Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to get the employment taxes? Superior Markets, Inc., operates three stores in a large metropolitan area. A segmented absorption costing income statement for the

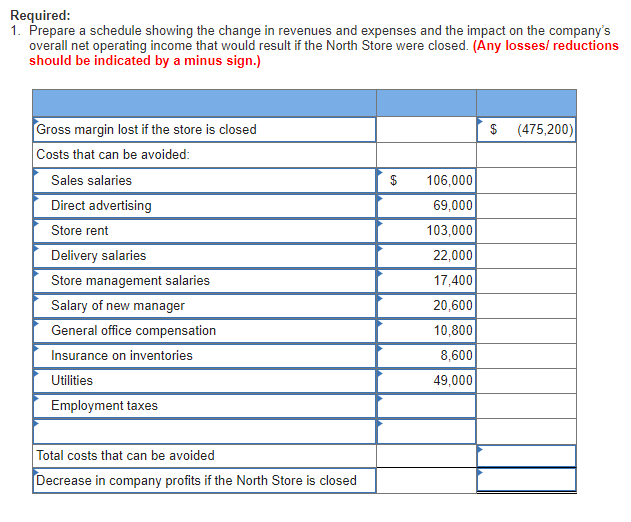

How to get the employment taxes?

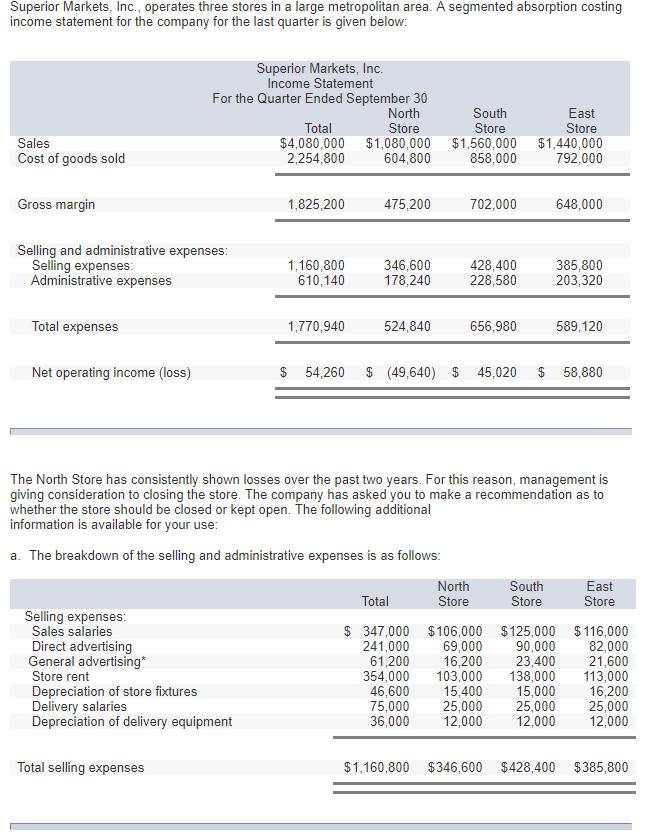

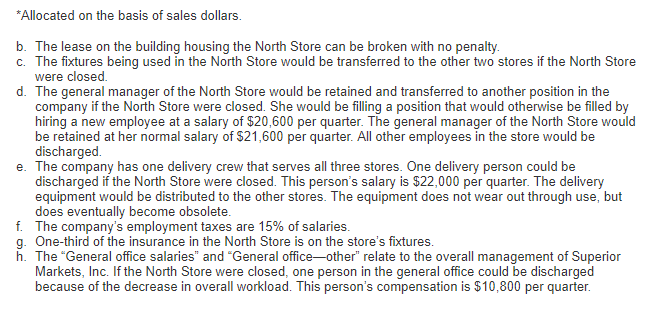

Superior Markets, Inc., operates three stores in a large metropolitan area. A segmented absorption costing income statement for the company for the last quarter is given below: Superior Markets, Inc. Income Statement For the Quarter Ended September 30 Total 2,254,800 North Store South Store East Store Sales Cost of goods sold $4,080,000 $1,080,000 $1,560,000 $1,440,000 604,800 858,000 792,000 Gross margin 1, 825,200 475,200 702,000 648,000 Seling and administrative expenses Selling expenses Administrative expenses 1,160,800 610,140 346,600 178,240 428,400 228,580 385,800 203,320 Total expenses 1,770,940 524,840 656,980 589,120 Net operating income (loss) S 54,260 (49,640) 45,020 S 58,880 The North Store has consistently shown losses over the past two years. For this reason, management is giving consideration to closing the store. The company has asked you to make a recommendation as to whether the store should be closed or kept open. The following additional information is available for your use a. The breakdown of the selling and administrative expenses is as follows North Store South Store as Total Store Selling expenses Sales salaries Direct advertising General advertising* Store rent Depreciation of store fixtures Delivery salaries Depreciation of delivery equipment $ 347,000 $106,000 $125,000 $116,000 82,000 23,400 21,600 354,000 103,000 138,000 113,000 16,200 25,000 69,000 16,200 241,000 90,000 61,200 46,600 75,000 36,000 2,000 ,000 12,000 15,400 25,000 15,000 25,000 Total selling expenses $1,160,800 $346,600 $428,400 $385,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started