Answered step by step

Verified Expert Solution

Question

1 Approved Answer

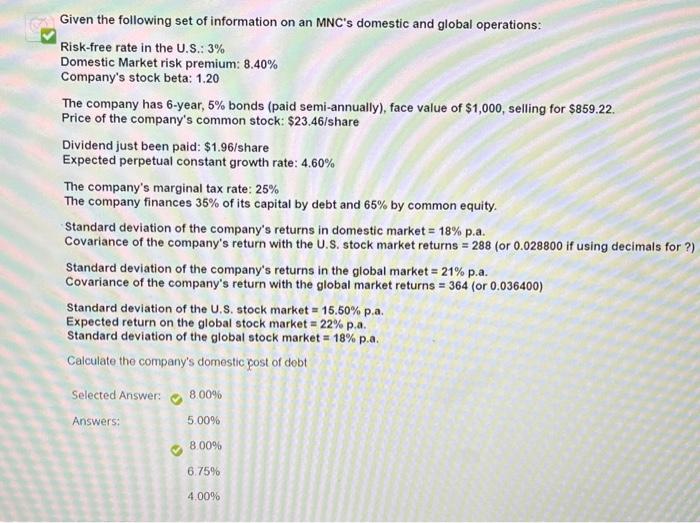

How to get these answers please! Given the following set of information on an MNC's domestic and global operations: Risk-free rate in the U.S.: 3%

How to get these answers please!

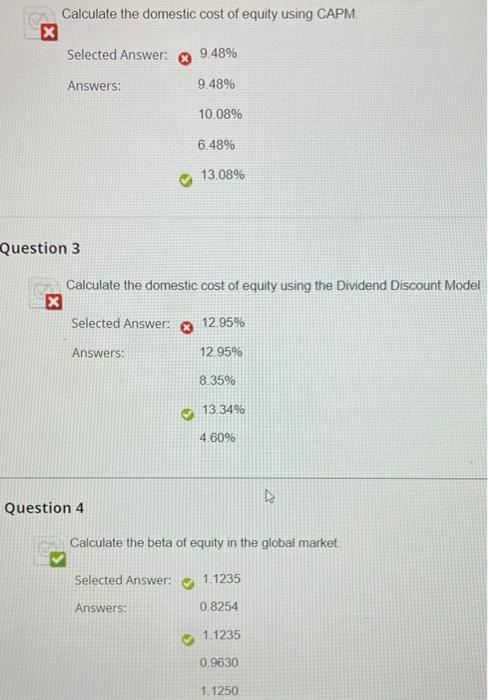

Given the following set of information on an MNC's domestic and global operations: Risk-free rate in the U.S.: 3% Domestic Market risk premium: 8.40% Company's stock beta: 1.20 The company has 6-year, 5% bonds (paid semi-annually), face value of $1,000, selling for $859.22. Price of the company's common stock: $23.46 /share Dividend just been paid: $1.96/ share Expected perpetual constant growth rate: 4.60% The company's marginal tax rate: 25% The company finances 35% of its capital by debt and 65% by common equity. Standard deviation of the company's returns in domestic market =18% p.a. Covariance of the company's return with the U.S. stock market returns =288 (or 0.028800 if using decimals for ?) Standard deviation of the company's returns in the global market =21% p.a. Covariance of the company's return with the global market returns =364 (or 0.036400 ) Standard deviation of the U.S. stock market =15.50% p.a. Expected return on the global stock market =22% p.a. Standard deviation of the global stock market =18% p.a. Calculate the company's domestic post of dobt Selected Answer: 800% Answers: 5.00% 800% 6.75% 4.00% Calculate the domestic cost of equity using CAPM. x Selected Answer: Answers: 9.48%9.48%10.08%6.48%13.08% uestion 3 Calculate the domestic cost of equity using the Dividend Discount Model Selected Answer: 812.95%12.95%8.35%13.34%4.60% Answers:1295% Question 4 Calculate the beta of equity in the global market. Selected Answer: 1.1235 Answers: 0.8254 1. 1235 0.9630 1.1250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started