Answered step by step

Verified Expert Solution

Question

1 Approved Answer

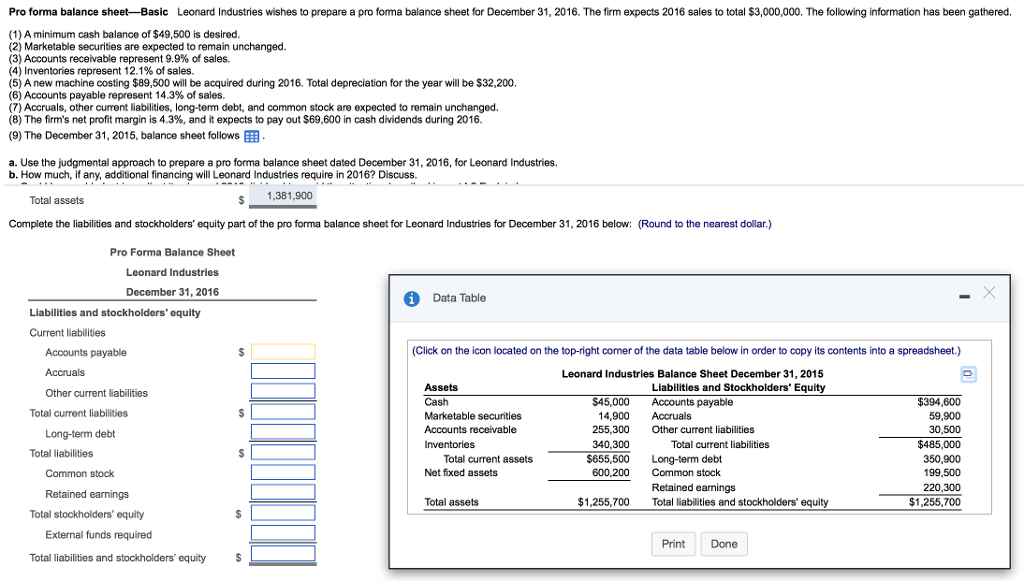

How to get the answers to the blanks? Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31,

How to get the answers to the blanks?

Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2016. The firm expects 2016 sales to total $3,000,000. The following information has been gathered (1) A minimum cash balance of $49,500 is desired (2) Marketable securities are expected to remain unchanged (3) Accounts receivable represent 9.9% of sales. (4) Inventories represent 12.1% of sales. (5) A new machine costing $89,500 will be acquired during 2016. Total depreciation for the year will be $32,200. (6) Accounts payable represent 14.3% of sales. (7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged. (8) The firm's net profit margin is 4.3%, and it expects to pay out $69,600 in cash dividends during 2016. (9) The December 31, 2015, balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2016, for Leonard Industries. b. How much, if any, additional financing will Leonard Industries require in 2016? Discuss. 1,381,900 Total assets Complete the liabilities and stockholders' equity part of the pro forma balance sheet for Leonard Industries for December 31, 2016 below: (Round to the nearest dollar.) Pro Forma Balance Sheet Leonard Industries December 31, 2016 Data Table Liabilities and stockholders' equity Current liabilities (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Accounts payable Accruals Other current liabilities Leonard Industries Balance Sheet December 31, 2015 Liabilities and Stockholders' Equity Assets Cash Marketable securities Accounts receivable $394,600 59,900 30,500 $485,000 350,900 199,500 220,300 $1,255,700 S45,000 Accounts payable Total current liabilities Long-term debt Total liabilities 14,900 Accruals 255,300 Other current liabilities 340,300 Total current liabilities Total current assets 5655.500Long-term debt Common stock Net fixed assets 600,200 Common stock Retained earnings Total liabilities and stockholders' equity Retained earnings Total assets $1,255,700 Total stockholders' equity External funds required Print Done Total liabilities and stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started