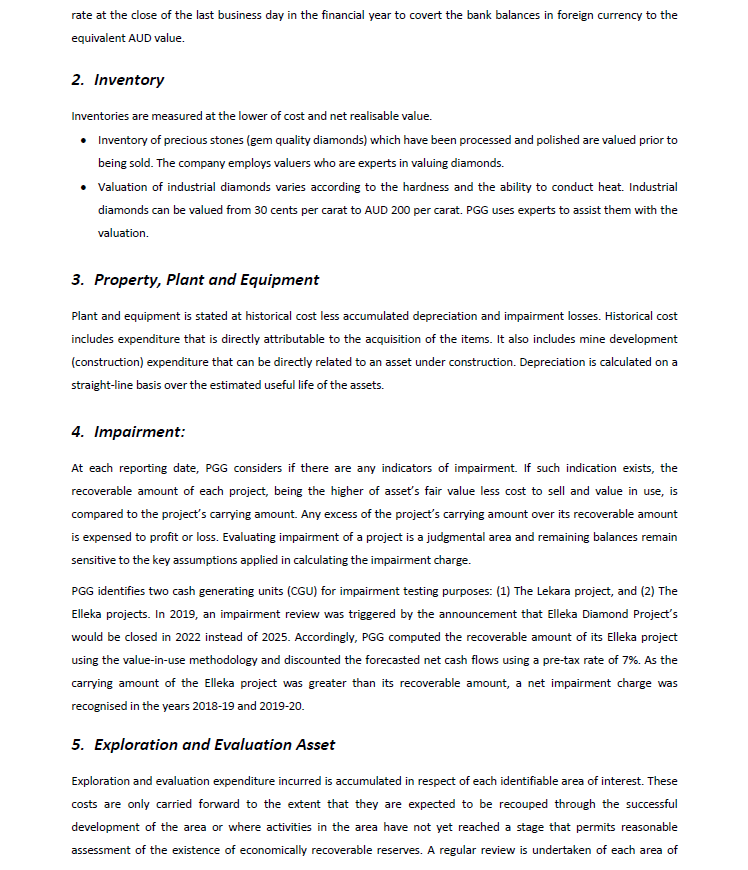

4. PP&E (NET) Assertion Substantive tests Existence 1. 2. 3. 1. Valuation and allocation 2 3. 5. E&E asses Assertion Substantive tests Existence 1. 2. 3. 1. Valuation and allocation 6. Provisions Assertion Substantive tests Completeness 1. 2. 3. 1. Valuation and allocation 2. 3. The Case PGG Limited (ASX: PGG) is a listed public company involved in the mining of diamonds in Australia and Africa. The company was incorporated in 2005 and was listed on the ASX in January 2010. PGG currently operates two diamond mining projects (Lekara Industrial Diamond mine in South Africa and Elleka Diamond project in South Australia) and two exploration projects (Phoenix exploration project in South Africa and Tikara exploration project in Western Australia). You have been the external auditor of PGG since July 2018 and have always issued an unqualified audit opinion. PGG's objectives and strategies To maintain and grow its market share, PGG has undertaken the following strategies: 1. Shifting of its 'industrial diamond operations at Lekara Industrial Diamond mine from open-pit mining to underground mining Currently, the open-pit mine is only producing about half of its average yearly capacity and the final blasting operations of the open-pit mine are scheduled for the first half on 2021. Shifting from open-pit to underground mining will allow PGG to explore the mine at greater depth and extend the life of the mine by at least 10 years. The construction costs of the underground mine have been partially funded by long-term debt and PGG plans to fund the remaining expenditure by raising equity via issue of shares on the ASX. 2. Commencement of the construction of an open-pit mine at the Phoenix exploration project, South Africa PGG's ongoing exploration activities resulted in the find of a large 'gem quality diamond deposits in north-west of South Africa. Development will commence in 2020. The ongoing funding of the project is planned through long-term debt. In March 2020, initial funding was secured and the terms of the debt finalised. The stipulated debt covenants (namely maintaining a minimum of 10% net profit ratio (i.e. EBIT) and retaining of the chairperson of the Board of Directors for the whole tenure) were agreed by PGG. 3. Continued investment in exploration activities at the Tikara exploration project, Western Australia As PGG's Elleka Diamond mine in South Australia is expected to start its mine closure activities in 2022, the company has increased its exploration activities in the Gibson Desert of Western Australia. PGG is optimistic of finding new diamond resources in this unexplored area of Western Australia. 4. Implementation of significant cost-cutting measures PGG's management has been continuously evaluating its expenses and have taken significant measures to minimise costs and increase productivity. PGG had announced a reduction of 200 jobs in 2018 over the period of five years as part of its cost minimisation program. PGG's key stakeholders Shareholders - A large Chinese company holds 15% stake in PGG to ensure a secure supply of both industrial and gem quality diamonds to China. Key executives Mr Cliff (Chairperson) and Mr Stroter (CEO) are the founders of PGG Ltd. Their continuation with the company is critical to the future direction of the company. Customers - One customer in the U.S. accounts for 40% of the total 'gem quality diamond sales. This customer has a significant influence on the price setting for diamond sales to the U.S. market. Industry The Australian Diamond industry is heavily export-oriented and operators depend on global demand for diamonds. Although the rising demand from Chinese markets and other South-East Asian countries for both industrial and gem- quality diamonds is likely to boost diamond prices in the future, the industry profitability is expected to fall substantially over the next five years. The root cause is the closure of existing mines and the lack of new diamond resources. The diamond industry faces increased competition from synthetic diamonds. Consumers and the world's finest retailers are often unable to distinguish between a synthetic and a mined diamond. These diamonds cost a fraction of the price of a mined diamond. Though the synthetic diamond cannot replace the true value of a real diamond, it shall definitely affect the demand for lower range diamonds. Further, when used for industrial purposes, synthetic diamonds are superior to its natural diamond counterpart because its properties can be tailored to specific use and can be produced in large quantities at a fraction of the price. Majority of the Australian industry's output is exported, and the prices of diamonds and gemstones are typically denominated in US dollars. When the Australian dollar appreciates against the US dollar, the relative price of Australian diamonds increases in comparison to other diamond suppliers. Consequently, as diamonds are generally a discretionary purchase, an appreciation of the Australian dollar against the US dollar typically reduces demand for Australian diamonds, negatively affecting industry revenue. However, if the Australian dollar depreciates against the US dollar, Australian diamond and gemstone miners' competitiveness strengthens. Table 1: Abstract from PGG's Comprehensive Income Statements In millions (AUD) 30-Jun-18 30-Jun-19 30-Jun-17 30-Jun-20 183.25 170.75 173.50 170.50 Item Sales/Operating Revenue Other Revenue Total Revenue Excluding Interest 2.32 2.89 3.02 3.35 185.57 173.64 176.52 173.85 132.22 128.35 112.47 109.28 12.30 13.35 13.20 18.50 15.00 10.00 Operating expenses Exploration expenses Impairment Foreign exchange gain/(loss) Depreciation and Amortisation Total Operating Expenses (3.25) (4.35) 2.35 5.92 20.35 17.00 15.50 12.75 161.62 154.35 158.52 156.45 23.95 19.29 18.00 17.40 7.33 6.43 8.42 10.16 EBIT Finance costs Profit before tax Tax Expense Net Profit after Tax 16.62 12.86 9.58 7.24 4.99 3.86 2.87 2.17 11.64 9.00 6.70 5.07 Impairment charge pertains to the Elleka Diamond project Abstract from PGG's Balance Sheets In millions (AUD) 30-Jun-18 30-Jun-19 Item 30-Jun-17 30-Jun-20 2.64 2.47 3.86 4.91 Current Assets Cash Receivables Inventories Total CA 18.56 31.77 36.51 26.05 31.26 35.30 33.47 27.84 49.03 59.77 70.93 74.88 600.00 584.65 662.15 Non-Current Assets PP&E E&E Asset Total NCA 617.65 9.62 13.19 600.00 584.65 627.27 675.34 Total Assets 649.03 644.42 698.20 750.22 16.39 Current Liabilities Account Payable Short-Term Debt Provisions Total a 19.25 28.65 19.83 23.20 5.00 48.03 16.87 33.54 3.81 34.99 6.50 3.25 51.16 54.22 57.88 160.00 132.00 177.00 219.00 Non-Current Liabilities Long-Term Debt Restoration provision Employee Benefit Provisions Total NCL 48.00 52.00 40.00 3.00 203.00 44.00 10.26 186.26 5.27 230.27 2.56 273.56 Total Liabilities 251.03 237.42 284.49 331.45 Net Assets 398.00 407.01 413.71 418.78 350.00 350.00 Shareholders' Equity Share Capital Retained Earnings Total Equity 350.00 48.00 350.00 68.78 57.01 63.71 398.00 407.01 413.71 418.78 Additional information 1. Cash and Bank Balance Cash and bank balance comprises of balances in Australian banks and bank accounts in USD and South African Rand- ZAR. Sales to customers are in USD and expenditure is incurred in local currency. PGG's accountant uses the exchange rate at the close of the last business day in the financial year to covert the bank balances in foreign currency to the equivalent AUD value. 2. Inventory Inventories are measured at the lower of cost and net realisable value. Inventory of precious stones (gem quality diamonds) which have been processed and polished are valued prior to being sold. The company employs valuers who are experts in valuing diamonds. Valuation of industrial diamonds varies according to the hardness and the ability to conduct heat. Industrial diamonds can be valued from 30 cents per carat to AUD 200 per carat. PGG uses experts to assist them with the valuation. 3. Property, plant and Equipment Plant and equipment is stated at historical cost less accumulated depreciation and impairment losses. Historical cost includes expenditure that is directly attributable to the acquisition of the items. It also includes mine development (construction) expenditure that can be directly related to an asset under construction. Depreciation is calculated on a straight-line basis over the estimated useful life of the assets. 4. Impairment: At each reporting date, PGG considers if there are any indicators of impairment. If such indication exists, the recoverable amount of each project, being the higher of asset's fair value less cost to sell and value in use, is compared to the project's carrying amount. Any excess of the project's carrying amount over its recoverable amount is expensed to profit or loss. Evaluating impairment of a project is a judgmental area and remaining balances remain sensitive to the key assumptions applied in calculating the impairment charge. PGG identifies two cash generating units (CGU) for impairment testing purposes: (1) The Lekara project, and (2) The Elleka projects. In 2019, an impairment review was triggered by the announcement that Elleka Diamond Project's would be closed in 2022 instead of 2025. Accordingly, PGG computed the recoverable amount of its Elleka project using the value-in-use methodology and discounted the forecasted net cash flows using a pre-tax rate of 7%. As the carrying amount of the Elleka project was greater than its recoverable amount, a net impairment charge was recognised in the years 2018-19 and 2019-20. 5. Exploration and Evaluation Asset Exploration and evaluation expenditure incurred is accumulated in respect of each identifiable area of interest. These costs are only carried forward to the extent that they are expected to be recouped through the successful development of the area or where activities in the area have not yet reached a stage that permits reasonable assessment of the existence of economically recoverable reserves. A regular review is undertaken of each area of interest to determine the appropriateness of continuing to carry forward costs in relation to that area of interest. PGG has capitalised all exploration and evaluation expenses incurred subsequent to the feasibility study of the Phoenix Exploration Project in 2018. Once development of the mine commences, these expenses will be transferred to PPE. 6. Interest bearing loans and borrowings Short term loans are taken from regional banks in local currency (AUD and ZAR) and the long term loans are in USD. All loans in foreign currencies are converted by PGG's accountant into AUD using the spot rate at the close of the last business day in the financial year. Short term loans are taken to meet working capital requirements. The long term loans are secured with a floating charge over the assets of the company and a personal guarantee by the chairperson of the Board of Directors. Accrued interest on each loan is also converted into AUD and is included in total accounts payable for the year. 7. Accounts payables Besides accrued interest on loans, accounts payables represent liabilities for goods acquired during the financial year which are unpaid. PGG makes all its purchases from a few selected suppliers and the payments are made in local currency. The amounts are unsecured and are generally settled on 30 day terms. PGG's accountant uses the exchange rate at the close of the last business day in the financial year to convert the accounts payable balance in ZAR to the equivalent AUD at the year end. The difference is accounted as foreign exchange gain or loss in the financial statements. 8. Employee Benefits provision The liability for long service leave is recognised in the provision for employee benefits and measured as the present value of expected future payments to be made in respect of services provided by employees up to the reporting date. It also includes provision for redundancy payments. PGG recognises a provision for termination when it has developed a detailed formal plan for the terminations and has informed those employees affected that it will carry out the terminations 9. Restoration provision Mine closure and restoration costs include the costs of dismantling and demolition of infrastructure or decommissioning, the removal of residual material and the remediation of disturbed areas specific to the infrastructure. The rehabilitation costs, provided for are the present value of the estimated costs to restore operating locations. The value of the provision represents the discounted value of the current estimate to restore and the discount rate used is the pre-tax rate that reflects the current market assessments of the time value of money and the risks specific to the liability. Significant uncertainty exists as to the amount of rehabilitation obligations which will be incurred due to the impact of changes in environmental legislation. At each reporting date the rehabilitation liability is re-measured in line with changes in discount rates, and timing or amount of the costs to be incurred. 10. Current Provisions Amount due to suppliers for services provided to PGG prior to 30 June and employee liabilities (wages and salaries, annual leave and accumulating sick leave) which are expected to be settled within 12 months of the reporting date are recognised in current provisions. 11.Sales/Operating Revenue and Accounts receivable Revenue from sale is recognised when risk and reward of ownership is passed which is when the title of a product passes from PGG pursuant to an enforceable contract, when selling prices are known or can be reasonable estimated. All sales are on credit and made in USD. Industrial diamonds are sold to a few large companies in the U.S. PGG has contracts entered with each company for a set quantity of diamonds. Prices are determined at the time of sale and depend on the strength of diamonds produced. All sales are in USD. Amounts outstanding are generally recovered within 90 days of invoicing and the collectability of unpaid amounts is assessed at the reporting date to determine whether a provision for doubtful debts is required. Bad debts are written off as incurred. Credit risk is managed centrally based on the continuing relationship existing with accounts receivable. Precious gems for jewellery are sold mostly to retailers in the U.S., China and India. Sales are generally made at a maximum of 30-day credit. For some trade receivables the company obtains security in the form of guarantees or letters of credit which can be called upon if the counterparty is in default under the terms of the agreement. Collectability of debtors is reviewed on an ongoing basis. Receivables which are known to be uncollectible are written off. An allowance for doubtful debts is raised when collection is questioned