Answered step by step

Verified Expert Solution

Question

1 Approved Answer

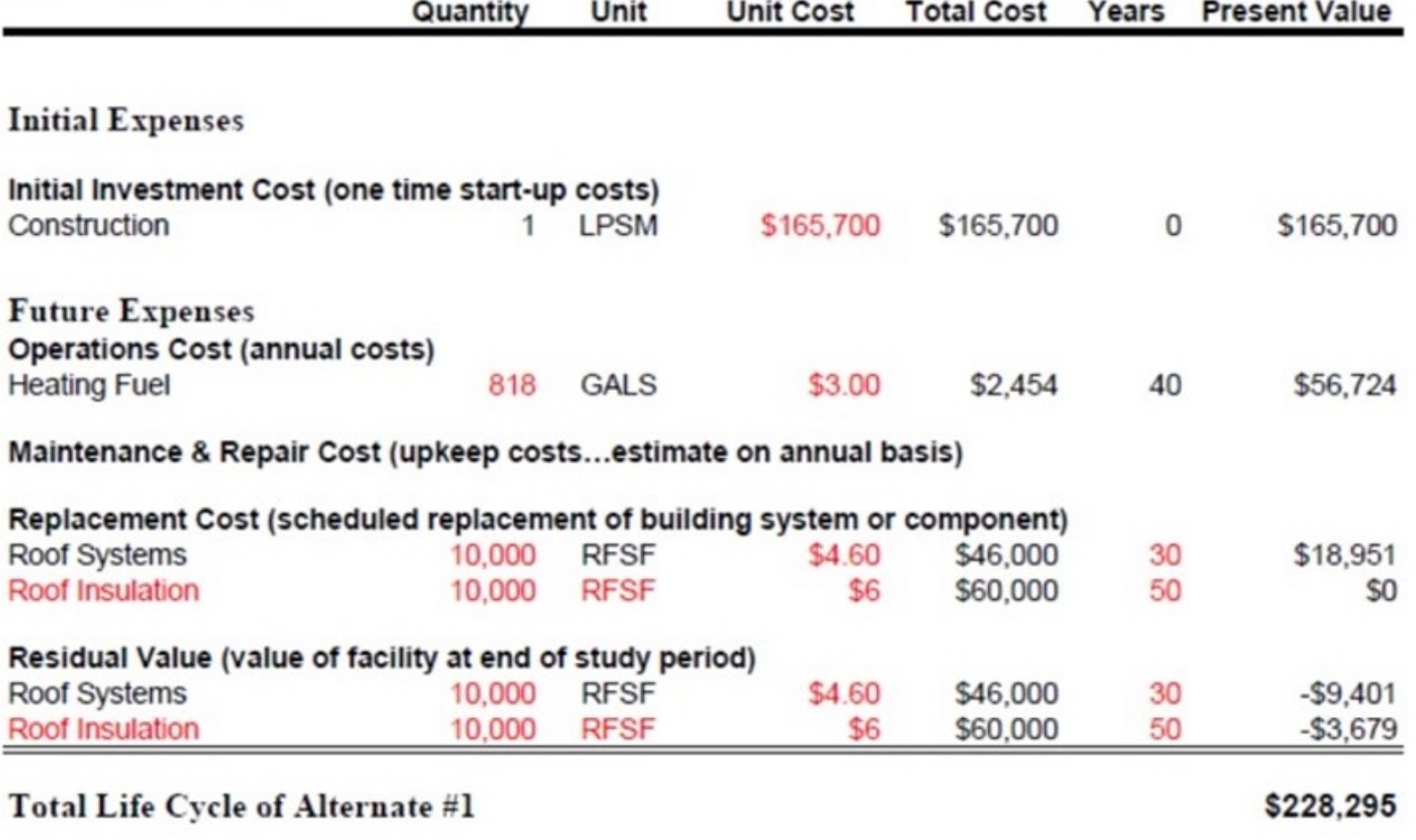

How was the residual value calculated given that the discount rate is 3 % ?and study period is 4 0 ?years? Initial Expenses Initial Investment

How was the residual value calculated given that the discount rate is ?and study period is ?years?

Initial Expenses Initial Investment Cost (one time start-up costs) Construction 1 LPSM Quantity Unit Future Expenses Operations Cost (annual costs) Heating Fuel Roof Systems Roof Insulation Roof Systems Roof Insulation 818 GALS Unit Cost Residual Value (value of facility at end of study period) 10,000 RFSF 10,000 RFSF Total Life Cycle of Alternate #1 Maintenance & Repair Cost (upkeep costs...estimate on annual basis) Replacement Cost (scheduled replacement of building system or component) 10,000 RFSF 10,000 RFSF $165,700 $165,700 $3.00 Total Cost $4.60 $6 $4.60 $6 $2,454 $46,000 $60,000 $46,000 $60,000 Years Present Value 0 40 30 50 30 50 $165,700 $56,724 $18,951 SO -$9,401 -$3,679 $228,295

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the residual value of the facility at the end of the study period we need to discount t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started