Question

How to write a letter to the prepared financial statements for verification and authorisation to print the finalised financial statement? In the letter I need

How to write a letter to the prepared financial statements for verification and authorisation to print the finalised financial statement?

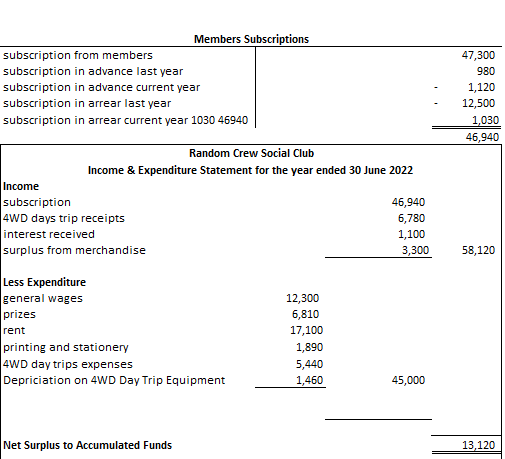

In the letter I need to explain at least three distinguishing features in preparing financial accounts and financial statements of a Not-for-profit organisation in contrast with those of a Reporting Entities statements.

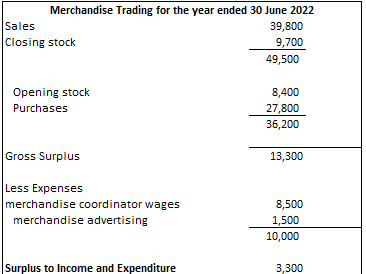

In each section where explain the income statement and balance sheet and cashflow, need to describe how this is different to a normal income statement/balance sheet/ cash flow. So things like the non profit does separate trading statements for certain parts of the business and the equity is not called net profit and no one member receives this, the funds stay within the organisation as accumulated funds etc, the slightly different names so the balance sheet is called a statement of assets and liabilities etc.

Please see below for all figures.

TIA

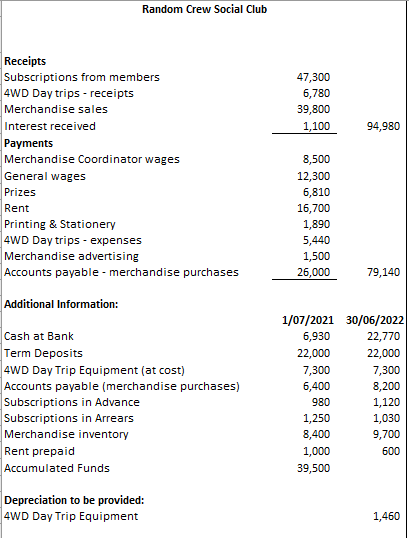

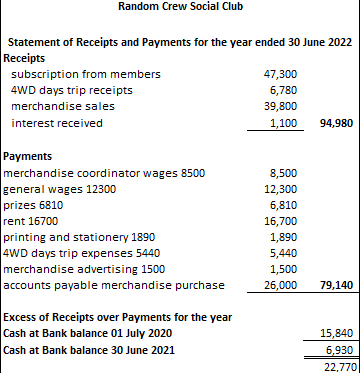

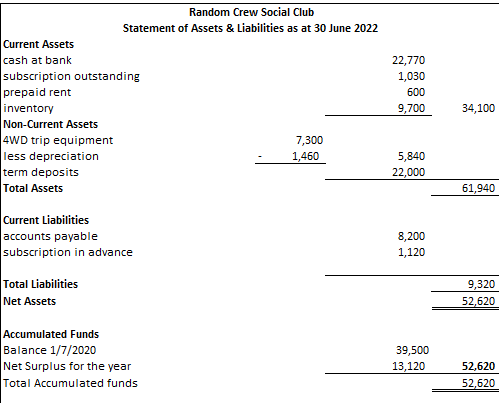

Net Surplus to Accumulated Funds Random Crew Social Club Statement of Receipts and Payments for the year ended 30 June 2022 Receipts subscription from members 4WD days trip receipts merchandise sales interest received 47,300 6,780 39,800 94,980 Payments merchandise coordinator wages 8500 general wages 12300 prizes 6810 rent 16700 printing and stationery 1890 4WD days trip expenses 5440 merchandise advertising 1500 accounts payable merchandise purchase 1,100 94,980 Excess of Receipts over Payments for the year Cash at Bank balance 01 July 2020 Cash at Bank balance 30 June 2021 \\begin{tabular}{r|} 15,840 \\\\ \\hline 6,930 \\\\ \\hline \\hline 22,770 \\end{tabular} Random Crew Social Club Receipts Subscriptions from members 4WD Day trips - receipts Merchandise sales Interest received Payments Merchandise Coordinator wages General wages Prizes Rent Printing \\& Stationery 4WD Day trips - expenses Merchandise advertising Accounts payable - merchandise purchases Additional Information: Cash at Bank Term Deposits 4WD Day Trip Equipment (at cost) Accounts payable (merchandise purchases) Subscriptions in Advance Subscriptions in Arrears Merchandise inventory Rent prepaid Accumulated Funds \\begin{tabular}{rr} 47,300 & \\\\ 6,780 & \\\\ 39,800 & \\\\ 1,100 & 94,980 \\\\ \\hline \\end{tabular} 8,500 12,300 6,810 16,700 1,890 5,440 1,500 26,000 79,140 \\( 1 / 07 / 2021 \\) \\( 30 / 06 / 2022 \\) 6,930 22,770 22,000 22,000 7,300 7,300 6,400 8,200 980 1,120 1,250 1,030 8,400 9,700 1,000 600 39,500 Depreciation to be provided: 4WD Day Trip Equipment 1,460

Net Surplus to Accumulated Funds Random Crew Social Club Statement of Receipts and Payments for the year ended 30 June 2022 Receipts subscription from members 4WD days trip receipts merchandise sales interest received 47,300 6,780 39,800 94,980 Payments merchandise coordinator wages 8500 general wages 12300 prizes 6810 rent 16700 printing and stationery 1890 4WD days trip expenses 5440 merchandise advertising 1500 accounts payable merchandise purchase 1,100 94,980 Excess of Receipts over Payments for the year Cash at Bank balance 01 July 2020 Cash at Bank balance 30 June 2021 \\begin{tabular}{r|} 15,840 \\\\ \\hline 6,930 \\\\ \\hline \\hline 22,770 \\end{tabular} Random Crew Social Club Receipts Subscriptions from members 4WD Day trips - receipts Merchandise sales Interest received Payments Merchandise Coordinator wages General wages Prizes Rent Printing \\& Stationery 4WD Day trips - expenses Merchandise advertising Accounts payable - merchandise purchases Additional Information: Cash at Bank Term Deposits 4WD Day Trip Equipment (at cost) Accounts payable (merchandise purchases) Subscriptions in Advance Subscriptions in Arrears Merchandise inventory Rent prepaid Accumulated Funds \\begin{tabular}{rr} 47,300 & \\\\ 6,780 & \\\\ 39,800 & \\\\ 1,100 & 94,980 \\\\ \\hline \\end{tabular} 8,500 12,300 6,810 16,700 1,890 5,440 1,500 26,000 79,140 \\( 1 / 07 / 2021 \\) \\( 30 / 06 / 2022 \\) 6,930 22,770 22,000 22,000 7,300 7,300 6,400 8,200 980 1,120 1,250 1,030 8,400 9,700 1,000 600 39,500 Depreciation to be provided: 4WD Day Trip Equipment 1,460 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started