Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve Addison owns a jewelry store and thinks the store could use an update to attract new customers. He is considering the following

How to solve

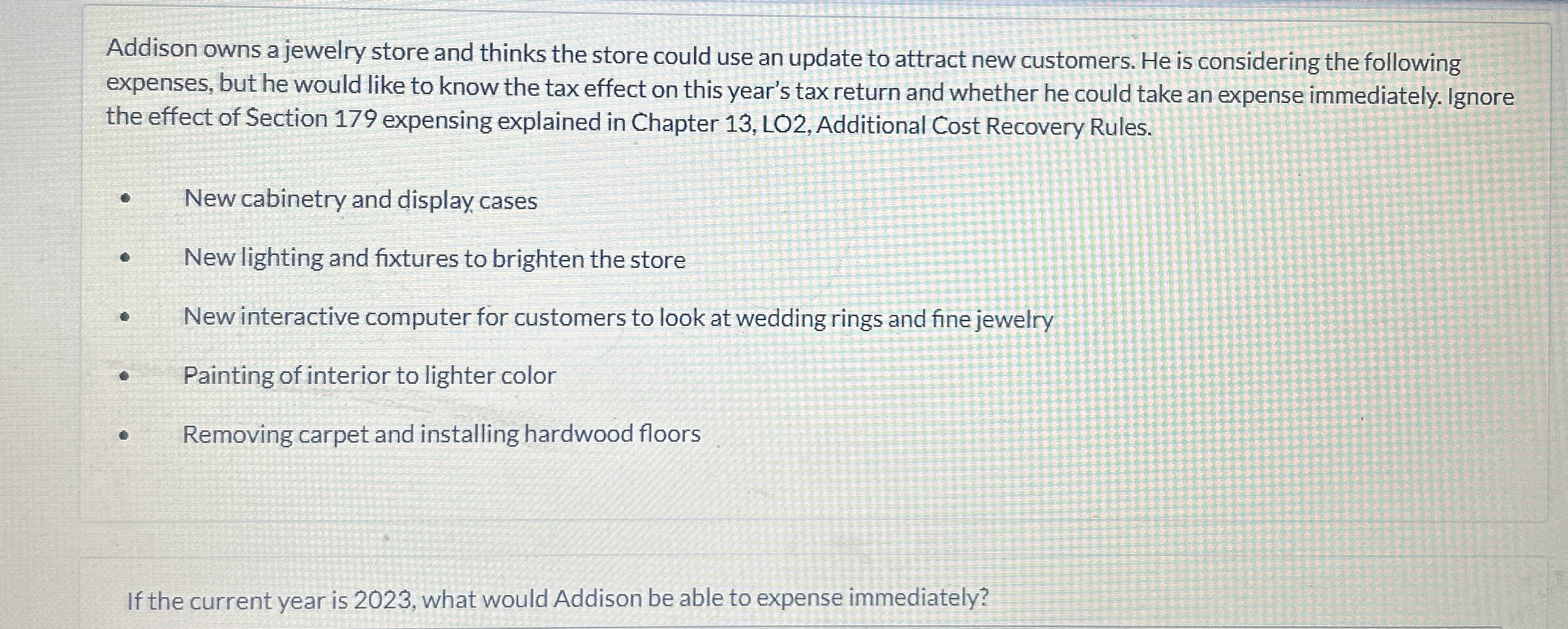

Addison owns a jewelry store and thinks the store could use an update to attract new customers. He is considering the following

expenses, but he would like to know the tax effect on this year's tax return and whether he could take an expense immediately. Ignore

the effect of Section expensing explained in Chapter LO Additional Cost Recovery Rules.

New cabinetry and display cases

New lighting and fixtures to brighten the store

New interactive computer for customers to look at wedding rings and fine jewelry

Painting of interior to lighter color

Removing carpet and installing hardwood floors

If the current year is what would Addison be able to expense immediately?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started