Answered step by step

Verified Expert Solution

Question

1 Approved Answer

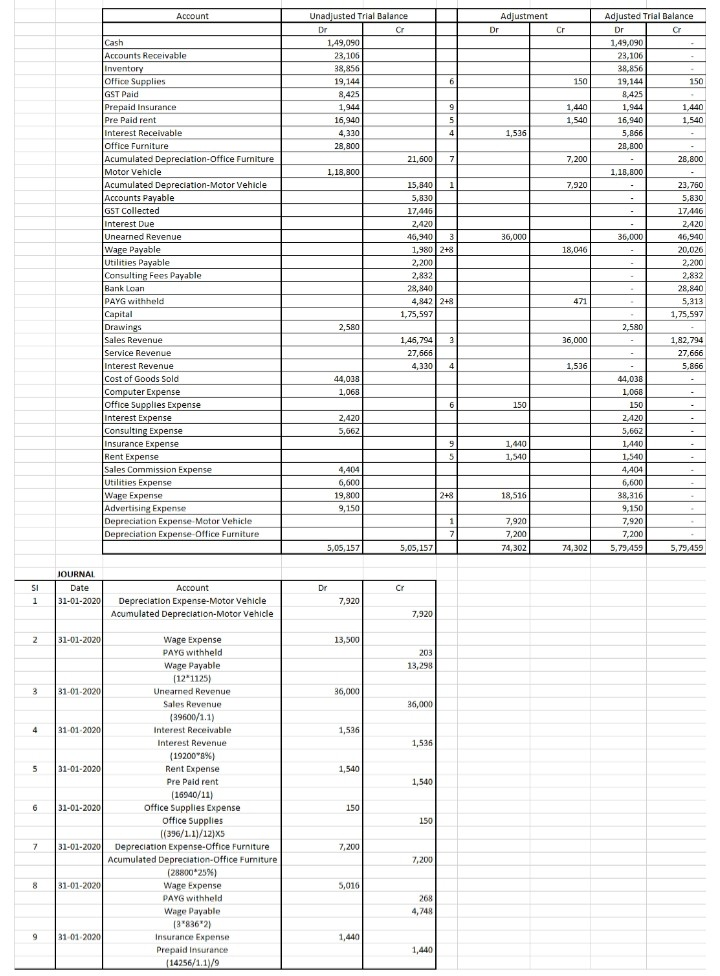

How to put the following information in to a General Ledger. Account Adjustment Dr Cr 150 1,440 1.540 1,536 Adjusted Trial Balance Dr Or 1,49,090

How to put the following information in to a General Ledger.

Account Adjustment Dr Cr 150 1,440 1.540 1,536 Adjusted Trial Balance Dr Or 1,49,090 23,106 38,856 19,144 150 8,425 1,944 1.440 16,940 1.540 5,866 20,800 28.800 1,10,BOO 23.760 5.830 17,446 2,420 36,000 46,940 20,026 2,200 2,832 7,200 7.920 Unadjusted Trial Balance Dr Cr 1,49,090 23,106 38,856 19,144 6 8,425 1,944 9 9 16,940 5 4,330 4 28,800 21,600 7 1,18,300 15,840 1 5,830 17,445 2,420 46,940 3 1,980 248 2,200 2,832 28,840 4,8422+8 1,75,597 2,580 1,45,794 3 27,665 4,330 4 44,038 1,068 36,000 Cash Accounts Receivable Inventory office Supplies GST Paid Prepaid Insurance Pre Paid rent Interest Receivable Office Furniture Acumulated Depreciation Office Furniture Motor Vehicle Acumulated Depreciation-Motor Vehicle Accounts Payable GST Collected Interest Due Unearned Revenue Wage Payable Utilities Payable Consulting Fees Payable Bank Loan PAYG withheld Capital Drawings Sales Revenue Service Revenue Interest Revenue Cost of Goods Sold Computer Expense Office Supplies Expense Interest Expense Consulting Expense Insurance Expense Rent Expense Sales Commission Expense Utilities Expense Wape Expense Advertising Expense Depreciation Expense. Motor Vehicle Depreciation Expense-Office Furniture 18,046 28,840 471 5,313 1,75,597 2,580 36,000 1,82,794 27,666 5,866 1,536 6 150 2,420 5,662 9 5 1,440 1,540 4,404 6,600 19,800 9,150 44,038 1,068 150 2,420 5,662 1.440 1,540 4,404 6,600 38,316 9,150 7,920 7,200 5,79,459 2+8 18,516 1 7 7,920 7,200 74,302 5,05,157 5,05,157 74,302 5,79,459 JOURNAL Date 31-01-2020 SI 1 Dr Account Depreciation Expense-Motor Vehicle Acumulated Depreciation-Motor Vehicle 7,920 7,920 z 13,500 203 13,298 3 36,000 36,000 4 1,536 1,536 5 1,540 1,540 31-01-2020 Wage Expense PAYG withheld Wage Payable (121125) 31-01-2020 Uneared Revenue Sales Revenue (39600/1.1) 31-01-2020 Interest Receivable Interest Revenue (19200 8%) 31-01-2020 Rent Expense Pre Paid rent (16940/11) 31-01-2020 Office Supplies Expense Office Supplies (396/1.1)/12)KS 31-01-2020 Depreciation Expense-Office Furniture Acumulated Depreciation Office Furniture (28800*25%) 31-01-2020 Wage Expense PAYG withheld Wage Payable (39836*2) 31-01-2020 Insurance Expense Prepaid Insurance (14256/1.1/9 6 150 150 7 7,200 7,200 5,016 268 4,748 9 1,440 1,440

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started