how to solve the case analysis part

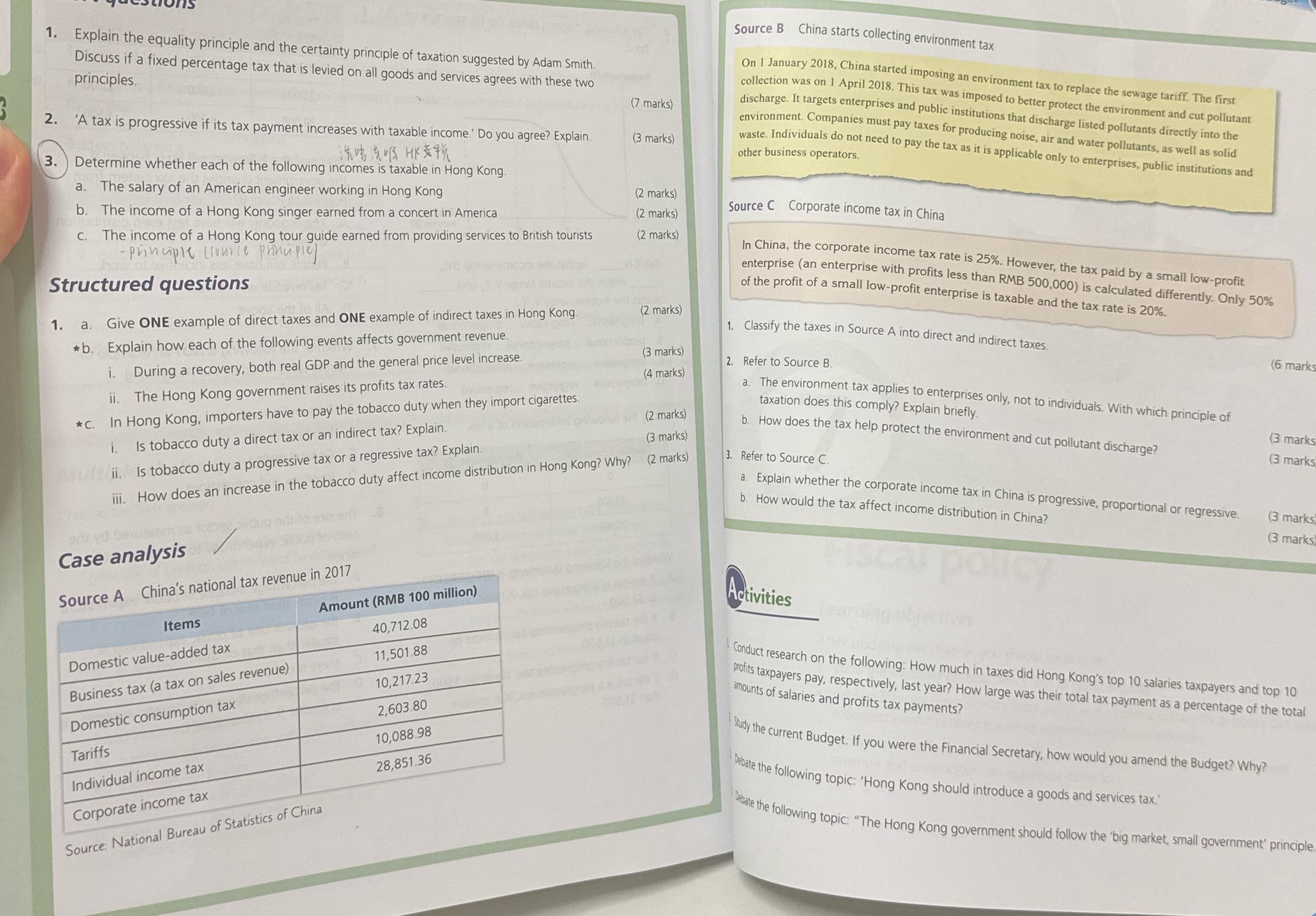

Source B China starts collecting environment tax 1. Explain the equality principle and the certainty principle of taxation suggested by Adam Smith. Discuss if a fixed percentage tax that is levied on all goods and services agrees with these two On 1 January 2018, China started imposing an environment tax to replace the sewage tariff. The first principles. collection was on 1 April 2018. This tax was imposed to better protect the environment and cut pollutant (7 marks) discharge. It targets enterprises and public institutions that discharge listed pollutants directly into the 2. 'A tax is progressive if its tax payment increases with taxable income.' Do you agree? Explain. environment. Companies must pay taxes for producing noise, air and water pollutants, as well as solid (3 marks) waste. Individuals do not need to pay the tax as it is applicable only to enterprises, public institutions and other business operators. 3 . Determine whether each of the following incomes is taxable in Hong Kong. . The salary of an American engineer working in Hong Kong (2 marks) b. The income of a Hong Kong singer earned from a concert in America (2 marks) Source C Corporate income tax in China c. The income of a Hong Kong tour guide earned from providing services to British tourists (2 marks) - principle ( source principle) In China, the corporate income tax rate is 25%. However, the tax paid by a small low-profit enterprise (an enterprise with profits less than RMB 500,000) is calculated differently. Only 50% Structured questions of the profit of a small low-profit enterprise is taxable and the tax rate is 20%. (2 marks) 1 . a. Give ONE example of direct taxes and ONE example of indirect taxes in Hong Kong 1. Classify the taxes in Source A into direct and indirect taxes. *b. Explain how each of the following events affects government revenue. (3 marks) Refer to Source B (6 marks i. During a recovery, both real GDP and the general price level increase. (4 marks) ii. The Hong Kong government raises its profits tax rates. a. The environment tax applies to enterprises only, not to individuals. With which principle of taxation does this comply? Explain briefly. *C. In Hong Kong, importers have to pay the tobacco duty when they import cigarettes. (2 marks) (3 marks) b. How does the tax help protect the environment and cut pollutant discharge? (3 mark i. Is tobacco duty a direct tax or an indirect tax? Explain. 3. Refer to Source C. (3 mark ii. Is tobacco duty a progressive tax or a regressive tax? Explain. iii. How does an increase in the tobacco duty affect income distribution in Hong Kong? Why? (2 marks) a. Explain whether the corporate income tax in China is progressive, proportional or regressive. b. How would the tax affect income distribution in China? (3 mark (3 mark Case analysis Source A China's national tax revenue in 2017 Amount (RMB 100 million) Activities ear Items 40,712.08 Domestic value-added tax 11,501.88 Conduct research on the following: How much in taxes did Hong Kong's top 10 salaries taxpayers and top 10 Business tax (a tax on sales revenue) 10,217.23 profits taxpayers pay, respectively, last year? How large was their total tax payment as a percentage of the total amounts of salaries and profits tax payments? 2,603.80 Domestic consumption tax 10,088.98 Study the current Budget. If you were the Financial Secretary, how would you amend the Budget? Why? Tariffs 28,851.36 Individual income tax Debate the following topic: 'Hong Kong should introduce a goods and services tax." Corporate income tax create the following topic: "The Hong Kong government should follow the "big market, small government' principle Source: National Bureau of Statistics of China