How to record the following?

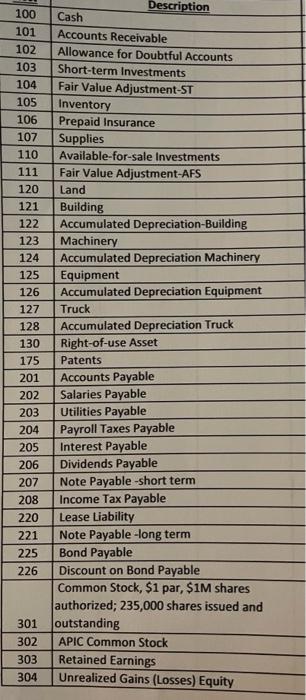

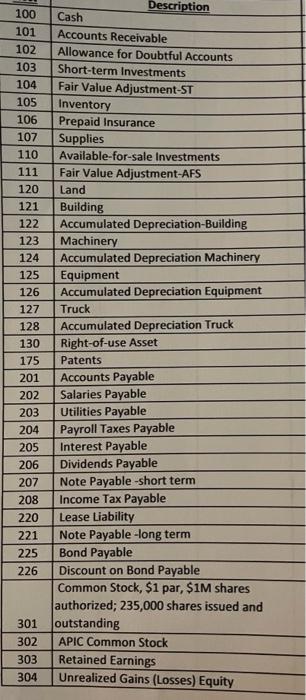

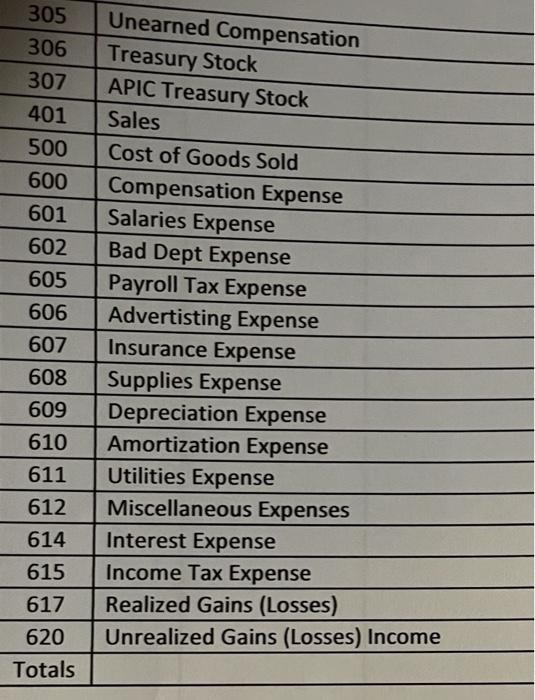

use these account names:

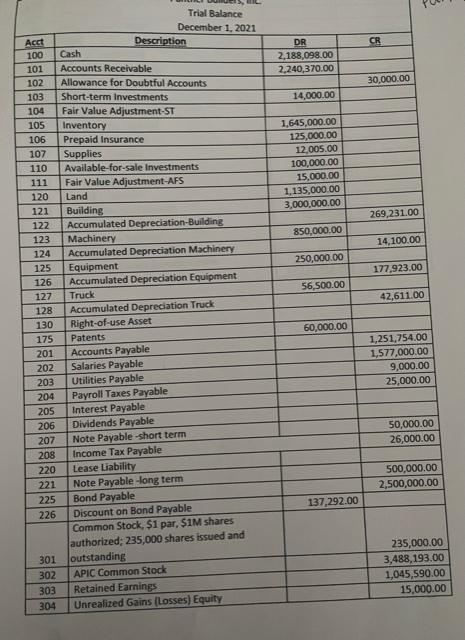

ajusted journal debt entries should equal $1,136,230.

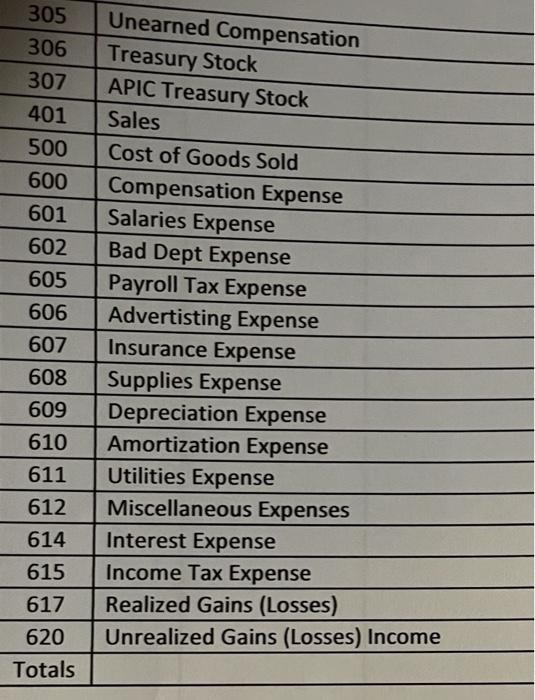

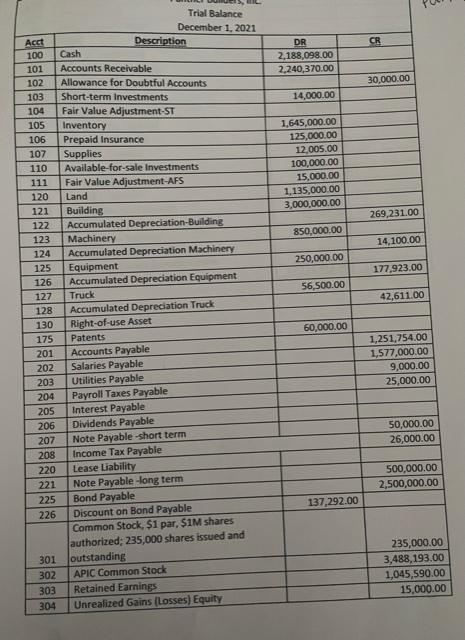

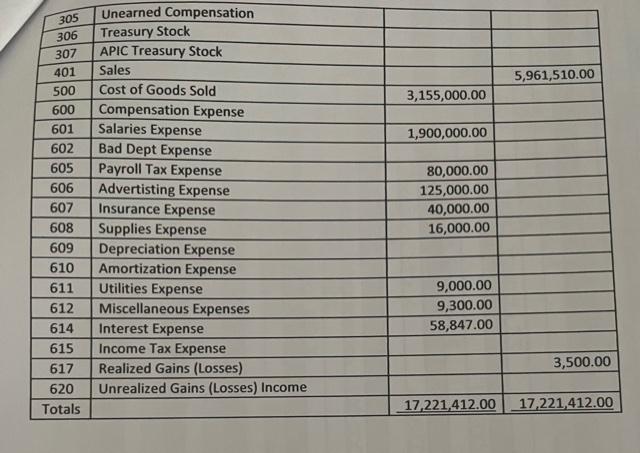

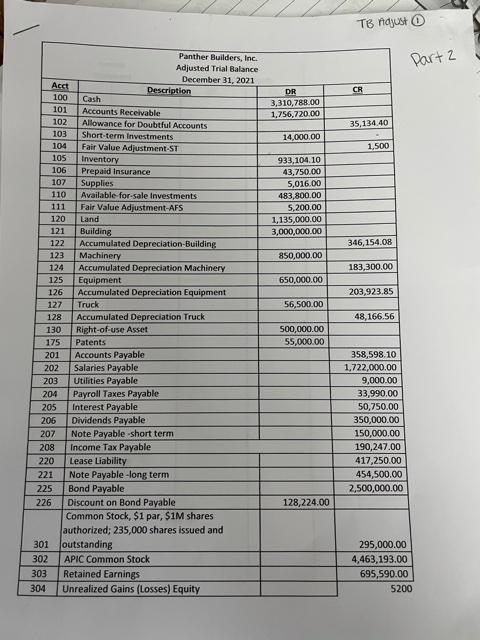

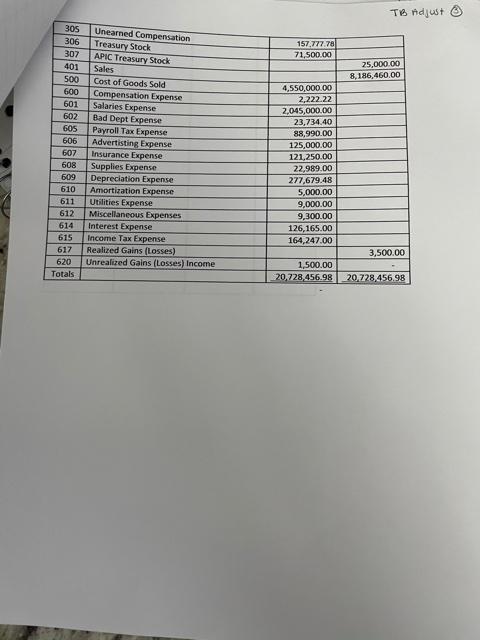

Trail Balance:

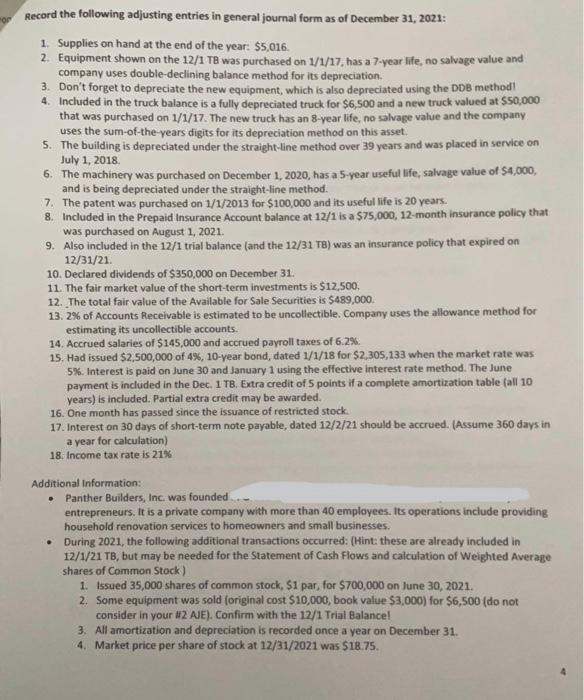

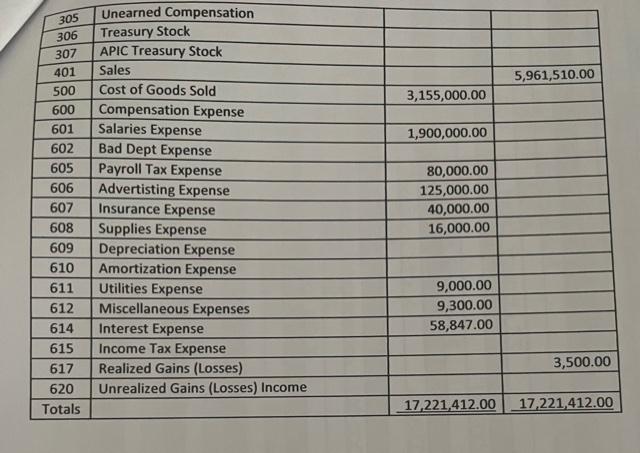

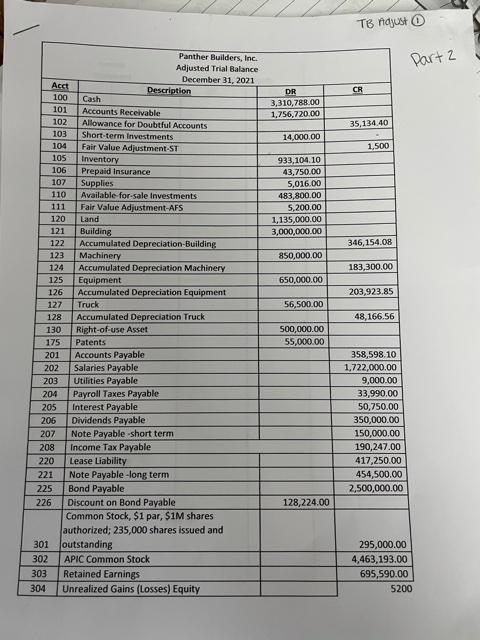

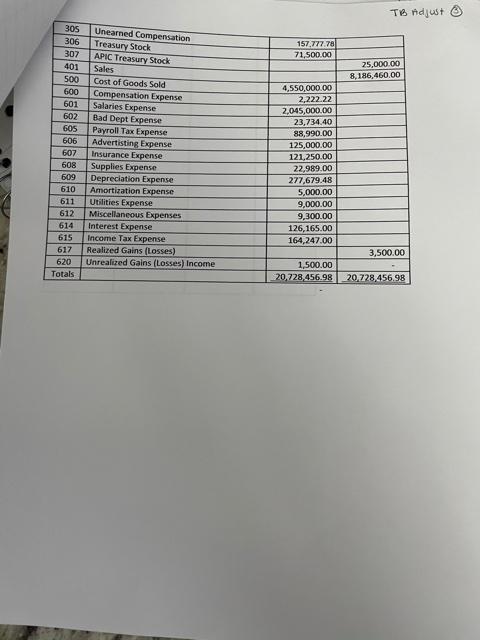

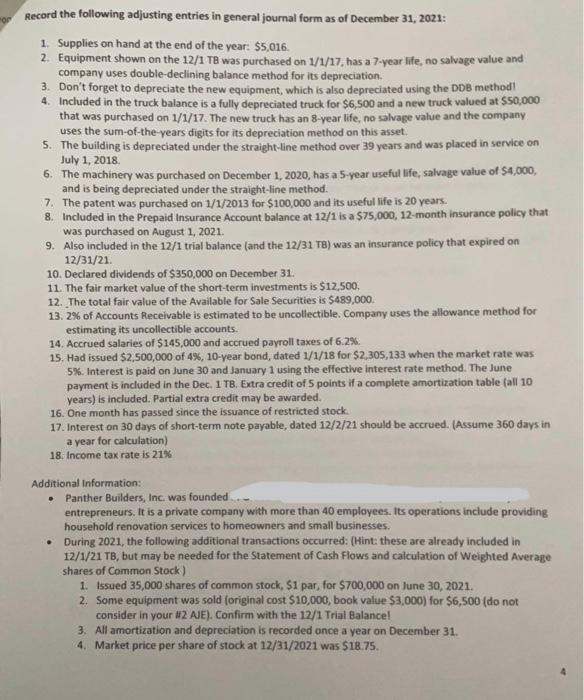

Record the following adjusting entries in general journal form as of December 31, 2021: 1. Supplies on hand at the end of the year: $5,016. 2. Equipment shown on the 12/1 Te was purchased on 1/1/17, has a 7-year life, no salvage value and company uses double-declining balance method for its depreciation. 3. Don't forget to depreciate the new equipment, which is also depreciated using the DDB method! 4. Included in the truck balance is a fully depreciated truck for $6,500 and a new truck valued at $50,000 that was purchased on 1/1/17. The new truck has an 8-year life, no salvage value and the company uses the sum-of-the-years digits for its depreciation method on this asset 5. The building is depreciated under the straight-line method over 39 years and was placed in service on July 1, 2018 6. The machinery was purchased on December 1, 2020, has a 5-year useful life, salvage value of $4,000, and is being depreciated under the straight-line method. 7. The patent was purchased on 1/1/2013 for $100,000 and its useful life is 20 years. 8. Included in the Prepaid Insurance Account balance at 12/1 is a $75,000, 12-month insurance policy that was purchased on August 1, 2021. 9. Also included in the 12/1 trial balance (and the 12/31 TB) was an insurance policy that expired on 12/31/21 10. Declared dividends of $350,000 on December 31. 11. The fair market value of the short-term investments is $12,500. 12. The total fair value of the Available for Sale Securities is $489,000. 13.2% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating its uncollectible accounts. 14. Accrued salaries of $145,000 and accrued payroll taxes of 6.2% 15. Had issued $2,500,000 of 4%, 10-year bond, dated 1/1/18 for $2,305,133 when the market rate was 5%. Interest is paid on June 30 and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. Extra credit of 5 points if a complete amortization table (all 10 years) is included. Partial extra credit may be awarded. 16. One month has passed since the issuance of restricted stock. 17. Interest on 30 days of short-term note payable, dated 12/2/21 should be accrued. (Assume 360 days in a year for calculation) 18. Income tax rate is 21% Additional Information: Panther Builders, Inc. was founded entrepreneurs. It is a private company with more than 40 employees. Its operations include providing household renovation services to homeowners and small businesses. . During 2021, the following additional transactions occurred: (Hint: these are already included in 12/1/21 TB, but may be needed for the Statement of Cash Flows and calculation of weighted Average shares of Common Stock) 1. Issued 35,000 shares of common stock, S1 par, for $700,000 on June 30, 2021. 2. Some equipment was sold (original cost $10,000, book value $3,000) for $6,500 (do not consider in your #2 AJE). Confirm with the 12/1 Trial Balance! 3. All amortization and depreciation is recorded once a year on December 31. 4. Market price per share of stock at 12/31/2021 was $18.75. 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 206 207 208 220 221 225 226 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and outstanding APIC Common Stock Retained Earnings Unrealized Gains (Losses) Equity 301 302 303 304 306 305 Unearned Compensation Treasury Stock 307 APIC Treasury Stock 401 Sales 500 Cost of Goods Sold 600 Compensation Expense 601 Salaries Expense 602 Bad Dept Expense 605 Payroll Tax Expense 606 Advertisting Expense 607 Insurance Expense 608 Supplies Expense 609 Depreciation Expense 610 Amortization Expense 611 Utilities Expense 612 Miscellaneous Expenses 614 Interest Expense 615 Income Tax Expense 617 Realized Gains (Losses) 620 Unrealized Gains (Losses) Income Totals Puer CR DR 2,188,098.00 2,240,370.00 30,000.00 14,000.00 1,645,000.00 125,000.00 12.005.00 100,000.00 15,000.00 1,135,000.00 3,000,000.00 269.231.00 Acct 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 850,000.00 14,100.00 250,000.00 177,923.00 56,500.00 42,611.00 Trial Balance December 1, 2021 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available for sale investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable Discount on Bond Payable Common Stock. $1 par, S1M shares authorized; 235,000 shares issued and outstanding APIC Common Stock Retained Earnings Unrealized Gains (Losses) Equity 60,000.00 1,251,754.00 1,577,000.00 9,000.00 25,000.00 206 50,000.00 26,000.00 207 208 220 221 225 226 500,000.00 2,500,000.00 137,292.00 301 302 303 304 235,000.00 3,488,193.00 1,045,590.00 15,000.00 305 306 5,961,510.00 3,155,000.00 1,900,000.00 307 401 500 600 601 602 605 606 607 608 609 610 611 612 614 615 617 620 Totals Unearned Compensation Treasury Stock APIC Treasury Stock Sales Cost of Goods Sold Compensation Expense Salaries Expense Bad Dept Expense Payroll Tax Expense Advertisting Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense Income Tax Expense Realized Gains (Losses) Unrealized Gains (Losses) Income 80,000.00 125,000.00 40,000.00 16,000.00 9,000.00 9,300.00 58,847.00 3,500.00 17,221,412.00 17,221,412.00 TB Adjust Part 2 CR DR 3,310,788.00 1,756,720.00 35,134.40 14,000.00 1,500 933,104.10 43,750.00 5,016.00 483,800.00 5,200.00 1,135,000.00 3,000,000.00 346,154.08 850,000.00 183,300.00 650,000.00 203,923.85 56,500.00 48,166.56 Panther Builders, Inc. Adjusted Trial Balance December 31, 2021 Acct Description 100 Cash 101 Accounts Receivable 102 Allowance for Doubtful Accounts 103 Short-term Investments 104 Fair Value Adjustment-ST 105 Inventory 106 Prepaid Insurance 107 Supplies 110 Available for sale investments 111 Fair Value Adjustment-AFS 120 Land 121 Building 122 Accumulated Depreciation Building 123 Machinery 124 Accumulated Depreciation Machinery 125 Equipment 126 Accumulated Depreciation Equipment 127 Truck 128 Accumulated Depreciation Truck 130 Right-of-use Asset 175 Patents 201 Accounts Payable 202 Salaries Payable 203 Utilities Payable 204 Payroll Taxes Payable 205 Interest Payable 206 Dividends Payable Note Payable short term 208 Income Tax Payable 220 Lease Liability 221 Note Payable-long term 225 Bond Payable 226 Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and 301 outstanding 302 APIC Common Stock 303 Retained Earnings 304 Unrealized Gains (Losses) Equity 500,000.00 55,000.00 358,598.10 1.722,000.00 9,000.00 33,990.00 50,750.00 350,000.00 150,000.00 190,247.00 417,250.00 454,500.00 2,500,000.00 207 128,224.00 295,000.00 4,463,193.00 695,590.00 5200 TB ndjust 3 157,777.78 71,500.00 25,000.00 8,186,460.00 305 306 307 401 500 600 601 602 605 606 607 608 609 610 611 612 614 615 617 620 Totals Unearned Compensation Treasury Stock APIC Treasury Stock Sales Cost of Goods Sold Compensation Expense Salaries Expense Bad Dept Expense Payroll Tax Expense Advertising Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense Income Tax Expense Realized Gains (Losses) Unrealized Gains (Losses) Income 4,550,000.00 2,222.22 2,045,000.00 23,734.40 88.990.00 125,000.00 121,250.00 22,989.00 277,679.48 5,000.00 9,000.00 9,300.00 126,165.00 164,247.00 3,500.00 1,500.00 20,728,456.98 20,728,456.98 Record the following adjusting entries in general journal form as of December 31, 2021: 1. Supplies on hand at the end of the year: $5,016. 2. Equipment shown on the 12/1 Te was purchased on 1/1/17, has a 7-year life, no salvage value and company uses double-declining balance method for its depreciation. 3. Don't forget to depreciate the new equipment, which is also depreciated using the DDB method! 4. Included in the truck balance is a fully depreciated truck for $6,500 and a new truck valued at $50,000 that was purchased on 1/1/17. The new truck has an 8-year life, no salvage value and the company uses the sum-of-the-years digits for its depreciation method on this asset 5. The building is depreciated under the straight-line method over 39 years and was placed in service on July 1, 2018 6. The machinery was purchased on December 1, 2020, has a 5-year useful life, salvage value of $4,000, and is being depreciated under the straight-line method. 7. The patent was purchased on 1/1/2013 for $100,000 and its useful life is 20 years. 8. Included in the Prepaid Insurance Account balance at 12/1 is a $75,000, 12-month insurance policy that was purchased on August 1, 2021. 9. Also included in the 12/1 trial balance (and the 12/31 TB) was an insurance policy that expired on 12/31/21 10. Declared dividends of $350,000 on December 31. 11. The fair market value of the short-term investments is $12,500. 12. The total fair value of the Available for Sale Securities is $489,000. 13.2% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating its uncollectible accounts. 14. Accrued salaries of $145,000 and accrued payroll taxes of 6.2% 15. Had issued $2,500,000 of 4%, 10-year bond, dated 1/1/18 for $2,305,133 when the market rate was 5%. Interest is paid on June 30 and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. Extra credit of 5 points if a complete amortization table (all 10 years) is included. Partial extra credit may be awarded. 16. One month has passed since the issuance of restricted stock. 17. Interest on 30 days of short-term note payable, dated 12/2/21 should be accrued. (Assume 360 days in a year for calculation) 18. Income tax rate is 21% Additional Information: Panther Builders, Inc. was founded entrepreneurs. It is a private company with more than 40 employees. Its operations include providing household renovation services to homeowners and small businesses. . During 2021, the following additional transactions occurred: (Hint: these are already included in 12/1/21 TB, but may be needed for the Statement of Cash Flows and calculation of weighted Average shares of Common Stock) 1. Issued 35,000 shares of common stock, S1 par, for $700,000 on June 30, 2021. 2. Some equipment was sold (original cost $10,000, book value $3,000) for $6,500 (do not consider in your #2 AJE). Confirm with the 12/1 Trial Balance! 3. All amortization and depreciation is recorded once a year on December 31. 4. Market price per share of stock at 12/31/2021 was $18.75. 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 206 207 208 220 221 225 226 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available-for-sale Investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable -short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and outstanding APIC Common Stock Retained Earnings Unrealized Gains (Losses) Equity 301 302 303 304 306 305 Unearned Compensation Treasury Stock 307 APIC Treasury Stock 401 Sales 500 Cost of Goods Sold 600 Compensation Expense 601 Salaries Expense 602 Bad Dept Expense 605 Payroll Tax Expense 606 Advertisting Expense 607 Insurance Expense 608 Supplies Expense 609 Depreciation Expense 610 Amortization Expense 611 Utilities Expense 612 Miscellaneous Expenses 614 Interest Expense 615 Income Tax Expense 617 Realized Gains (Losses) 620 Unrealized Gains (Losses) Income Totals Puer CR DR 2,188,098.00 2,240,370.00 30,000.00 14,000.00 1,645,000.00 125,000.00 12.005.00 100,000.00 15,000.00 1,135,000.00 3,000,000.00 269.231.00 Acct 100 101 102 103 104 105 106 107 110 111 120 121 122 123 124 125 126 127 128 130 175 201 202 203 204 205 850,000.00 14,100.00 250,000.00 177,923.00 56,500.00 42,611.00 Trial Balance December 1, 2021 Description Cash Accounts Receivable Allowance for Doubtful Accounts Short-term Investments Fair Value Adjustment-ST Inventory Prepaid Insurance Supplies Available for sale investments Fair Value Adjustment-AFS Land Building Accumulated Depreciation-Building Machinery Accumulated Depreciation Machinery Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Right-of-use Asset Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Note Payable short term Income Tax Payable Lease Liability Note Payable-long term Bond Payable Discount on Bond Payable Common Stock. $1 par, S1M shares authorized; 235,000 shares issued and outstanding APIC Common Stock Retained Earnings Unrealized Gains (Losses) Equity 60,000.00 1,251,754.00 1,577,000.00 9,000.00 25,000.00 206 50,000.00 26,000.00 207 208 220 221 225 226 500,000.00 2,500,000.00 137,292.00 301 302 303 304 235,000.00 3,488,193.00 1,045,590.00 15,000.00 305 306 5,961,510.00 3,155,000.00 1,900,000.00 307 401 500 600 601 602 605 606 607 608 609 610 611 612 614 615 617 620 Totals Unearned Compensation Treasury Stock APIC Treasury Stock Sales Cost of Goods Sold Compensation Expense Salaries Expense Bad Dept Expense Payroll Tax Expense Advertisting Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense Income Tax Expense Realized Gains (Losses) Unrealized Gains (Losses) Income 80,000.00 125,000.00 40,000.00 16,000.00 9,000.00 9,300.00 58,847.00 3,500.00 17,221,412.00 17,221,412.00 TB Adjust Part 2 CR DR 3,310,788.00 1,756,720.00 35,134.40 14,000.00 1,500 933,104.10 43,750.00 5,016.00 483,800.00 5,200.00 1,135,000.00 3,000,000.00 346,154.08 850,000.00 183,300.00 650,000.00 203,923.85 56,500.00 48,166.56 Panther Builders, Inc. Adjusted Trial Balance December 31, 2021 Acct Description 100 Cash 101 Accounts Receivable 102 Allowance for Doubtful Accounts 103 Short-term Investments 104 Fair Value Adjustment-ST 105 Inventory 106 Prepaid Insurance 107 Supplies 110 Available for sale investments 111 Fair Value Adjustment-AFS 120 Land 121 Building 122 Accumulated Depreciation Building 123 Machinery 124 Accumulated Depreciation Machinery 125 Equipment 126 Accumulated Depreciation Equipment 127 Truck 128 Accumulated Depreciation Truck 130 Right-of-use Asset 175 Patents 201 Accounts Payable 202 Salaries Payable 203 Utilities Payable 204 Payroll Taxes Payable 205 Interest Payable 206 Dividends Payable Note Payable short term 208 Income Tax Payable 220 Lease Liability 221 Note Payable-long term 225 Bond Payable 226 Discount on Bond Payable Common Stock, $1 par, $1M shares authorized; 235,000 shares issued and 301 outstanding 302 APIC Common Stock 303 Retained Earnings 304 Unrealized Gains (Losses) Equity 500,000.00 55,000.00 358,598.10 1.722,000.00 9,000.00 33,990.00 50,750.00 350,000.00 150,000.00 190,247.00 417,250.00 454,500.00 2,500,000.00 207 128,224.00 295,000.00 4,463,193.00 695,590.00 5200 TB ndjust 3 157,777.78 71,500.00 25,000.00 8,186,460.00 305 306 307 401 500 600 601 602 605 606 607 608 609 610 611 612 614 615 617 620 Totals Unearned Compensation Treasury Stock APIC Treasury Stock Sales Cost of Goods Sold Compensation Expense Salaries Expense Bad Dept Expense Payroll Tax Expense Advertising Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense Income Tax Expense Realized Gains (Losses) Unrealized Gains (Losses) Income 4,550,000.00 2,222.22 2,045,000.00 23,734.40 88.990.00 125,000.00 121,250.00 22,989.00 277,679.48 5,000.00 9,000.00 9,300.00 126,165.00 164,247.00 3,500.00 1,500.00 20,728,456.98 20,728,456.98