Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve Ashley is a junior at State College. To offset the cost of attending college full - time, Ashley has a part -

How to solve

Ashley is a junior at State College. To offset the cost of attending college fulltime, Ashley has a parttime job. During the tax year,

Ashley earned $ Her parents also provided some support for her and claimed her on their tax return. During the tax year, Ashley

paid $ of her tuition bill and her parents paid $ Ashley also paid for her own books, which cost $ Her parents helped

her by paying part of her rent and grocery bills. After reading about refundable tax credits, Ashley realized that she or her parents

were eligible to claim the American Opportunity Credit.

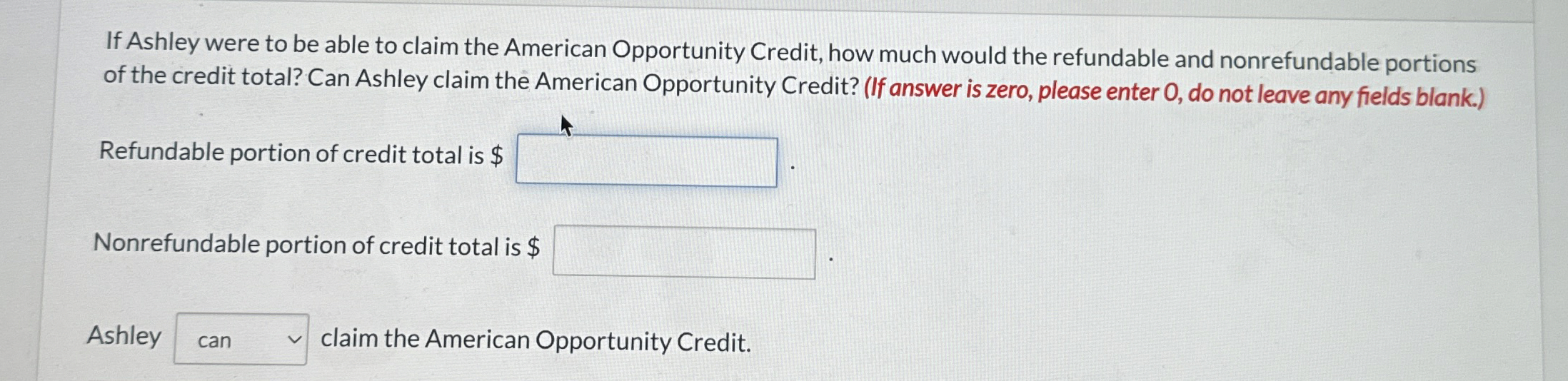

If Ashley were to be able to claim the American Opportunity Credit, how much would the refundable and nonrefundable portions

of the credit total? Can Ashley claim the American Opportunity Credit? If answer is zero, please enter O do not leave any fields blank.

Refundable portion of credit total is $

Nonrefundable portion of credit total is $

Ashley

claim the American Opportunity Credit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started