Answered step by step

Verified Expert Solution

Question

1 Approved Answer

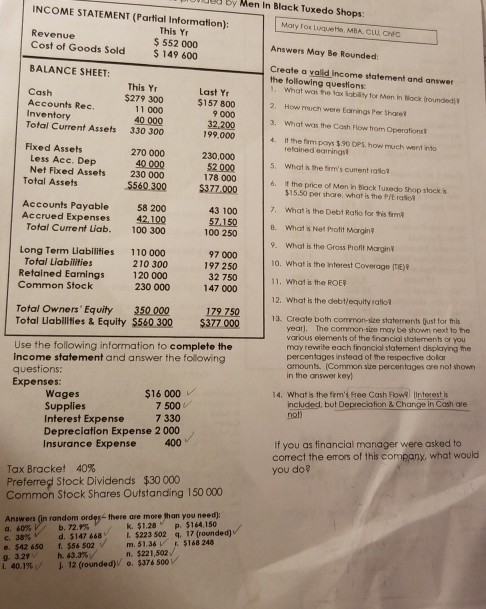

how to get #14 : what is the firm's free cash flow? (intrest is included, but depreciation & change in cash are not ) uil

how to get #14 : what is the firm's free cash flow? (intrest is included, but depreciation & change in cash are not )

uil by Men In Black Tuxedo Shops: INCOME STATEMENT (Partial Information): Revenue Cost of Goods Sold 149 600 BALANCE SHEET: Mary Fox Luqueno MBA. CLU, CHIC This Yr $552 000 Answers May Be Rounded: Create a valid income statement and answer the following questions . what was the tax sabilty for Men In Black troundedj This Yr Last Yr $279 300 11 000 $157 800 9 000 2. How much were Earmings Per Share 3. What was the Cash Flow trom Operations 4. It the fiam pays $.90 DPS, how much went into Accounts Rec. Inventory Total Current Assets 330 300 99,000 tetained eatringst 5. What & the fim's cuent raso 6. If the price of Men in Black Tusedo Shop stock s Fixed Assets 270 000 230,000 52 000 178 000 $377.000 Less Acc. Dep 40 000 230 000 Net Fixed Assets Total Assets 5560 300 $15.50 per share, what is the P/E rasol 7. What is the Debt Ratio for this frm B. What s Net Protit Margin 9. What is the Gross Profit Margin 10, what is the interest coverage ITE) 11. What is the ROER 12. What is the debt/equity ratioR 13. Create both common-size statements just for his Accounts Payable Accrued Expenses Total Current Liab. 58 200 42100 100 300 100 250 97 000 197 250 32 750 147 000 Long Term Liabilities 110 000 Total Liabilities Retained Earnings Common Stock 210 300 120 000 230 000 179 750 $377 000 350 000 Total Liabilies & Equity $560 300 Total Owners' Equity year. The common-size may be shown rext to the various elements the fron cial shalements or you may rewrite each financial statement dsplaying the percentages instead of the respective dolar amounts. (Common size percentages are not shown in the answer key Use the following information to complete the income statement and answer the following questions: Expenses $16 000 7500. 7 330 14. What is the firm's Free Cash Flowe Unterest s incuded, but Depreciafion& Change in Cash are nal) Supplies Interest Expense Depreciation Expense 2 000 Insurance Expense 400 If you as financial manager were asked to correct the errors of this company, what would you do? 40% Tax Bracket Preferred Stock Dividends $30 000 Common Stock Shares Outstanding 150 000 Answers (in random orde- there are more than you need) k. $1.28p. $164,150 L $223 502 q. 17 (rounded) m. 51.36 V $168 248 n. $221,502 d. $147 468 e. $42 65o f $56 502 g. 329 l. 40.1%./ j. 12 (rounded) o. S376 500V h. 63.3%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started